Can the auto finance market avoid a debt crisis? Industry experts weigh in on alarming signs of instability

Canva

Can the auto finance market avoid a debt crisis? Industry experts weigh in on alarming signs of instability

A slightly blurred photo of traffic on a multilane roadway

With auto loan rates at historic highs, rising payments, and mounting consumer debt, the auto lending industry is facing an inflection point. With lenders continuing to tighten restrictions and some even deciding to leave the consumer auto loans market, the stage is set for what could become a full-blown auto loan debt crisis. But how impactful such a crisis would be and how the industry can navigate its way out remains to be seen.

Automoblog digs into some alarming signs that a debt crisis in the auto loan industry may be on the horizon.

The auto loan industry is showing serious signs of trouble

Automotive finance loans are one of the most popular loan products in the country and a staple of most major lending institutions’ portfolios. In a stable market, they are a fairly safe bet for lenders, as they are backed by the vehicle being purchased as collateral, and a relatively small loan amount compared to mortgages and some other types of loans.

However, the auto loans market has been anything but stable recently. Following a series of increases to the federal funds rate from the Federal Reserve, auto finance interest rates have skyrocketed. Higher rates don’t necessarily spell trouble for the industry on their own, but along with several other significant red flags, the combination of factors currently present in the market paints a worrisome picture.

![]()

Automoblog

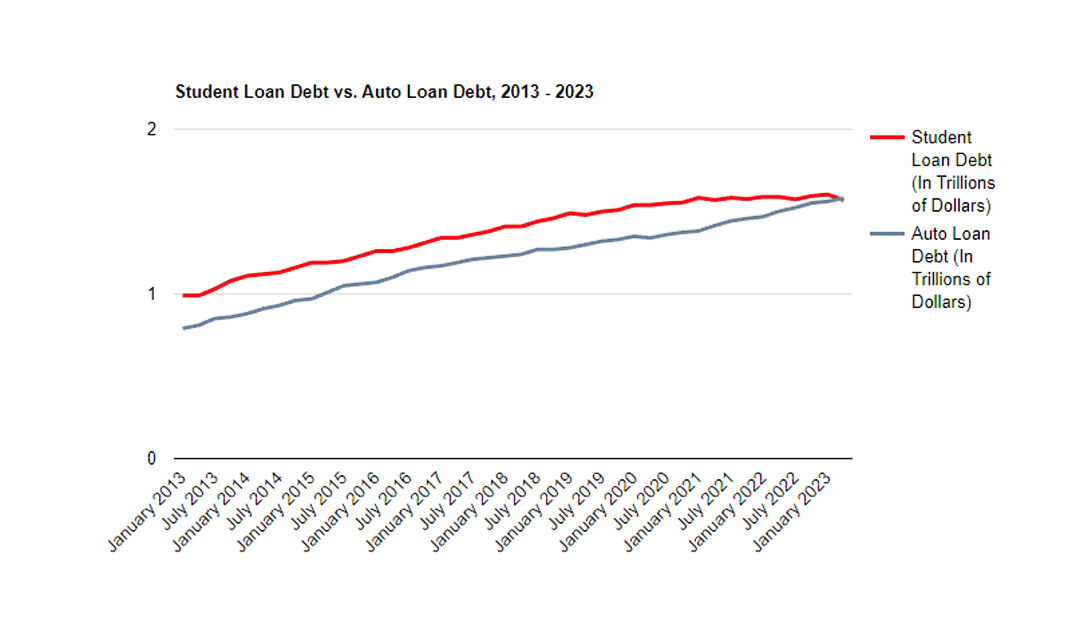

Auto loan debt has surpassed student loan debt

A line chart Student Loan Debt vs. Auto Loan Debt, 2013 – 2023

In the first quarter of 2023, more than 43 million people in the U.S. were holding federal and private student loan debt, totaling more than $1.77 trillion overall. The staggering statistics around student loan debt have made the topic a fixture of news headlines and a recurring point of discussion in the halls of government.

However, in September, the Wall Street Journal reported that the total amount of auto loan debt had surpassed student loan debt. At the end of Q2 2023, auto loan debt reached $1.58 trillion compared to $1.57 trillion in student loan debt.

The issue of student loan debt has been recognized in the national conversation and among lawmakers as one that poses an existential threat to borrowers and the economy at large. With auto loan debt now exceeding student loan debt, will authorities and the general public recognize this development as a major warning sign for the future of the automotive finance industry?

