How much does a new car really cost?

BOISE, Idaho (KIFI) – Buying a new car is an expensive proposition, but according to new research by AAA, Idaho drivers are paying less, on average, than in other parts of the country.

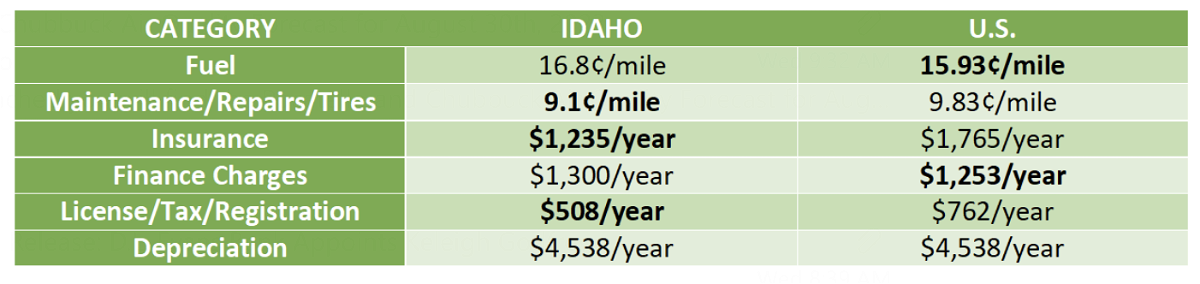

According to AAA’s Your Driving Costs study, drivers in the Gem State will pay, on average, $11,475 per year to own and operate a new vehicle in 2023, about 6% less than the U.S. average of $12,182 per year.

The U.S. average was just $10,728 last year. Global supply chain issues have pushed vehicle prices higher, along with a staggering 90% increase in finance charges.

Here’s a side-by-side comparison across several cost categories over five years and 75,000 miles:

AAA formulated its estimates for each cost category using a combination of the top-selling vehicles across nine vehicle types. Actual costs for a specific vehicle and vehicle type may vary.

“Applying several baseline measurements both in Idaho and nationwide makes for an interesting comparison,” AAA Idaho public affairs director Matthew Conde said. “A new car is a major investment, but we may fare a little better than vehicle buyers in some of the other states.”

Driving costs by vehicle type

At an average cost of nearly 60 cents per mile, small sedans are the cheapest to own and operate, making them an attractive option for first-time buyers. But they are also the most likely to be totaled in the event of a crash (rather than taking on the expense of major repairs). Not surprisingly, ½ ton pickups are the most expensive vehicle category, with an average cost of $1.06 per mile. Medium SUVs and mid-size pickups clock in between 80 and 82 cents per mile.

“On the more economical side of the scale, hybrids, subcompact and compact SUVs, and electric vehicles are great options,” Conde said. “The hybrids and EVs have a higher up-front cost, including depreciation, but they tend to be less expensive for fuel and maintenance costs over time.”

AAA’s Your Driving Costs is available to the public. Prospective vehicle buyers can research the total cost of vehicle ownership with state-specific information for a variety of vehicles and trim packages, including used vehicles up to five years old. Visit AAA.com/aar/drivingcosts for more information.

Depreciation – one of the biggest costs of new vehicle ownership – is based on the difference between a new vehicle’s purchase price and its value when sold. It starts taking effect the moment you drive a car off the lot. For purposes of the study, AAA’s “Maintenance & Repair” calculation includes parts and labor for routine maintenance specified by the vehicle manufacturer, along with normal wear-and-tear during the first five years of vehicle ownership. The “Fuel” category assigns a weighted average for both internal-combustion and electric vehicles.

“The average MSRP of the new vehicles from our study is $34,876, nearly 5% more than last year,” Conde said. “But the MSRP doesn’t always correspond to what buyers will actually pay, and it certainly doesn’t measure everything that should factor into an informed purchase decision. Our calculator tool is a great way to do some homework before you buy.”

While this year’s average cost of fuel has decreased by roughly two cents per mile from a year ago, the cost of charging EVs has increased by about the same amount, likely the result of higher-than-expected inflation.

Tips for purchasing a new car

With vehicle prices rising, AAA offers seven tips to make a savvy purchase:

- Select a vehicle that fits your needs. Unique capabilities, such as heavy towing capacity, generally come at a higher cost.

- Remember, the narrower your focus, the less leverage you may have when it comes to price. And in the case of some of the most popular vehicles, you may have to pre-order and wait for it to arrive if there are supply chain delays.

- Set a budget and stick to it.

- Consider how a new car may affect your insurance premiums, maintenance, and fuel requirements.

- Check multiple websites and dealers to find the most competitive price.

- Obtain pre-approval from a bank or credit union. Finance charges will vary by institution, so it’s a good idea to comparison shop their lending rates.

- If you don’t want the cost associated with a new car, consider a used vehicle that may be cheaper to finance and insure, with some of the depreciation already taken out of the cost of ownership.

“Technically, there are three negotiations when you’re buying a new car – the purchase cost, the finance rate, and the trade-in value of your current vehicle,” Conde said. “Try to keep each transaction separate. While you may get more by selling your vehicle privately, a trade-in may be easier and more hassle-free.”