Americans have shed more than 10% of total student loan debt since March 2020

Canva

Americans have shed more than 10% of total student loan debt since March 2020

A group of three multiethnic students sit together on a college quad

A mix of factors, including voluntary repayment and piecemeal forgiveness, has subtracted more than $150 billion from the total amount of outstanding student loan debt since 2020. Still, student loan borrowers are preparing to resume payments on balances that—perhaps anticlimactically—aren’t much different from what they were three years ago.

In the time since federal student loan repayment was paused in 2020, there’s been increasingly dramatic news regarding the loans that more than 40 million Americans borrowed to pay for their education. Last-minute pause extensions and debates over loan payments that are a major financial obligation for many kept borrowers on their toes. The latest development came in June when the Supreme Court struck down the Biden administration’s plan that would have forgiven up to $20,000 in student loan debt per borrower.

With all the stir surrounding the resumption of student loan payments this fall, Experian analyzed data going back to when the student loan pause began in March 2020 to determine what’s changed—in fact, very little has not changed—and what possibly lies ahead.

![]()

Canva

Student loan debt has declined since the start of the repayment pause

A Black female student sitting at a desk and studying

Federally owned student loans were first paused, and payments were suspended, in March 2020 as one of many government responses to the pandemic. The pause was subsequently extended numerous times by the Trump and Biden administrations well into 2023. Those pauses will end with certainty on August 31, with payments due once again beginning in October.

But during that time, according to Experian data, since the repayment pause began, total student loan debt has dropped by just over 10% from $1.544 trillion in March 2020 to $1.388 trillion as of June 2023, just days after the Supreme Court’s decision to disallow the Biden administration’s plan. (Note that these totals include both federal and some private student loans, though federal loans comprise the overwhelming majority of student loans.)

What accounts for the $157 billion net reduction in student loan debt, which, prior to 2020, had been increasing with predictability for the past 20 years? It’s a mix of various administrative remedies, as well as initiative by some borrowers:

- Loan forgiveness programs: Solutions include the Public Student Loan Forgiveness (PSLF) program, which has eliminated over $42 billion in loans for more than 600,000 borrowers.

- Government action on for-profit college student loans: More than 1.3 million students who attended some educational institutions may have as much as $22 billion relieved as settlements between the Department of Education and those institutions are finalized. The loan relief is based on misleading information provided by those schools to students.

- Continued payments: Even though they weren’t required to make payments, some borrowers paid down their student loan debt during the pause anyway. As many as 9 million borrowers were making payments at some point during the pause.

- Re-accounting of payments previously made by borrowers: Although it’s not yet apparent in the data, an additional $39 billion of student loans is set to be forgiven in the coming months, as the Department of Education has determined that some borrowers had already made sufficient loan repayments toward their loans that weren’t properly captured by loan servicers and other entities during the life of the loan.

Meanwhile, some student loans that weren’t part of the loan payment pause, such as private loans, continued to accrue interest. And recent graduates, although not yet making payments, will now have their own student loan balances to attend to shortly. Both add to overall student loan debt, even as others have had loans forgiven and still others paid down their loans.

But starting September 1, interest on federally owned student loan balances will once again begin to accrue. This resumption will end the 42-month pause on interest being assessed on what was more than $1.5 trillion in federally owned student loan debt when the pause began.

There’s more potential relief to come for other student loan borrowers, however. A new income-based repayment plan, known as the Saving on a Valuable Education, or SAVE, plan, intends to lower or eliminate minimum monthly payments depending on the borrower’s current annual income.

