VC investment in Latin America outpaces these US tech hubs

ImageFlow // Shutterstock

VC investment in Latin America outpaces these US tech hubs

Business team members standing over night city background with double exposure of planet.

Venture capital investments in Latin America are continuing on an upward trajectory with a promising outlook for the region. While venture capital investments in Latin America have long lagged behind those of other industrialized nations, as well as China and India, recent surges in the region’s fundraising have made its venture capital ecosystem comparable to well-established technology hubs in the United States, such as Seattle.

The Latin American venture capital market reached its second-highest level on record in 2023, according to the Association for Private Capital Investment in Latin America—a continuation of a three-year-long trend. A growing talent pool and demand for middle-class-friendly services largely drive the region’s surge in venture capital investments, as each increases the appeal of emerging startups to investors.

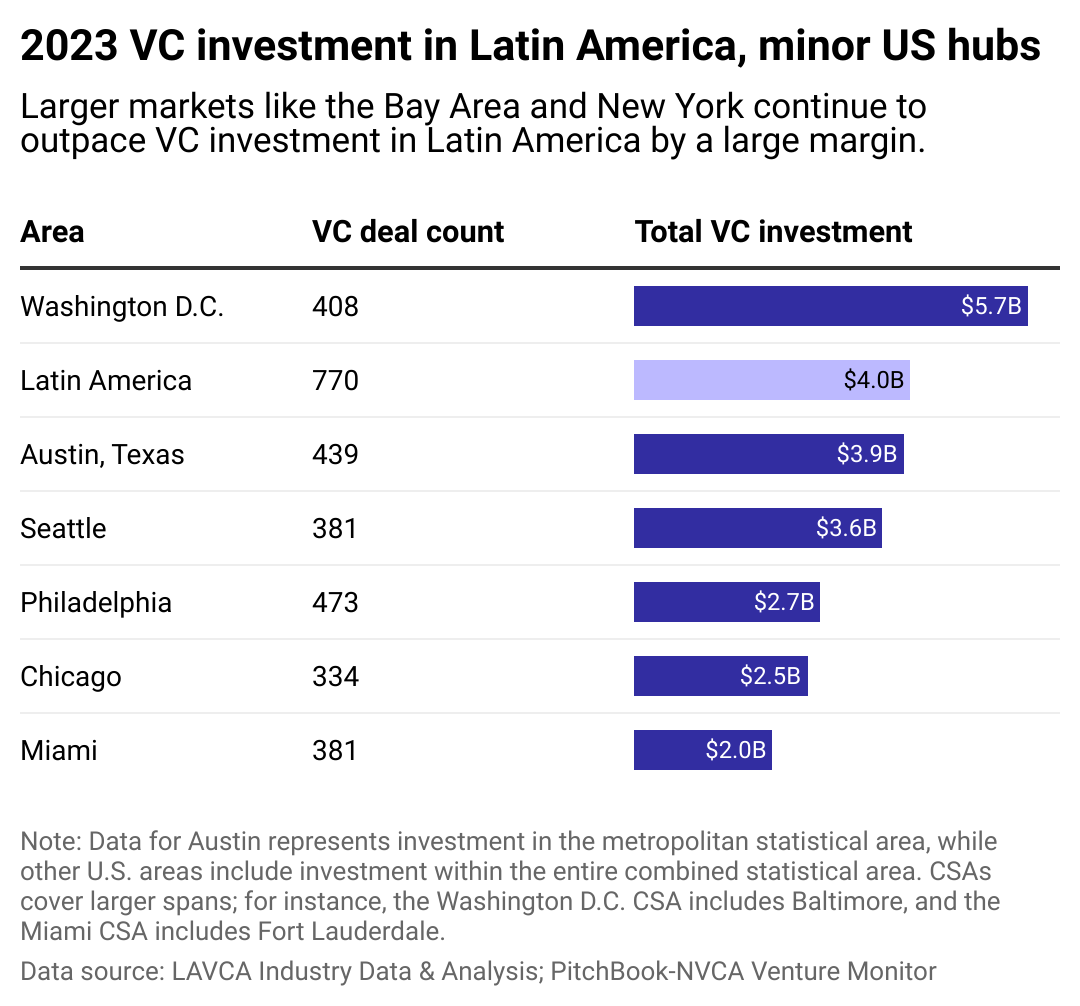

In light of these developments, Revelo charted venture capital investments in Latin America compared to six rising U.S. technology hubs, using data from LAVCA and the National Venture Capital Association. The largest venture capital markets in the world—New York, Boston, the San Francisco Bay region, and Los Angeles—are not shown in the table due to their incomparably large size. The southern shores of the San Francisco Bay region, colloquially known as Silicon Valley, was the largest by far, with 2,625 total deals made in 2023, amounting to $63.3 billion.

Countries in Central America and South America comprise the region. And while Brazil drives a significant percentage of its overall economic growth, neighboring countries’ business ecosystems are also rapidly maturing. According to a report from Bloomberg Linea, a Colombian online supermarket startup has begun the process of being listed on the New York Stock Exchange. Currently, Colombian stock listings comprise energy, manufacturing, and financial services, marking the country’s first potential stock listing within the e-commerce sector.

![]()

Revelo

Comparing 2023 VC investments

A table showing the number of VC rounds and value of investments in Latin America and 6 US markets.

While significantly more venture capital deals were made in Latin America, the total investment volume is similar to those with fewer deals. Per the LAVCA report, at least 2 in 5 (42%) venture capital deals made in Latin America in 2023 were for early-stage ventures, which tend to have lower valuations as they lack proof of profitability.

While Latin American countries have some of the highest interest rates worldwide, there has been a mass shift to reducing rates. Mexico, with the second-largest economy in Latin America, became the latest in the region to do so when it changed the interest rate from 25 to 11 in March 2024, per the Financial Times. Reduced interest rates empower those seeking to capitalize on their investments, enhancing the region’s allure for prospective stakeholders.

Adding to the region’s growing appeal to investors is the rise of its middle class. In addition to signifying more potential consumers, this means there is more disposable income and thus increased demand for banking services.

In Latin America, banks are typically only used by the affluent, as they impose strict credit requirements. Per a Silicon Valley Bank report, between 30% and 50% of Latin Americans are underbanked, which limits their access to mainstream financial offerings. This has left a tremendous need in the region for accessible, innovative banking services—a prime opportunity for prospective financial service startups. As a result, fintech companies captured a significant number of investor dollars in 2023, constituting 19% of total investment volume.

Additionally, the talent pool in Latin America is rapidly growing and improving in tandem with the emergence of high-tech industries. As the workforce diversifies in skillsets and expertise, there is potential for more innovation and productivity. It also allows investors to tap into an emerging market in its infancy. According to a report by Latam Republic, several foreign investors have launched initiatives to support Latin American entrepreneurs amid the rise in its venture capital marketplace.

Story editing by Shannon Luders-Manuel. Copy editing by Paris Close.

This story originally appeared on Revelo and was produced and

distributed in partnership with Stacker Studio.