As Americans faced high gas prices, big oil companies doubled their profits

Brooks Kraft / Getty Images

As Americans faced high gas prices, big oil companies doubled their profits

Image of a gas pump in the foreground and a gas price sign in the background

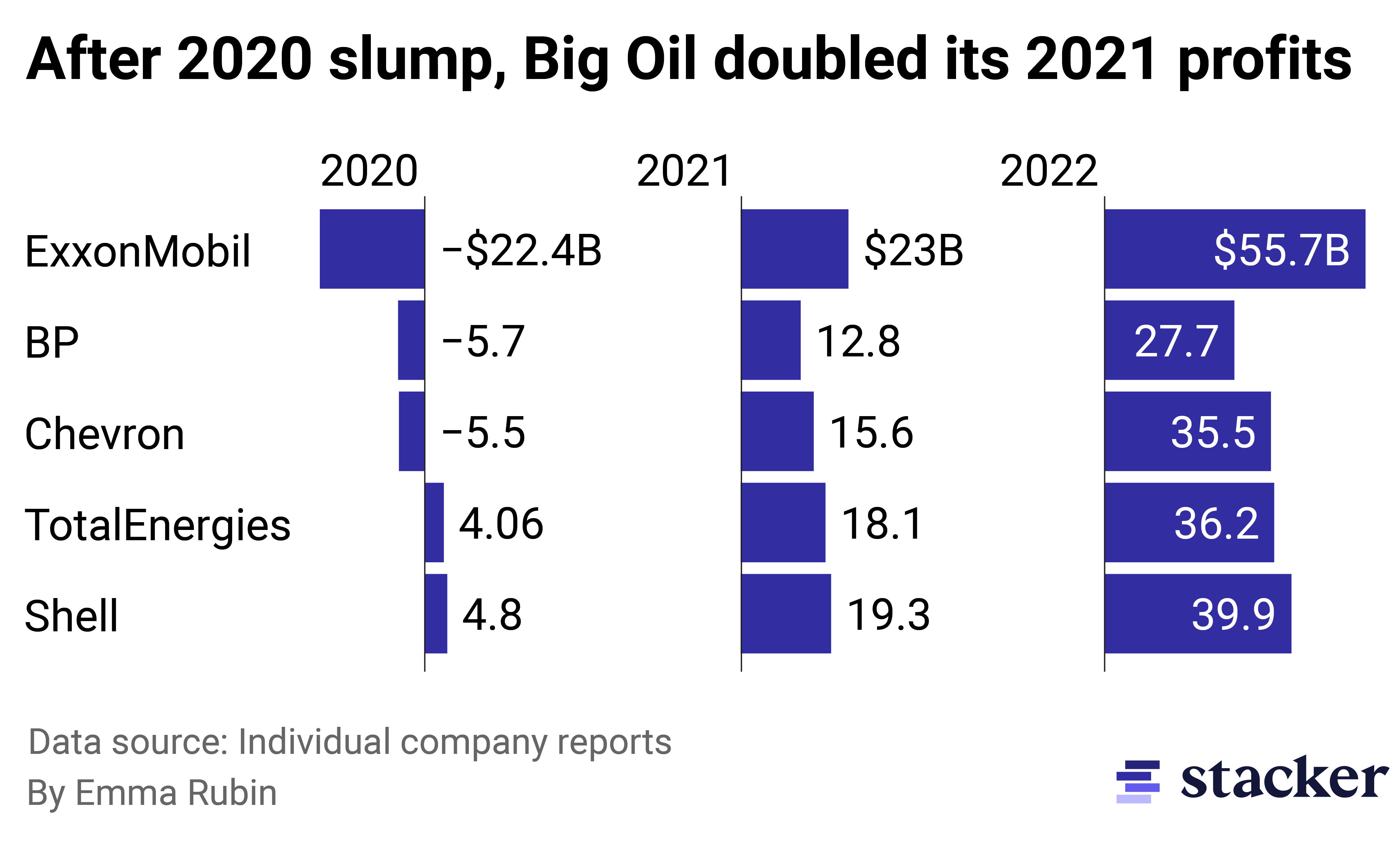

The top five oil companies based in the West set new earning records in 2022, all at least doubling their 2021 profits to achieve combined earnings of nearly $200 billion. ExxonMobil reported the highest profits of any single company at almost $56 billion. These earnings come in the wake of Russia’s invasion of Ukraine. The war has impacted the price of various commodities, especially oil, and strained an already rising inflation rate.

Americans saw gas prices reach their peak in mid-June with a national average of $5 per gallon according to the American Automobile Association. It would take another two months before prices fell below $4 a gallon. The decision to prioritize shareholder interests has drawn criticism from both the Biden administration and other Democrats.

“They invested too little of that profit to increase domestic production and keep gas prices down,” President Biden said during the State of the Union address on Feb. 7. “Instead, they used those record profits to buy back their own stock, rewarding their CEOs and shareholders.”

![]()

Stacker

Annual reports show profits outpaced production growth

Bar chart showing oil companies’ profits for 2020, 2021, and 2022.

Profits during both 2021 and 2022 came after losses in 2020 tied to the pandemic. When the lockdowns, social restrictions, and trend toward remote work drastically shifted people’s transportation habits, oil traders were at times paying buyers to take barrels from them.

Historically, times of low oil supply and subsequent surging prices have led companies to increase drilling and restock the market. These sudden shifts in supply have also led to crashes in oil prices, as exemplified by the energy crises of the 1970s, which later culminated in the 1980s oil glut and a sustained collapse in oil demand that lasted nearly a decade. Concurrently, vehicles with better fuel economy entered the market and newly discovered oil fields meant demand didn’t keep up with production increases.

Oil companies have been careful not to recreate the boom and bust pattern, the lesson of 40 years ago remaining fresh in corporate consciousness, and that means they were slower to increase production even as gasoline prices surged to new heights. While 2022 profits more than doubled for most companies, the increase in year-over-year production grew at a much slower pace.

Exxon reported a 2.8% increase in global production of crude oil and other liquids, equal to 65,000 barrels per day. Chevron’s year-end reports show global oil production stayed about even with last year, while BP said it reached its lowest production costs since 2006.

The Biden administration released barrels from the nation’s strategic oil reserve throughout 2022 to temper demand as well, the continuation of a policy that had been set in 2021 to curb inflation. The pressure from Biden to increase oil production seemed to come in contrast with the administration’s climate goals. Environmental groups say production boosts offer only short-term relief but keep Americans dependent on a commodity that too often wavers in price and is largely controlled by a few major companies.

“More U.S. drilling isn’t going to help solve the problem or lower prices. It will just deepen our dependence on expensive fossil fuels while destroying our climate, harming our health, and polluting communities,” John Noël, senior climate campaigner at Greenpeace USA, said in a statement last fall.

After pandemic losses, oil companies felt shareholder pressure to diversify their energy portfolios. Even Exxon, historically resistant to transitioning from oil and gas, made investments in the hydrogen and carbon capture space; however, record profits this year mean Big Oil has little incentive to increase its decidedly limited spending on clean energy. BP, which has struggled to climb out from under a significant debt load, is even backtracking on its carbon goals. After planning to cut emissions 30-35% by 2030, BP now says it will increase oil and gas production in 2023. In the immediate aftermath of the announcement, the company’s stock price hit a near 4-year high.