Experian

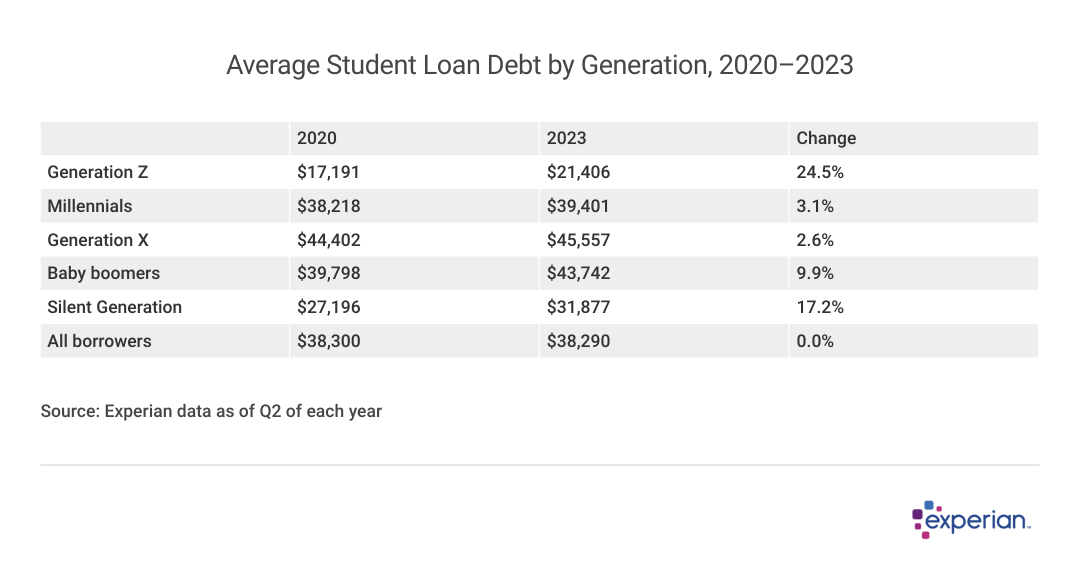

Average student loan balance highest among Generation X borrowers

A table showing Average Student Loan Debt by Generation, 2020–2023

Among the generations, Generation X (ages 42 to 57 as of 2023) still has the largest average balances. Interestingly, their balances grew the least during the repayment pause.

The youngest cohort, Generation Z (ages 18 to 26 as of 2023), still owes the least. Conversely, however, their balances grew the most, tacking on an additional 24.5% since 2020, as more former students find their way through life after college.

(Observant readers may be wondering why the average balance of each generation has increased over the past three years, while the overall average is virtually flat over the same period. We refer those readers to Simpson’s paradox, a statistical phenomenon where “an association between two variables in a population emerges, disappears or reverses when the population is divided into subpopulations.” Further reading is not for the math-allergic, but could be enlightening for those interested.)

Experian

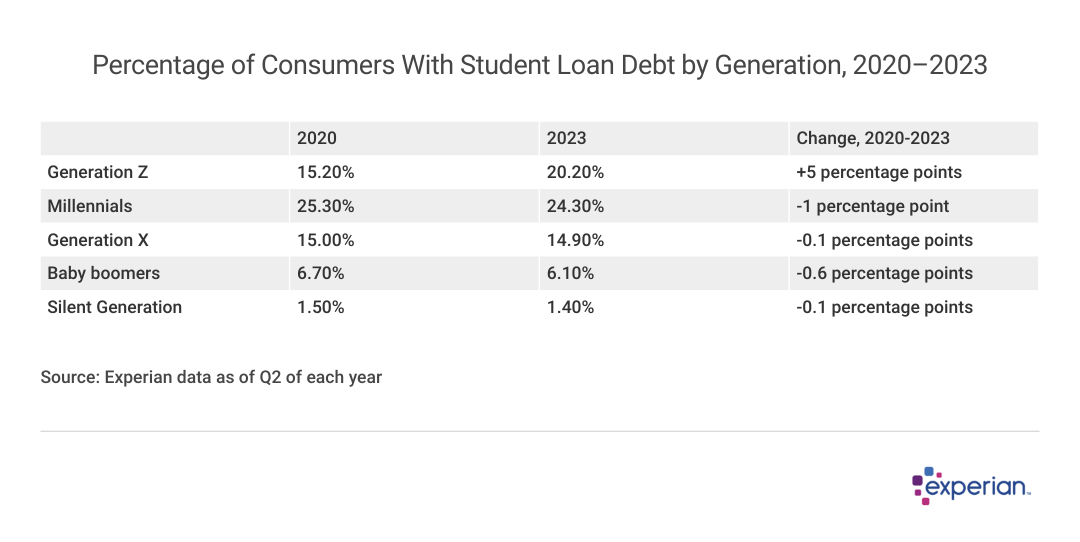

Percent of Gen Z with student loan debt grows; only generation to see increase

A table showing Percentage of Consumers With Student Loan Debt by Generation, 2020–2023

Generation Z was the only generation to see growth in terms of the percentage of the generation that has student loan debt in their name.

