23 cities where credit card balances are double the national average

Felix Mizioznikov // Shutterstock

23 cities where credit card balances are double the national average

City and coastal view of Northern Palm Beach, Florida.

Credit card bills are increasing nearly everywhere in the U.S., as the average credit card balance approached $6,700 among all U.S. consumers in the second quarter of 2024. But in some locales, a $6,700 balance would be considered relatively modest.

In this report, Experian identifies those cities where credit card balances are much greater than the national average to see—for some, not the first time—what they have in common, or not, when compared with more typical cities across the U.S.

![]()

Experian

Credit Card Balances: 23 Cities Double the National Average

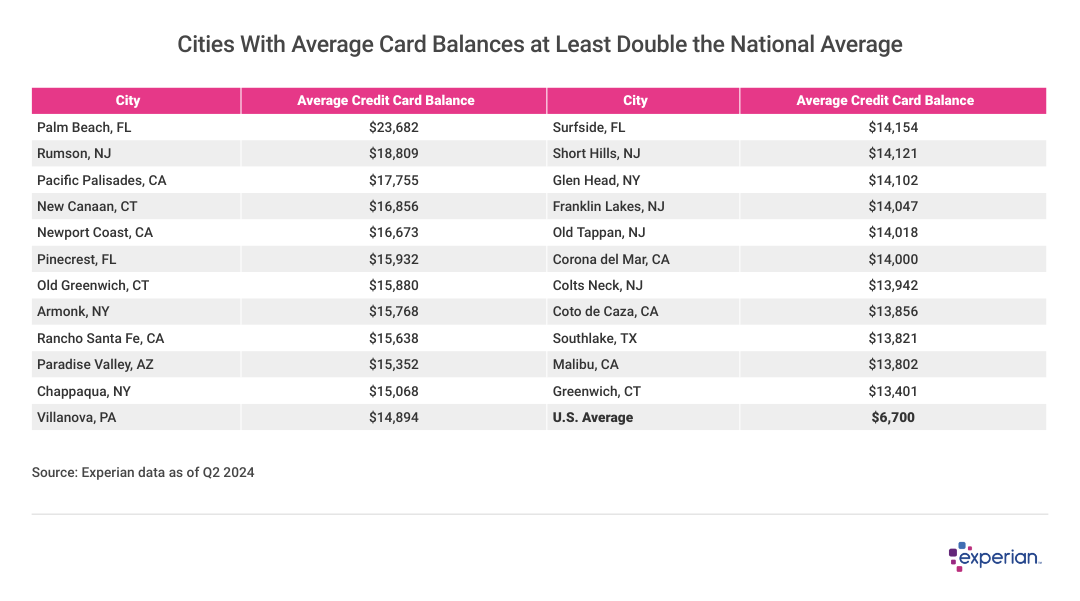

Table listing the “Cities With Average Card Balances at Least Double the National Average”

Credit card balances are increasing in all but a handful of the thousands of cities Experian tracks data for across the U.S. And not only are credit card balances growing almost everywhere, but they’ve grown to more than twice the level of the national average in some places. Above are the 23 cities where average balances exceed $13,400, as of June 2024.

It’s probably no surprise that some of the nation’s wealthiest burgs, primarily those in the coastal states of California and New York, are heavily represented on this list. However, leading the cities is Palm Beach, Florida, with an average credit card balance not only twice, but three times the U.S. average, at $23,682 as of Q2 2024.

This raises an obvious question: Why do these wealthy cities owe so much more, on average, than other cities with incomes closer to the national average?

Credit Card Users in High-Balance Cities Have More Credit Available

Average credit card balances are one thing, but credit usage is another. And as it turns out, at least as measured by their credit utilization ratios, these communities aren’t especially different from those with more nationally typical levels of credit card debt and income. The average utilization ratio among the high-balance cities was 20%, meaning that, for example, someone may have a balance of $13,400, but they’ve been extended more than $65,000 in total credit.

Credit limits are largely a function of an applicant’s credit scores, debt-to-income ratio, and other factors. Individuals who are able to show a creditor that they are more than able to afford their debt balances may be granted a high credit limit.

