Moving to a major city? Here's the income you'll need to make ends meet

jumis // Shutterstock

Moving to a major city? Here’s the income you’ll need to make ends meet

Scenic view of a classic Brooklyn brownstone block with a long facade and ornate stoop balustrades on a summer day in Clinton Hills, Brooklyn.

Most of the world’s population, nearly 4.4 billion people, live in cities, and America is no exception. In fact, according to the U.S. Census Bureau, nearly 80% of the U.S. population resides in an urban area. Whether it’s employment or entertainment that attracts you, joining the migration to America’s largest metro areas puts you in good company.

However, amid a nationwide housing crunch, one critical factor to consider before relocating to a major city is the cost of rent. So before you call the moving company, take a closer look at how America’s most populous cities compare in terms of affordability.

ConsumerAffairs analyzed February 2024 rent data from Zillow for each of America’s 125 largest cities to determine the income required to live comfortably based on the federal government’s recommended 30% affordability threshold.

Key insights

- In four of America’s 15 largest cities, you’ll need to earn $100,000 annually (or more) to afford rent comfortably.

- Heavily populated cities with more affordable housing are located in the South and Southwestern U.S.

- Out of the 15 most populated cities, New York City requires the most income to live comfortably, while Columbus, Ohio, requires the least.

![]()