Auto finance delinquencies are still on the rise

At the same time that total auto loan debt is increasing, so is the number of Americans who are failing to meet their auto loan payments. According to the Federal Reserve, auto loans delinquent for 60 days or more increased again in September for the fifth month in a row, and up 13.3% on the year. Delinquencies among subprime borrowers reached a nearly 30-year high in September of 6.1% – the highest rate since 1994.

But while delinquencies increased between August and September, auto loan defaults – in which a lender formally terminates a loan agreement after failure to pay – actually decreased. However, even with the slight decrease, the default rate in September was still 31.7% higher than one year earlier.

High delinquency and default rates mean that lenders could face significant losses as they have a harder time recouping funds they lent out. But while these numbers may look alarming, Experian Head of Automotive Financial Insights Melinda Zabritski told Automoblog that the increase in people failing to meet loan obligations doesn’t come as a surprise.

“While delinquencies are slightly above pre-pandemic levels, we must keep in mind the increase was expected, particularly over the past few years,” said Zabritski. “2020 to 2022 was a bit of an anomaly. Keeping a close eye on these trends over the coming quarters will be paramount.”

Automoblog

People are paying more each month toward auto loans

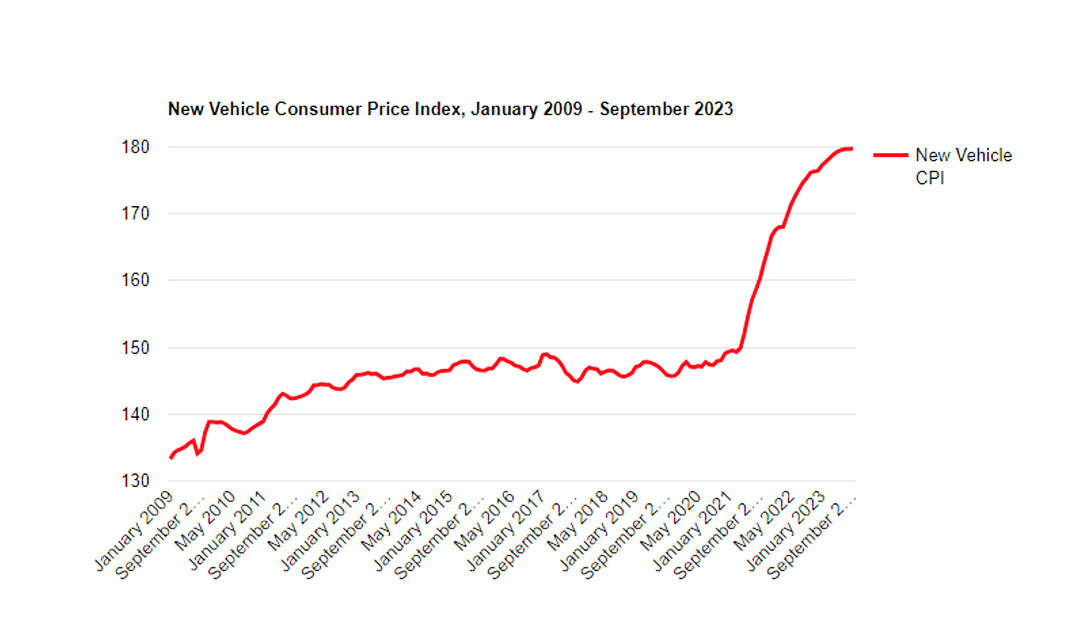

A line chart New Vehicle Consumer Price Index, January 2009 – September 2023

Another notable trend is the rise in average car payments. According to an industry report from Edmunds, the average new car payment in Q3 2023 reached $736 per month – a 4.6% increase over a year earlier.

In addition to the rise in the average payment, there has also been a significant increase in car payments that far exceed that average. In July, Experian reported that three times as many people were paying more than $1,000 per month towards an auto loan in April 2023 than were doing so in 2019.

The dramatic surge in annual percentage rates (APRs) since 2022 has played a substantial role in increasing car payments. However, Zabritski explained that another factor influencing this trend is a similar rise in the price of new cars since 2020.

“Perhaps the biggest factor contributing to auto loan debt is vehicle prices,” she said. “Inventory shortages led to an uptick in vehicle pricing, resulting in car shoppers having to take out larger loans.”

After remaining relatively flat throughout the 2010s, new car prices increased sharply beginning in 2020. According to data from the U.S. Bureau of Labor Statistics (BLS), the new car consumer price index (CPI) rose only 6.1% from 2010 to 2020. Then, between January 2020 and September 2023, the new car CPI increased by 22%. Much of this increase happened at the same time as interest rates began to climb, leaving car buyers paying higher interest rates on top of higher prices.

