Average auto loan debt grew 5.2% in 2023. How will it affect car buyers in 2024?

Canva

Average auto loan debt grew 5.2% in 2023. How will it affect car buyers in 2024?

car buyers in a dealership talking to sales

The average auto loan balance held by consumers in the United States increased 5.2% to $23,792 in 2023, according to Experian data.

As in 2022, this increase was broadly based, impacting all U.S. regions and types of consumers who are financing their new and used vehicles. The average balance did not grow as much as it did in 2022, however, as vehicles joined most other goods and services that experienced slowing price increases last year.

As part of our continuing coverage of consumer credit and debt, Experian looked at its own anonymized credit data to observe recent trends in auto financing and analyze how those trends may continue to affect car buyers in 2024.

![]()

Experian

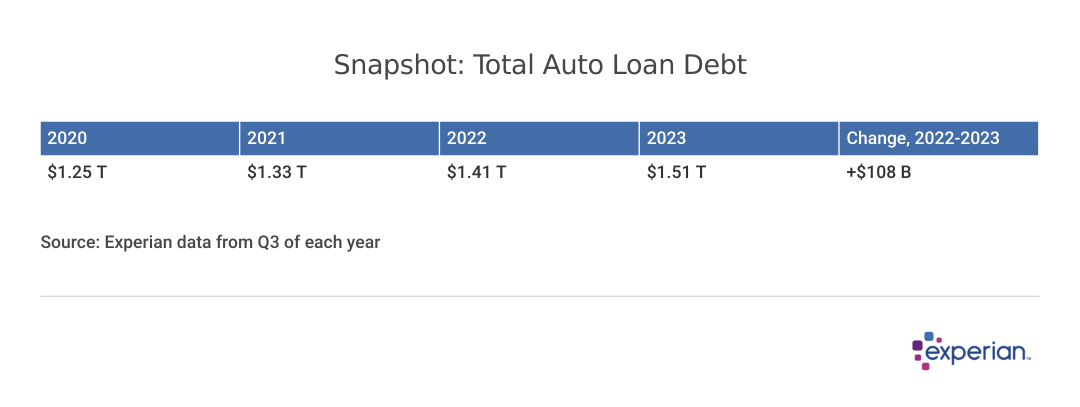

Total auto debt climbs to $1.51 trillion

Snapshot: Total Auto Loan Debt

Drivers owed $1.51 trillion on cars, motorcycles and other personal vehicles as of the third quarter (Q3) of 2023, according to Experian data, an increase of $108 billion over 2022. The increase is attributable to a combination of factors:

- Increased costs for new vehicles

- Sharply higher rates for both new and used car loans

- Longer terms on auto loans—the average auto loan term for a new vehicle is more than 68 months, according to Experian Automotive

Experian

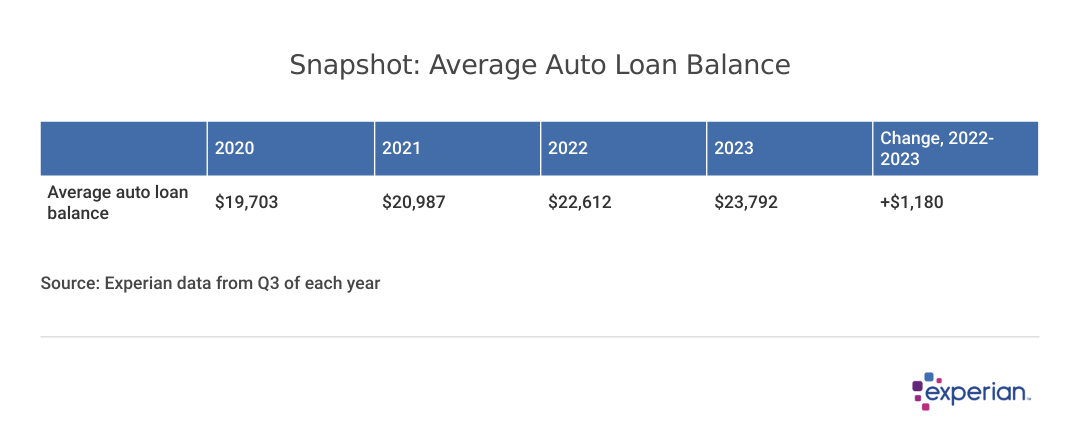

Average auto loan balance grows 5.2%

Snapshot: Average Auto Loan Balance

Average outstanding auto loan debt balances increased by 5.2% to $23,792 from Q3 2022 to Q3 2023—less than the 7.7% increase from 2021 to 2022, but still more than overall inflation, which was still running at about a 3% annual rate in late 2023.

