Legislative tax plan could slice revenue and federal fiscal aid

BOISE, Idaho (KIFI)-A legislative tax proposal could result in deep cuts in state revenue and risk federal fiscal aid to the state, according to an alaysis of House Bill 332 by the Idaho Center for Fiscal Policy.

The bill would reduce the income and corporate tax rates. It would also provide a one-time tax rebate. The analysis indicates the package would cost the state between $386 million and $389.4 million in its first year. It would cost $160 million to $169.4 million in following years based on the bill's fiscal note by the Institute on Taxation and Economic Policy.

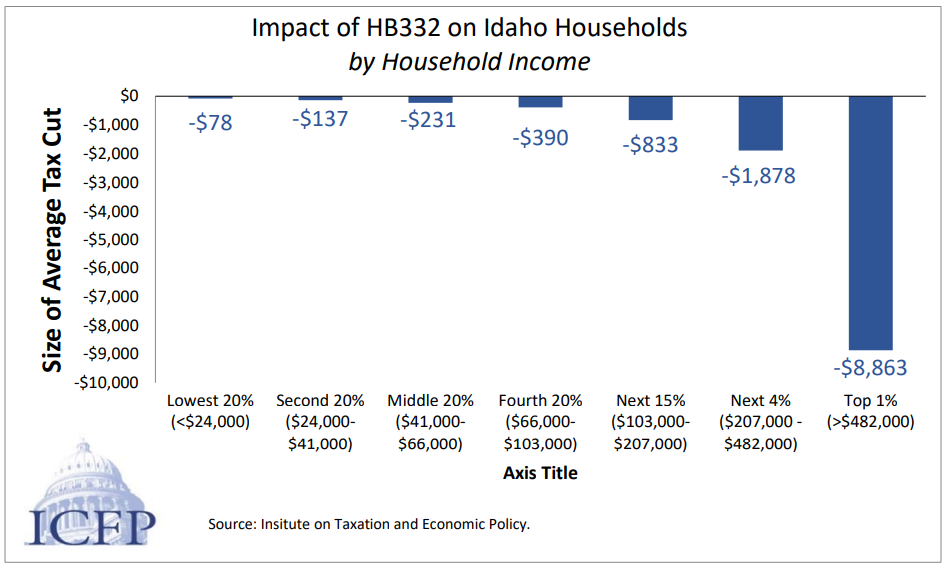

The Center for Fiscal Policy says the tax benefit would go almost exclusively to the wealthiest Idahoans. Households with incomes of up to $66,000 a year would see a decrease in their tax liability in the range of $78 to $231, depending on their circumstances. The top 1% of Idahoans, with incomes of $482,000 and above, would see a tax cut of $8,863 on average.

“To ensure our state fully recovers from the recession, we must make long-term investments in proven strategies for economic growth,” said Alejandra Cerna Rios, director of the Idaho Center for Fiscal Policy. “By focusing on cuts at the top, the current proposals do not meet the objective of bolstering middle-class families who have been hit the hardest by the recession,” Cerna Rios continued.

In addition, of the $1.2 billion set aside for Idaho in the American Rescue Plan, the bill's fiscal impact of $389 million could reduce Idaho's fiscal aid allocation by one-third, to about $800 million.

Other recent Idaho tax cuts and the out-year impact of HB 322 could reduce the loss even more.

81% of the proposed corporate tax cut would go to shareholders who live in other states and countries, according to the center.

Recent reports from the Idaho Tax Commission have shown Idaho's total tax collections per person are eighth lowest in the country and second lowest in the western states.

You can see the full Center for Fiscal Policy analysis here.