How official health insurance numbers understate consumer risks

Rostislav_Sedlacek // Shutterstock

How official health insurance numbers understate consumer risks

A patient in an office filling out medical document with doctor sitting across the table.

How bad is America’s health coverage problem? The country is undoubtedly an outlier among its peers. The United States is the only major industrialized country without universal health coverage, which provides residents with medical services at little-to-no out-of-pocket cost.

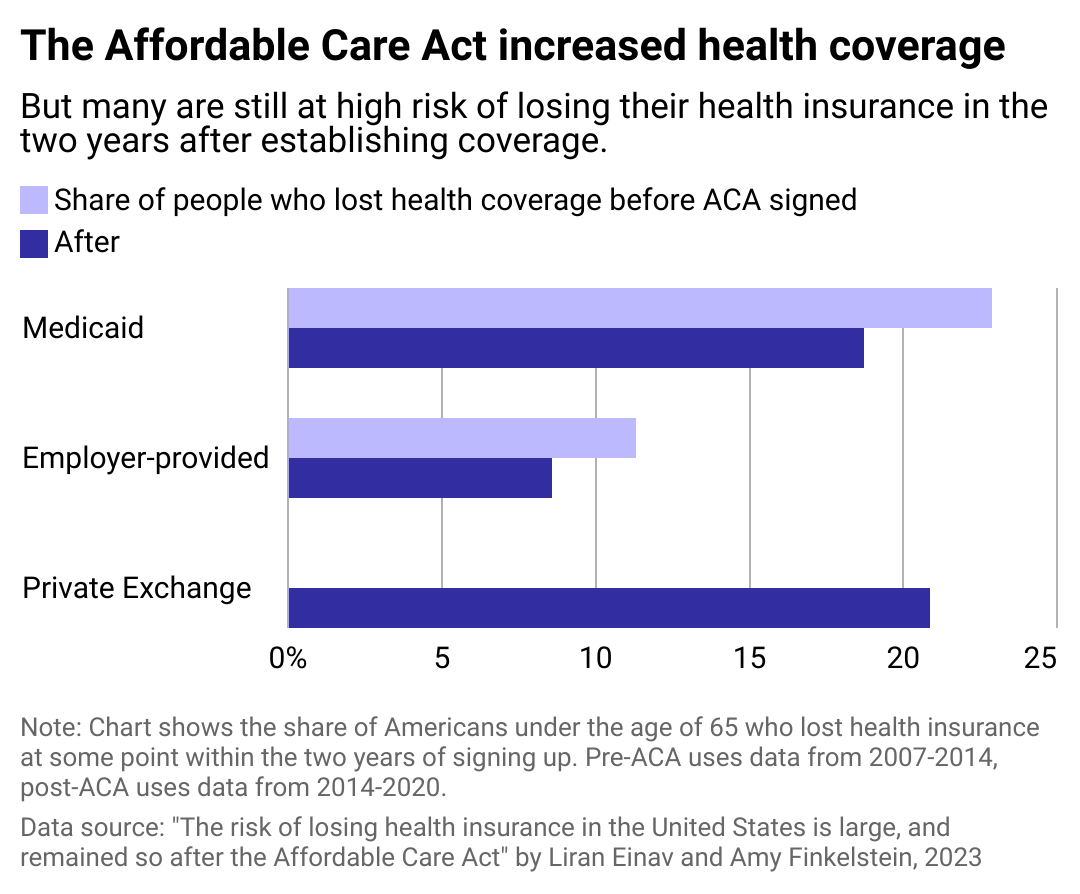

This fact has not escaped the attention of lawmakers. The Affordable Care Act, often known as Obamacare, was passed in 2010 to address America’s health coverage gaps. The central portions of the act came into law in 2014 and had a drastic impact almost immediately. The share of Americans aged 18-64 without health insurance fell from around 15% to less than 10%. The latest data suggests just 7.7% of adults under 65 lacked health coverage in the first quarter of 2023.

These results have been a drastic victory for the bill’s proponents, but the headline numbers significantly downplay how much risk Americans still face. Care Better looked at research in the Proceedings of the National Academy of Sciences journal to understand why this might be the case. Their work shows that a startling one-quarter of Americans between 18 and 64 can expect to lose their health coverage at some point two years after they first sign up for insurance.

![]()

Care Better

Some people are at much higher risk of losing their coverage than others

Bar chart showing the

The main reason for this discrepancy is that typical statistics only capture a snapshot of the population and do not account for the risk that a specific individual might lose their health insurance. People relying on Medicaid for health coverage can lose their plans for a whole host of reasons, including if they receive a raise that pushes them out of eligibility or if they move to another state with different qualification criteria. People who lose their jobs can lose their employer-sponsored health plans or be unable to afford plans they bought through private exchanges.

People with Medicaid or who buy their insurance through private exchanges are especially at risk. These individuals have a roughly 20% chance of losing their coverage in the first two years after enrolling. In contrast, people who get their insurance through their employers have less than a 10% chance of losing their plan over the same interval.

Some demographics are at higher risk of losing their health insurance than others. The study found that people with fewer educational qualifications, younger people, and Hispanic and Black Americans are especially likely to lose their insurance within two years of starting a new plan. These groups are both more likely to be enrolled in Medicaid and less likely than white Americans to work at jobs that have employer-sponsored health care coverage. Moreover, around half of those who lose their insurance do so for at least six months, while about a quarter remain uninsured for over two years.

In addition to the direct risks Americans face by not having health insurance, the study notes that inconsistent coverage can also force people into delaying vital health procedures. Spotty coverage can also confuse people about the services their plans cover or whether they have health coverage at all.

America’s health insurance woes are not just about the “permanently uninsured,” but also what the authors call the “transiently uninsured,” explaining that being insured is a dynamic state.

Story editing by Ashleigh Graf and Kelly Glass. Copy editing by Kristen Wegrzyn.

This story originally appeared on Care Better and was produced and

distributed in partnership with Stacker Studio.