Experian

Despite High Balances, Credit Card Utilization Is Low

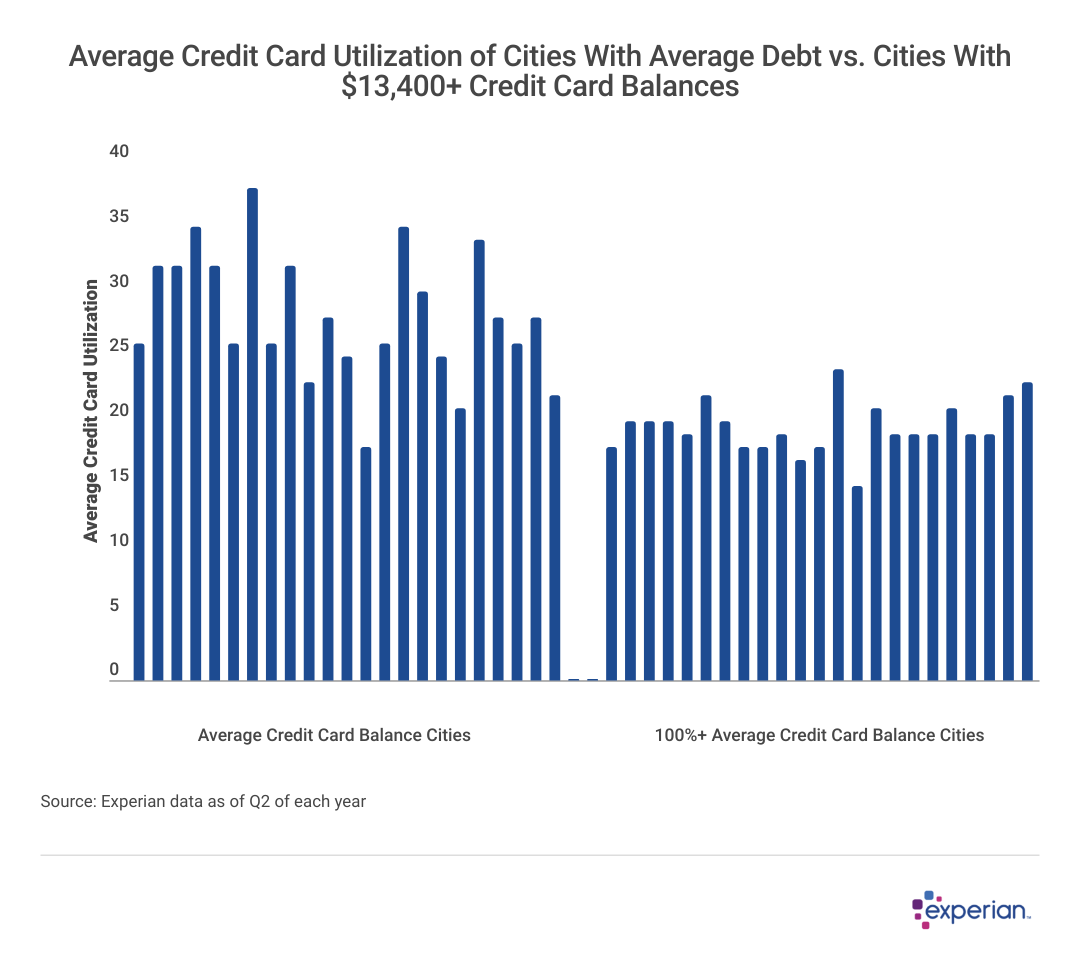

Bar graph showing data on “Average Credit Card Utilization of Cities With Average Debt vs. Cities With $13,400+ Credit Card Balances”

To demonstrate further, Experian selected 23 communities with average balances close to the national average of $6,700 to make comparisons and contrasts between the two sets of cities.

The average credit card utilization in the cities with typical credit card debt was 28%, slightly lower than the national average of 29%. (Experts recommend keeping balances below 30% to avoid excessive damage to credit scores.)

There’s quite a spread between the high and low, however: Alvarado, Texas, has the highest average credit card utilization of the sample at 38%, even though credit card balances there are roughly equal to the national average of $6,700. Meanwhile, Sunset Beach, North Carolina, has an average credit card utilization of just 18%—lower than many of the high-balance cities.

However, cities with high card balances are more homogenous. The high-balance group of cities has an average credit card utilization of 20%, well below the national average. Nor is there much variance among these cities.

The high-balance city with the highest utilization, Surfside, California, has an average credit card utilization of 22%. Short Hills, New Jersey, meanwhile, is only using 14% of their credit, on average, despite average credit card balances exceeding $14,000. So while high-balance cities aren’t all alike, they are more similar than different, at least when considering credit.

The Bottom Line

Cities with close-to-average credit card balances have a more disparate range of credit scores versus those with higher average credit card balances. This indicates a wider range of overall financial health than those cities with higher card balances.

Nonetheless, high-balance cities are generally wealthier and have higher incomes, thus may have the wherewithal to manage the higher debts. But credit card debt comes with a price that’s meaningful for folks of all means: Carrying $13,400 in credit card debt implies interest payments exceeding $3,000 annually, assuming an average APR of 23%, as was prevailing in 2024.

This story was produced by Experian and reviewed and distributed by Stacker Media.