Meanwhile, a lower percentage of millennials owe on student loans now than they did three years ago, suggesting that this generation benefited the most from either forgiveness programs or from paying down their balances even though they weren’t required to do so.

Experian

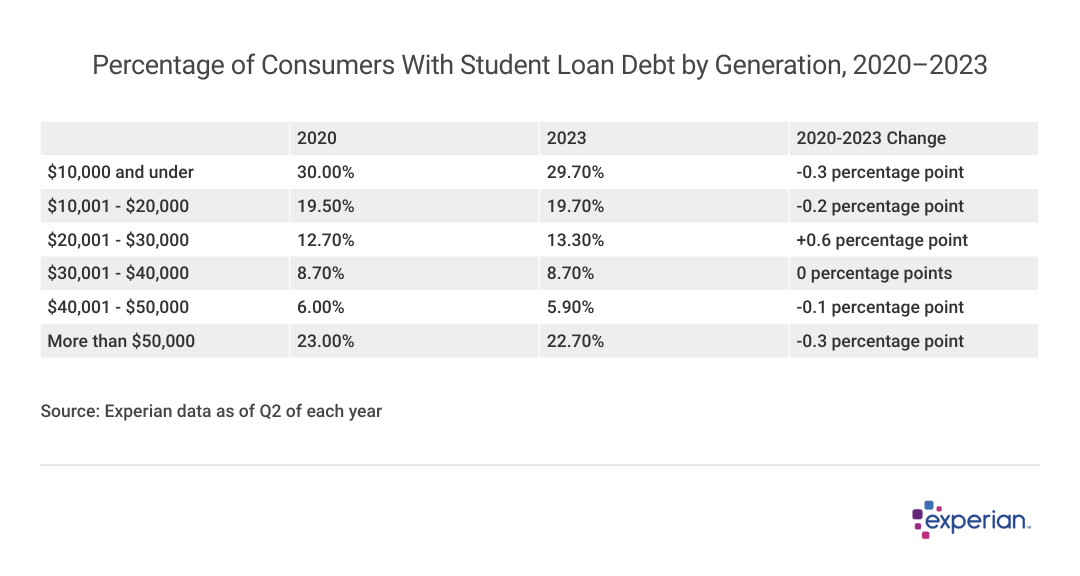

Majority of borrowers have a total balance above $20,000

A table showing Distribution of Student Loan Debt by Balance, 2020–2023

Expectedly, there hasn’t been much drift in what percentage of borrowers owe how much since 2020. Since interest accrual was paused, balances didn’t grow, and since most borrowers opted not to pay down their balances over the three years, most balances didn’t shrink either.