Lingering inflation continued to impact auto loan borrowers in 2023, but higher borrowing rates for all borrowers, no matter their FICO Score, also put upward pressure on borrowing costs. Higher interest rates mean, all other things being equal, more of the monthly loan repayment goes toward interest and less principal is paid down. This increases the overall cost of the loan and ramps up monthly loan payments. It’s why new car borrowers will be “underwater” on their car loan (with the loan amount higher than the value of the car) for longer than they otherwise would have been a few years ago.

Experian

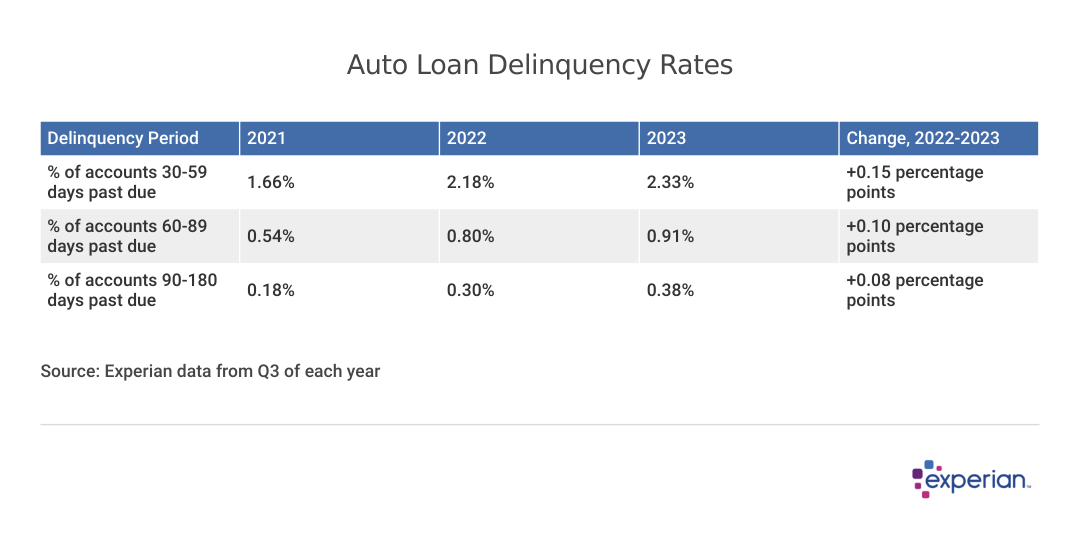

Rate of auto delinquencies rises in 2023

table showing Auto Loan Delinquency Rates

Auto delinquency rates increased in 2023. The percentage of borrowers 30 to 59 days late on their auto payments increased to 2.33% as of September 2023, a 0.15 percentage point increase from 2022.