ConsumerAffairs

Here’s how much you need to earn to afford the 15 largest U.S. cities

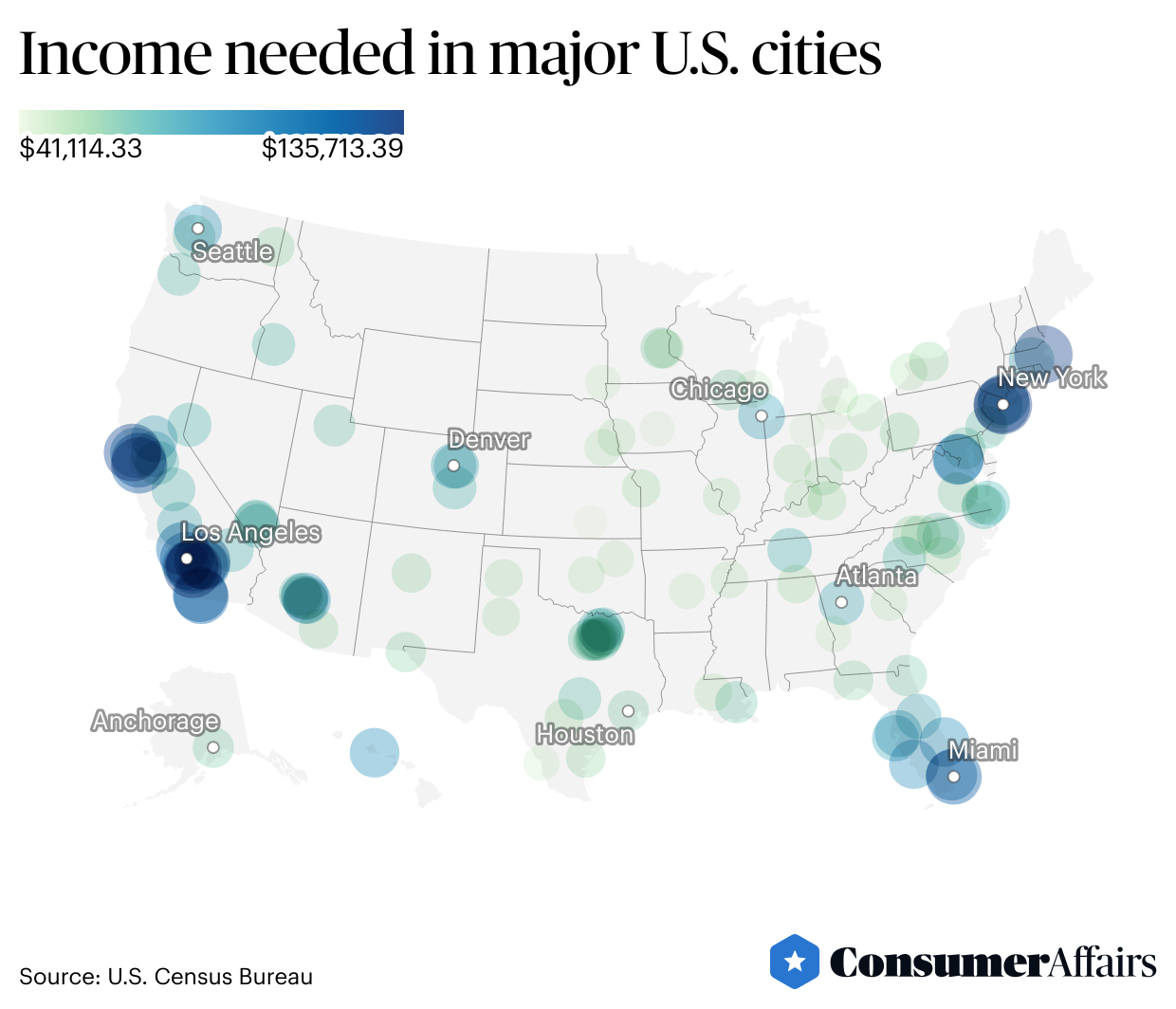

Heatmap showing “Income needed in major U.S. cities” results.

It’s no secret that housing costs are a major source of financial stress in households across America. While the Department of Housing and Urban Development (HUD) recommends housing expenses (rent or mortgage payments) make up no more than 30% of your income, nearly a third of the 15 most populated cities in the U.S. require a six-figure salary to make that happen.

The heavily populated cities you’ll pay a hefty premium to call home span both coasts. New York City demands the highest income, at a whopping $135,713 per year. However, San Jose, California, located in the heart of Silicon Valley, isn’t far behind, at $124,293.

Where can you find a little more cushion to cover the cost of living? Look toward the South and Southwestern U.S, specifically Texas, Florida and Arizona. More modest rents in these regions allow your paycheck to stretch a little farther.

Check out our list of America’s most populated major U.S. cities to discover which ones may be affordable enough for you to call home.

New York City, New York

- Income needed: $135,713

- Hourly wage needed: $65.25

- Median rent per month: $3,392.83

It’ll come as no surprise that the Big Apple tops our list of major cities that take an outsized bite out of consumers’ budgets. After all, the city that never sleeps is notorious for sky-high rents. Residents will need to make well over $100,000 per year to comfortably call this city home.

Los Angeles, California

- Income needed: $111,659

- Hourly wage needed: $53.68

- Median rent per month: $2,791.48

While rent in the City of Angels is surprisingly more affordable than other major California cities like San Diego and San Jose, it still requires a six-figure income to hang your hat in Los Angeles. It’s no wonder why so many LA residents are interested in a side hustle or two to make a living.

Chicago, Illinois

- Income needed: $83,465

- Hourly wage needed: $40.13

- Median rent: $2,086.64

If you’re moving to the Windy City, you might blow through your savings quicker than expected. Even though Chicago has slightly more affordable rents than Los Angeles and New York, the city’s notoriously chilly temperatures can also translate into some of the most expensive heating bills in the country.

Houston, Texas

- Income needed: $62,890

- Hourly wage needed: $30.24

- Median rent per month: $1,572.25

The largest city in Texas and the fourth-largest city in America offers a serious step toward affordability, but it isn’t the cheapest in the Lone Star State. According to Zillow data, at least two other Texas cities have rents that are more affordable than Houston, so don’t worry if this city isn’t where you end up hanging up your spurs.

Phoenix, Arizona

- Income needed: $68,430

- Hourly wage needed: $32.90

- Median rent per month: $1,710.75

The Sunbelt of the U.S. passes right through Arizona, but you won’t have to tighten your belt too far to afford rent in Phoenix.

Philadelphia, Pennsylvania

- Income needed: $68,175

- Hourly wage needed: $32.78

- Median rent per month: $1,704.38

Like most of the heavily populated cities in the U.S., the City of Brotherly Love struggles with affordable housing. While the income you’ll need to live in Philly is fairly modest compared with more expensive U.S. cities on this list, the Pennsylvania minimum wage is still a meager $7.25. That can make paying rent a struggle for many residents.

San Antonio, Texas

- Income needed: $55,705

- Hourly wage needed: $26.78

- Median rent per month: $1,392.62

Another relatively affordable city is San Antonio, where rents are lower than in most major U.S. cities. However, the higher cost of energy bills can still make residents feel the squeeze, especially when temperatures skyrocket in the summer.