Zabritski said that in addition to external factors causing an increase in the average price of new cars, buyers have also been opting for pricier vehicles – which also factors into the rise in auto loan payments.

“While we’ve seen that trend level out a bit, consumers are also financing more expensive vehicles,” she said. “For instance, SUVs made up more than 60% of new vehicles financed in Q2 2023.”

Lenders are making major changes to their auto finance programs

While the trends that have contributed to the current situation have developed quickly, they have not gone unnoticed by lending institutions. Since interest rates began to climb in March 2022, many lenders have made significant changes to their automotive finance businesses.

Lenders have tightened restrictions on auto financing

Auto loans have gotten more expensive over the last several years due to rising new and used car prices. However, they have also gotten harder to come by.

In April 2023, the Federal Reserve conducted a survey of senior loan officers at U.S. banks to gauge their institutions’ lending behaviors. One question focused on how respondents’ credit standards or approval processes have changed in the past three months. While a majority of respondents said there have been no significant changes, 30% said that their lending standards have either “tightened significantly” or “tightened somewhat.”

These heightened restrictions don’t appear to be easing up anytime soon, either. The same survey asked respondents whether they expected their banks’ lending practices to change by the end of 2023. A majority – 61% – said that they did not expect any changes to their practices by the end of the year, and 39% said they expected standards to tighten somewhat or significantly. None of the respondents said that they expected their standards to loosen before the end of the year.

Some lenders have left the auto finance market

One of the most troubling developments this year is lenders drastically reducing their automotive finance options or leaving the market entirely. In September 2022, Capital One CEO Richard Fairbanks announced that the bank would significantly reduce the auto loans portion of its business. The announcement came after Capital One saw a 12% drop in earnings from the first quarter of 2022 to the second.

Another major lender, Citizens Financial Group, announced in June of 2023 that it would be exiting the auto loans market. The company had served as an indirect lender, meaning that it did not offer loans to car buyers directly, but instead through dealerships. Through a spokesperson, the company implied that this change to their business model would be permanent.

Lenders outside the U.S. are also leaving the troubled auto finance market. Canadian firm Bank of Montreal (BMO) announced in September that it, too, would shutter its indirect auto loans division. In a statement to Reuters, the company said that it would shift its focus to other sectors of the financial services industry.

The current situation spells trouble for both car buyers and dealerships

As 2023 draws to a close, the auto finance industry is in a precarious position, but not yet in a state of emergency. However, if the trends that have developed in recent years continue, a true crisis could easily develop, which may have a grave impact on the auto industry and the economy at large.

More lenders leaving the indirect auto loans market would significantly reduce the financing options available to dealerships, and therefore, to their customers. As credit becomes less available, lower-income and lower-credit borrowers would likely have to accept even higher APRs for car loans, substantially reducing their purchasing power or even taking them out of the market entirely.

Continued increases in the cost of auto loans and restrictions on lending standards would make vehicles less affordable and more difficult to buy. With fewer buyers in the market and reduced budgets for those who remain, the auto industry as a whole could see weakened demand and a softened market.

Significantly lower demand could be a complete disaster for an industry already embattled by years of supply chain issues and other hurdles. And for people in need of a new vehicle, the lack of available or affordable credit could result in some difficult situations.

With no immediate relief in sight, borrowers must protect themselves

There is no guarantee that the current situation will develop into a full-blown auto loan crisis. However, it is unlikely that car buyers, dealerships, or manufacturers will see the situation improve any time soon.

The Federal Reserve has already indicated that the federal funds rate will not go down before the end of the year. Some of the most optimistic forecasters predict that the country may see the funds rate drop in the middle of 2024, but Federal Reserve Chairman Jerome Powell has been steadfast in his assertion that they will not lower the rate until several benchmarks are reached.

While the supply chain looks to be recovering, even a full recovery won’t translate into an immediate return to full inventory. And there is no guarantee that full inventories will result in the price of new and used cars coming down. Due to the substantial increase in car prices since 2020, even a significant decrease would still result in historically high sticker prices.

Auto lenders have very few levers that they can pull to improve the current lending environment. Some are turning to new practices, such as the use of AI, to identify new opportunities and mitigate risk. Car dealerships and the brands they represent are at the mercy of several external factors over which they have very little control, if any.

Individual car buyers have even less influence over the situation. That means that the safest bet for car owners is to prepare for the possibility that it could be a long time before the auto finance market becomes more favorable, and for the very real possibility that things could get worse before they get better.

This story was produced by Automoblog and reviewed and distributed by Stacker Media.