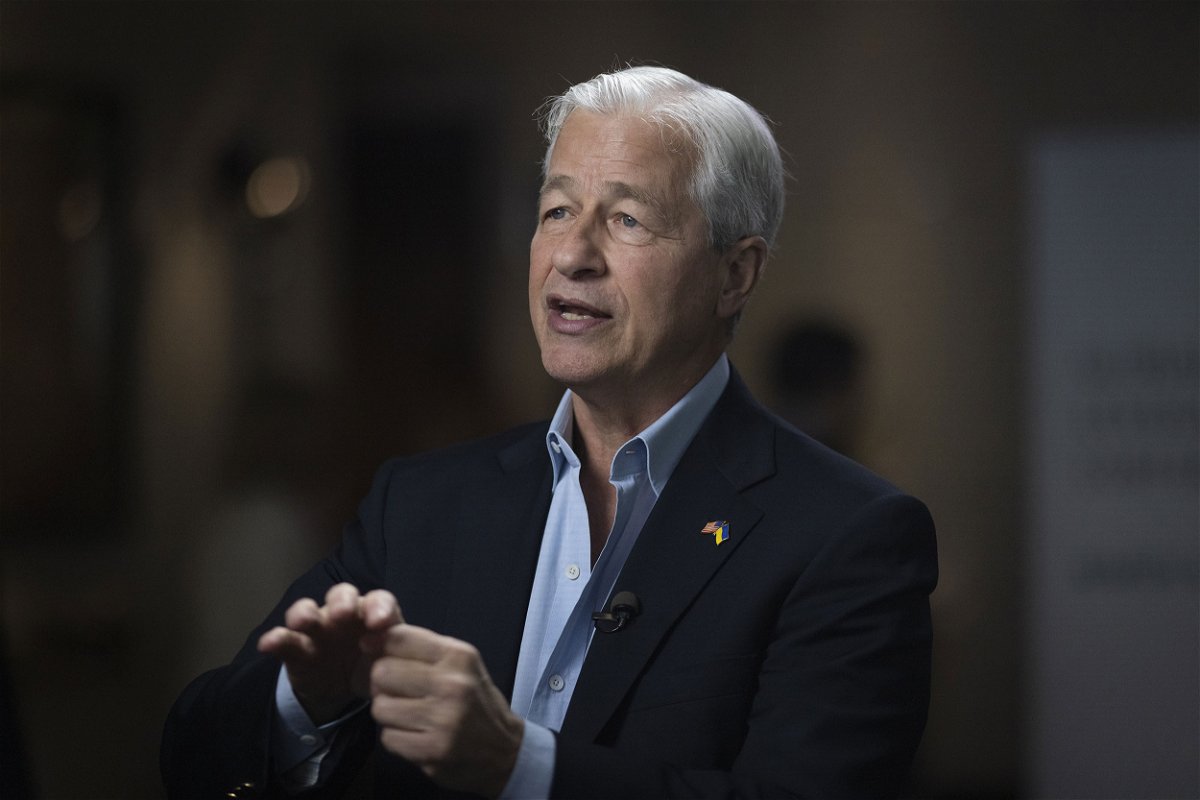

Jamie Dimon: Risk of recession not raised by latest bank failure

The collapse of First Republic Bank is unlikely to worsen the US economic outlook

By Matt Egan, Chris Isidore and Alicia Wallace, CNN

The collapse of First Republic Bank is unlikely to worsen the US economic outlook, JPMorgan CEO Jamie Dimon said Monday.

“It hasn’t changed anything about the odds of a recession,” Dimon said in response to a question from CNN during a press call held after JPMorgan agreed to buy most of First Republic.

Dimon told CNN’s Poppy Harlow early last month that the stress in the banking system had increased the odds of a US recession.

Now, First Republic has become the second-biggest bank failure in US history.

Asked whether his recession concerns factored into the decision to do a deal for First Republic, Dimon said the deal “helps stabilize the system, which is a good thing.” Dimon added that the threat of bank failures is “getting near the end” and noted that many regional banks reported strong financial results.

This period is “nothing like 2008-2009 for a lot of different reasons,” Dimon said Monday. “There are only so many banks that are off-sides on uninsured deposits.”

At the start of the year First Republic had more than two-thirds of its deposits in accounts that were over the $250,000 limit above which they were not covered by the Federal Deposit Insurance Corporation. The bank had $100 billion in those deposits withdrawn from the bank during the first quarter, it reported last week.

While it’s not clear whether any more banks will fall, Dimon said the worst of the crisis appears to be over.

“The American banking system is extraordinarily sound,” he said. “Obviously, going forward, [if] you have a recession, rates going up and stuff like that, you will see other cracks in the system. That’s to be expected.”

The JPMorgan CEO said the banking stress will “clearly” cause “some reduction” in bank lending. This reduction in loans, Dimon said, adds “a little bit of weight to the recessionary scale” but is not “definitive on its own.”

The fallout from the recent banking troubles will likely show up in the real economy in the next 60 to 90 days, RSM economist Joseph Brusuelas wrote in a note on Monday.

“Tighter lending … will play a greater role in the economic narrative in the second half of the year, as hiring slows, corporate investment pulls back further and the combination of tension over the debt ceiling and tighter financial conditions weigh on a US household that is currently propping up the American economy,” he wrote.

RSM increased its probability of a recession to 75% following the banking issues that unraveled in March. But he agreed with Dimon that the seizure of First Republic, however, does not shift those forecasts, he told CNN Monday.

The-CNN-Wire

™ & © 2023 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.