Experian

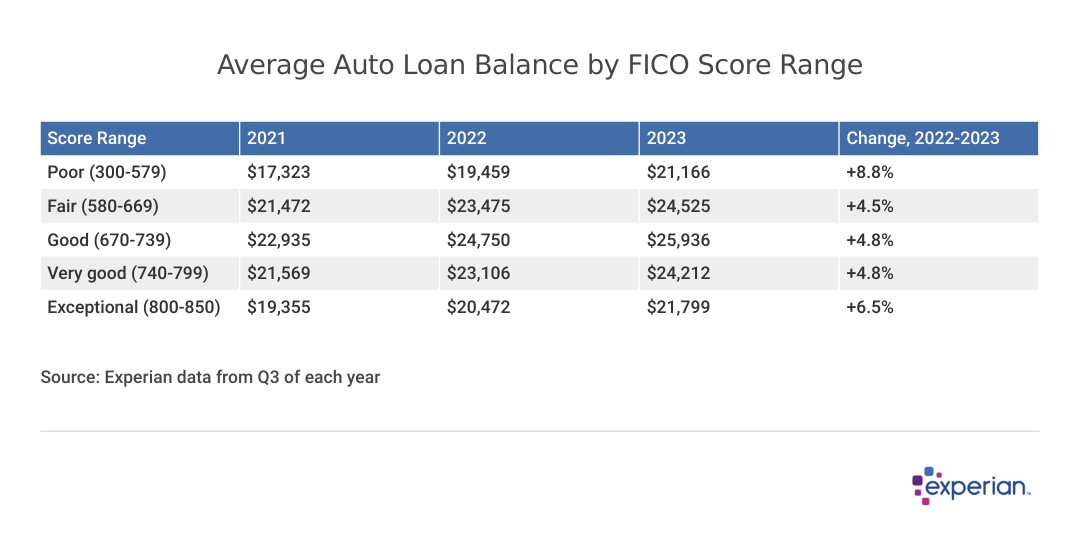

Auto loan balances rise across all credit score ranges

table: Average Auto Loan Balance by FICO Score Range

Average balances increased for all auto loan borrowers again in 2023. Those with poor credit scores saw the largest average balance increase, 8.8%, as subprime financing costs, which already carry much higher financing APRs than car loans for those with better credit, increased even more in 2023.

The 30% of auto loan borrowers with FICO Scores in the good range owe an average of $25,936 on their auto loans. Those with higher scores, apart from likely obtaining better financing offers than those with lower credit scores, have slightly lower average balances. This is also true for borrowers with fair or poor credit, who tend to finance less expensive cars (though with higher-interest loans) than those with good or better credit.