Experian

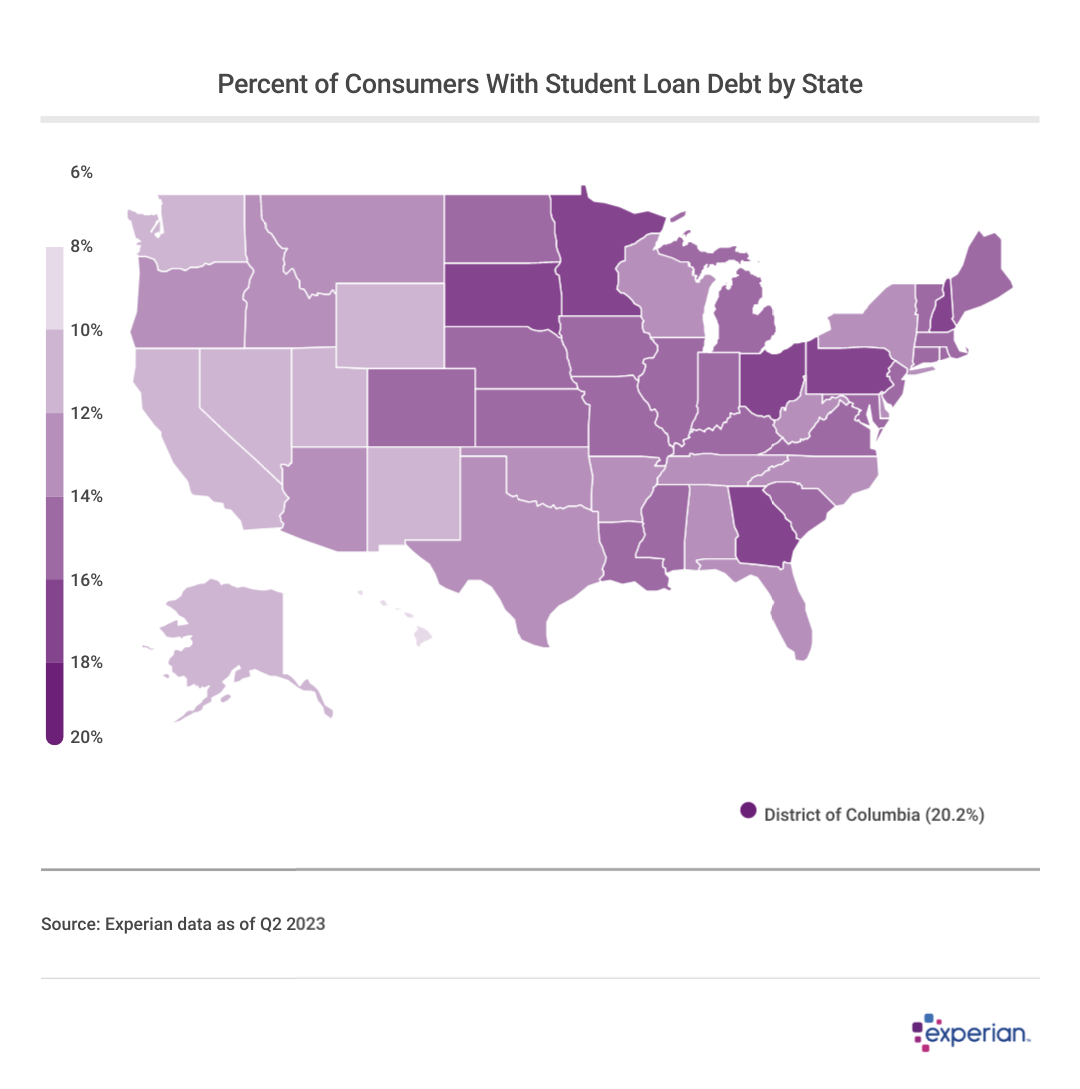

Which state has the most student loan borrowers?

A national map showing Percent of Consumers With Student Loan Debt by State

In 2023, Washington, D.C., with its colonies of youthful, largely college-educated congressional aides, has the highest percentage of residents with student loan debt: More than 20% of people there have some form of student loan debt in their name. Retiree magnet Hawaii had the lowest percentage of consumers with student loan debt—only 9.4% of individuals there were troubled with student loan debts.

More than 1 million borrowers are expected to reduce monthly payments to $0

Going forward, the monthly payments borrowers are required to make will be lower for many federal student loan borrowers, and may be cut to $0 for more than 1 million borrowers, according to federal estimates. That’s because a new income-driven repayment plan, known as SAVE (Saving on A Valuable Education), is designed to replace the existing alphabet soup of existing repayment plans some borrowers are currently using, as well as become the foundation for newer borrowers or those not enrolled in any income-driven repayment (IDR) plan.

Even if the SAVE plan doesn’t reduce a borrower’s monthly payment to $0, it will lower monthly payments for many additional low- or moderate-income borrowers. The math behind the reductions is down to two differences in SAVE versus previous IDR plans:

- A higher minimum annual income than prior IDR programs, which reduces monthly payments to $0 if a borrower’s annual income is below that level

- Borrowers with incomes too high to qualify for $0 monthly payments will see a monthly bill no more than 5% of income above than minimum annual income level—what’s referred to as discretionary income.

Borrowers can sign up by visiting StudentAid.gov/SAVE. Eligible borrowers participating in previous IDR plans will be moved to the more generous terms offered by SAVE.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analyses. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.