San Diego, California

- Income needed: $118,538

- Hourly wage needed: $56.99

- Median rent per month: $2,963.46

San Diego’s beachside lifestyle contributes to housing costs that only a six-figure median income can combat. The city places third on our top 15 list when it comes to median rent, at just under $3,000 per month.

Dallas, Texas

- Income needed: $68,392

- Hourly wage needed: $32.88

- Median rent per month: $1,709.81

You’ll come out ahead on rent in some of the Lone Star State’s major cities, and Dallas is no exception. While rent can be a few hundred dollars more than in San Antonio or even Houston, the city’s world-class sports scene is hard to put a price on.

Austin, Texas

- Income needed: $68,772

- Hourly wage needed: $33.06

- Median rent per month: $1,719.29

Austin has some of the most expensive rents in Texas, but they’re still relatively affordable compared with other cities on our list. The city’s cheaper housing could be why big companies like Dell, Oracle, Whole Foods, and Tesla call Austin home.

Jacksonville, Florida

- Income needed: $63,864

- Hourly wage needed: $30.70

- Median rent per month: $1,596.59

If you’re looking for beachside lodgings for less, Jacksonville certainly offers a more affordable lifestyle than some other coastal cities (looking at you, San Diego). Just watch out for very high home and renters insurance bills.

San Jose, California

- Income needed: $124,293

- Hourly wage needed: $59.76

- Median rent per month: $3,107.32

Representing a major location in Silicon Valley, San Jose can be an expensive place to live. Let’s just hope those generous six-figure salaries that seem so common at tech companies come with the lease.

Fort Worth, Texas

- Income needed: $67,086

- Hourly wage needed: $32.25

- Median rent per month: $1,677.16

Like other big Texas cities, Fort Worth offers an affordable median rent, leaving breathing room for other expenses. It rounds out the Texas cities that are part of the 15 biggest in the country.

Columbus, Ohio

- Income needed: $55,215

- Hourly wage needed: $26.55

- Median rent per month: $1,380.37

Columbus is home to Ohio State University, which has one of the largest college campuses in the country. The affordable rent makes it an attractive place for students. In fact, the median rent is the lowest out of the 15 most populated cities in the U.S.

Charlotte, North Carolina

- Median income needed: $70,873

- Hourly wage needed: $34.07

- Median rent per month: $1,771.83

The home of the NASCAR Hall of Fame, Charlotte has higher rent costs than in some other Southern locales on the list, but the city enjoys several perks that may make it worth the cost, including a thriving sports and food scene.

ConsumerAffairs

Rent in the 15 most populated U.S.cities

Table showing the Top 15 “Income needed in America’s 125 largest cities”.

While this list focuses on the 15 most populated cities in the U.S., the cost of rent in other locales nationwide will surprise you. For instance, the median rents in Boston, Massachusetts, and Irvine, California, both come close to that in New York City.

Of the 125 most populated U.S. cities, the city with the lowest median rent, and thus the lowest income needed to afford housing, is Wichita, Kansas, where rent is just over $1,000 per month. That bargain basement rent is followed closely by similar prices in Toledo, Ohio, and Des Moines, Iowa.

Tips to save money when moving to that big city

Being cash-strapped when moving to a new city isn’t ideal, but you can avoid most of that stress by choosing a location wisely and budgeting appropriately. If you know housing costs are going to hog your financial bandwidth, find wiggle room by reducing expenses like transportation costs.

While affordability is front and center in this analysis, it’s not the final word on whether one of America’s major cities is a good fit for you or your family. Before you explore moving, evaluate the full menu of what major cities have to offer, including culture, diversity, nightlife, air quality and walkability. Calling a place home means more than just finding an inexpensive place to hang your hat.

Methodology

To determine the household income needed to live comfortably in the 125 most populous U.S. cities, ConsumerAffairs analyzed the February 2024 data from the Zillow Observed Rent Index (ZORI), which provided median rent figures for each major city as defined by 2022 U.S. Census population data. Please note that Zillow median rent data is not broken out by square footage or number of bedrooms.

Our affordability determination is based on HUD guidelines that individuals should allocate no more than 30% of their monthly income toward rent or mortgage payments. For each city, we first collected data on median rent and then calculated the minimum income required to afford housing in each location by applying the 30% affordability threshold.

This story was produced by ConsumerAffairs and reviewed and distributed by Stacker Media.