Experian

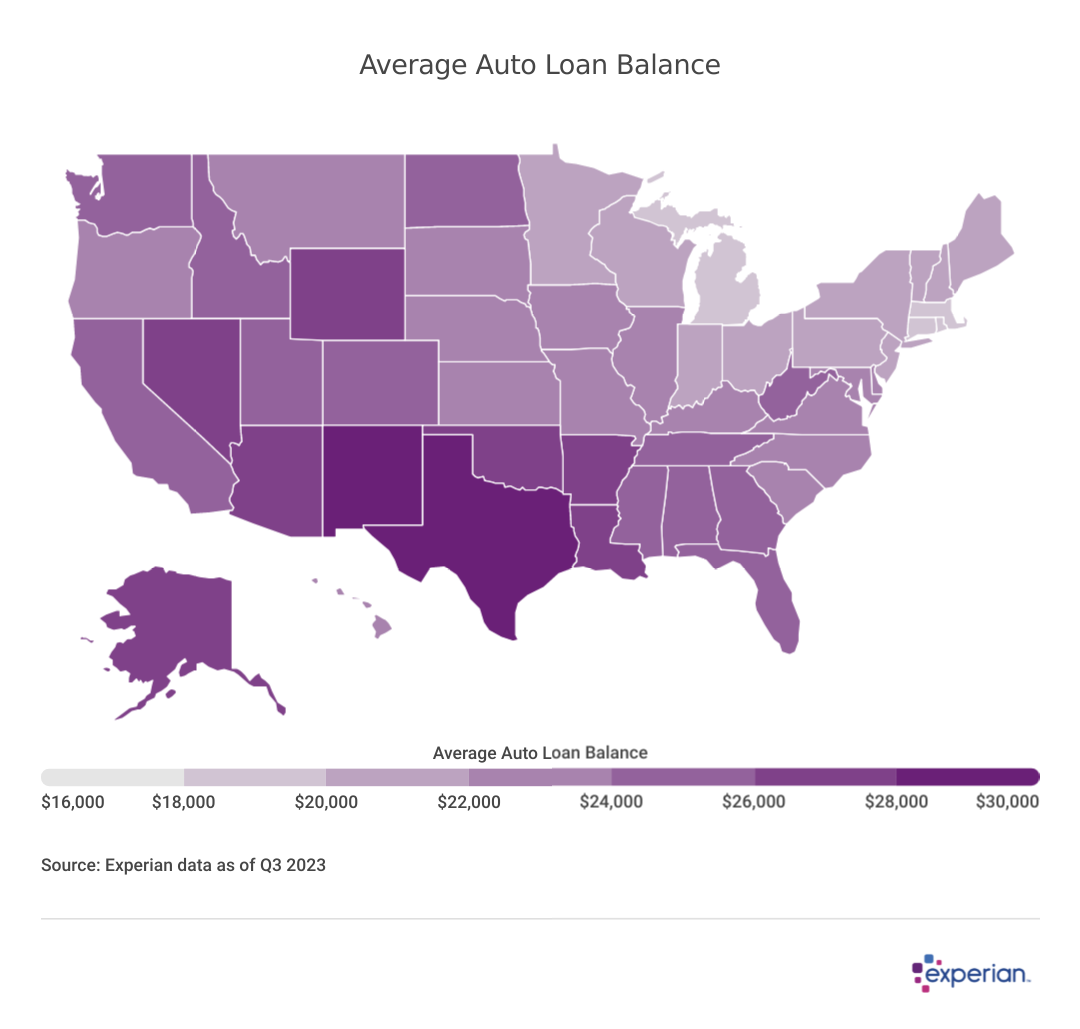

Auto balance increases moderate among the 50 states

map: Average Auto Loan Balance by State

Although the increases weren’t as severe as in 2022, auto balances still increased in every state and Washington D.C., in 2023. California, New York and New Jersey led the nation in average balance increases: Each saw a 7% or higher increase in 2023.

At least in California, with nearly 1 million registered electric vehicles in 2023, early adoption culture may be contributing to higher average balance increases. Electric vehicles have a higher average transaction price versus the new vehicle average, according to Kelley Blue Book.

In dollar terms, Texas leads the pack when it comes to auto loans. At $29,164, no other state sported a larger average auto balance in 2023.

Experian

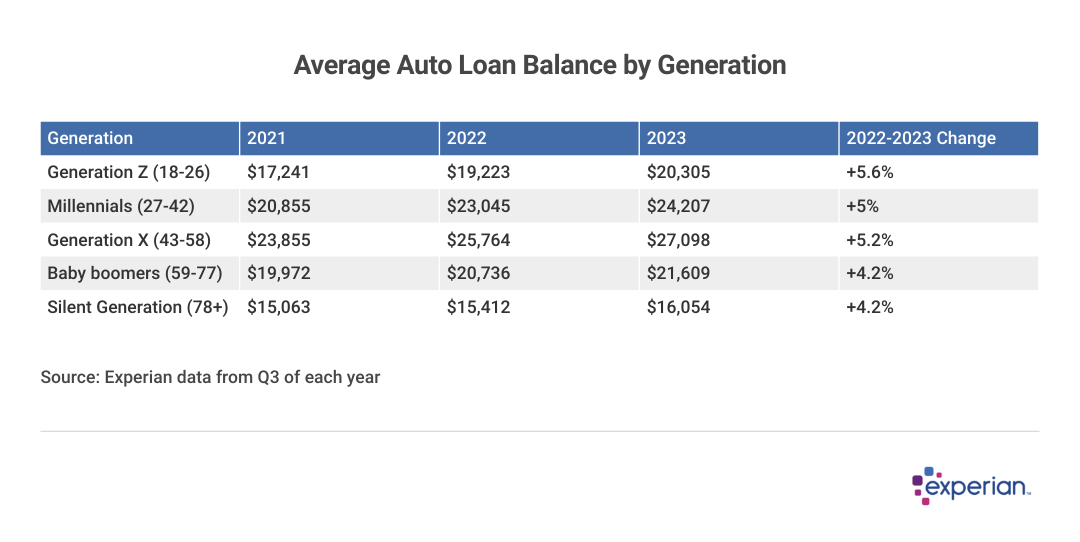

Generation X still carries the highest auto loan balances

Average Auto Loan Debt by Generation

When we sort auto balances by age, Generation X still carries the most among generations when it comes to balances owed, and it’s not even close. The generation owes more than $27,000 on vehicles, on average. That’s nearly $3,000 more than the average balance of millennials, the generation with the next-largest auto loan balance.

What’s in store for auto lending in 2024

Interest rates should moderate. The Federal Reserve is suggesting that not only will it stop raising its key interest rate, but may also begin lowering rates sometime in 2024. Lower rates can’t come soon enough: Average new car loans are around 8% APR for a five-year auto loan, according to Fed data.

Some are expecting a combination of increased supply and lower base rates may even bring the return of 0% APR financing for some new vehicles later in 2024, if your credit is sharp enough.

Supply is back. Inventories have increased significantly. According to Cox Automotive, there are now 1 million more new vehicles to choose from in 2023 than there were in 2022. That has more importance than simply finding a ride in the color you like: Larger inventories generally mean more dealer incentives for the consumer.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.