Car insurance costs are rising faster than overall inflation—here's a closer look

Canva

Car insurance costs are rising faster than overall inflation—here’s a closer look

A close up of two cars crashed in an accident.

The cost of car insurance shot up 19% in just one year, the latest Bureau of Labor Statistics data shows, significantly more than the overall inflation rate of 3%.

The vast increase outpaced every other spending category tracked by the BLS in November. It is strikingly out of place alongside otherwise cooling inflation. What’s more, the cost of new cars grew just 1.3% since last year after a period of record highs, and the cost of used cars and trucks actually fell.

So why the increase in car insurance costs? CheapInsurance.com identified reasons insurance costs are spiking, and compared historical inflation to the rising cost of car insurance using BLS data.

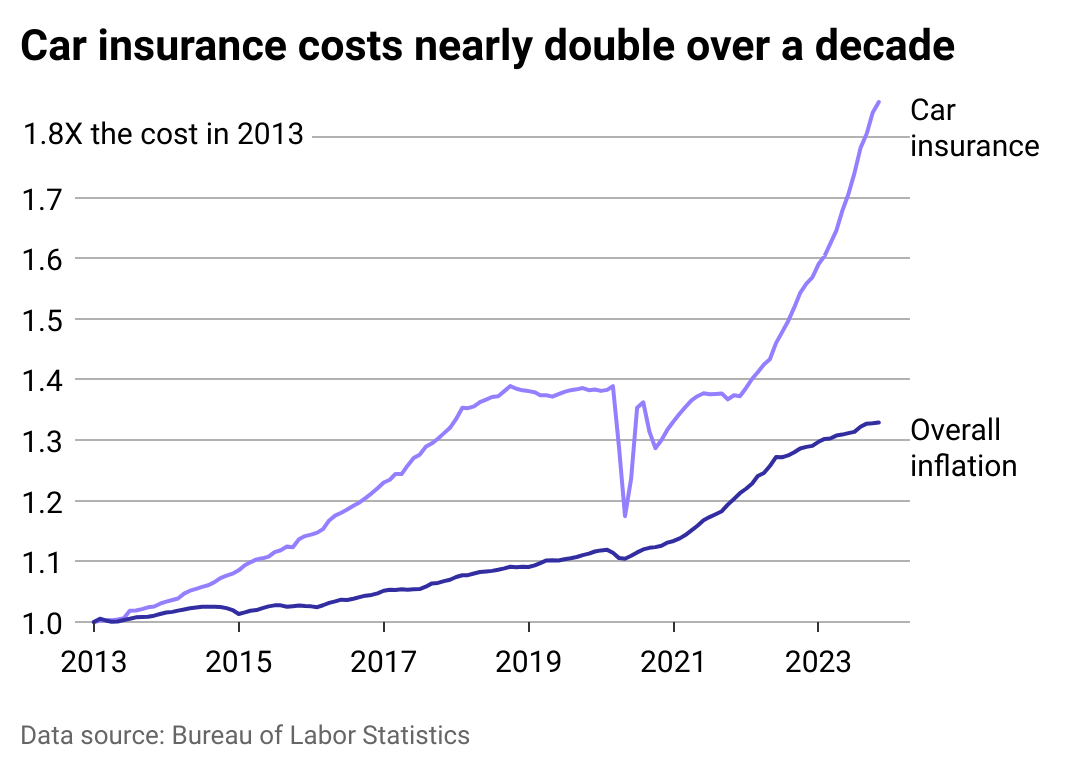

While the past year’s insurance premium spikes have been particularly jarring, car insurance costs have increased faster than overall inflation for most of the past decade. That’s largely due to faster cost increases in vehicle repairs, medical care, and (to some extent) legal costs, which all directly affect insurance agencies’ expenses.

Ownership and use of cars are also on the rise, meaning more congested roads and, in turn, more accidents. To top it off, distractions while driving have surged in the age of technology, again causing costly crashes that insurance providers must cover.

![]()

CheapInsurance.com

Repair frequency and costs drive up car insurance premiums

A multiline chart showing inflation of car insurance greatly surpassing overall inflation over the past decade.

Riskier driving habits, expensive repairs, and severe weather events are largely to blame for the recent spike in car insurance premiums.

Traffic fatalities have dropped from 2021 highs but remain elevated compared to pre-pandemic levels, Department of Transportation data shows. Insurance Information Institute CEO Sean Kevelighan told NPR that people “picked up some risky habits” during the pandemic, when stay-home orders meant fewer cars on the road. The return of denser vehicle traffic hasn’t tamed those behaviors.

More accidents have increased the need for services. Paired with higher labor costs, mechanic shortages, more challenging repairs in tech-enabled cars, and continuing supply chain issues, the cost of car repairs is up 8.5% annually as of November. As insurers are often the ones footing the bill, they have increased their prices in turn.

Natural disasters like hurricanes and floods also contribute to the rising costs. As climate change causes more severe and frequent extreme weather events, insurance companies must cover more claims. Losses due to catastrophes in the first half of 2023 were the highest in over 20 years, according to the Insurance Information Institute. Areas more prone to extreme weather, like Florida, are especially feeling the heat as insurance companies raise rates even higher or pull out altogether.

U.S. personal auto insurers are operating at an underwriting loss, meaning that the premiums paid by their customers don’t fully cover the costs insurers pay out in claims each year. III executive Dale Porfilio said the industry likely won’t become profitable again until 2025. For drivers, that will likely mean continued insurance cost bumps.

Story editing by Ashleigh Graf. Copy editing by Kristen Wegrzyn.

This story originally appeared on CheapInsurance.com and was produced and

distributed in partnership with Stacker Studio.