Airfares are down, but baggage fees are up: Low-cost airlines are reshaping how we pay for flights

Photo Illustration by Michael Flocker // Stacker // Canva

Airfares are down, but baggage fees are up: Low-cost airlines are reshaping how we pay for flights

An illustration of a plane and four suitcases against a blue backdrop of a departure board.

Snagging a low fare on a plane ticket is a great feeling—until you’re hit with extra fees.

While domestic airfares dropped by 5.8% between April 2023 and 2024, today’s budget-conscious travelers face more “junk fees” than ever. Low-cost carriers (and even some full-service ones) have become notorious in recent years for tacking fees on top of base airfare prices for baggage, extra legroom, snacks, and more.

For that reason, Tile, a Bluetooth tracker company, used Bureau of Transportation Statistics data to explore the rise of low-cost carrier fees.

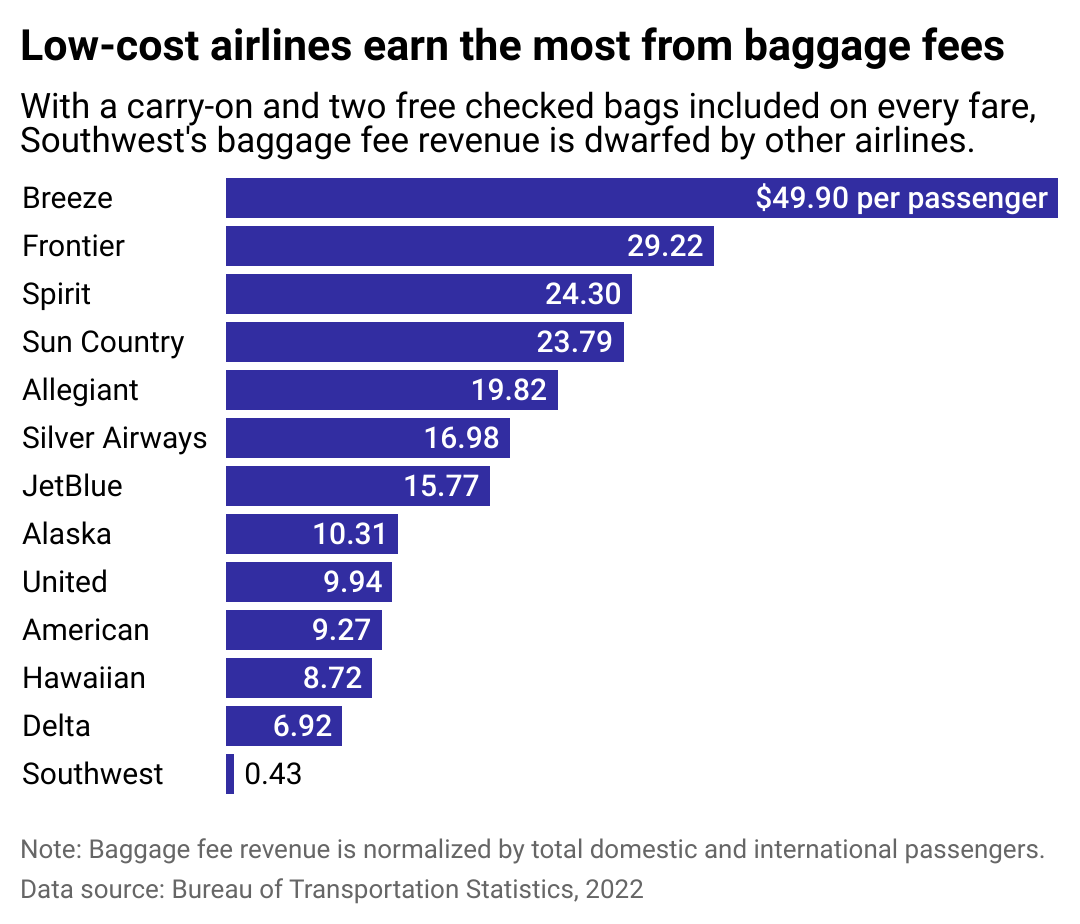

This fee structure has earned the ire of travelers but is part of the ultra-low-cost carrier business model—and it works. In 2022, airlines made over $6.7 billion in baggage fees, with Breeze Airways, Frontier Airlines, Spirit Airlines, and other budget carriers raking in the highest earnings for baggage.

This may soon change. New rules by the Department of Transportation will require airlines to disclose baggage, change, and cancellation fees to travelers upfront, as well as their fee structures on third-party booking sites. The regulation intends to ensure travelers aren’t surprised with extra costs when booking flights.

So how did we get here?

![]()

Tile

The rise of low-cost carriers

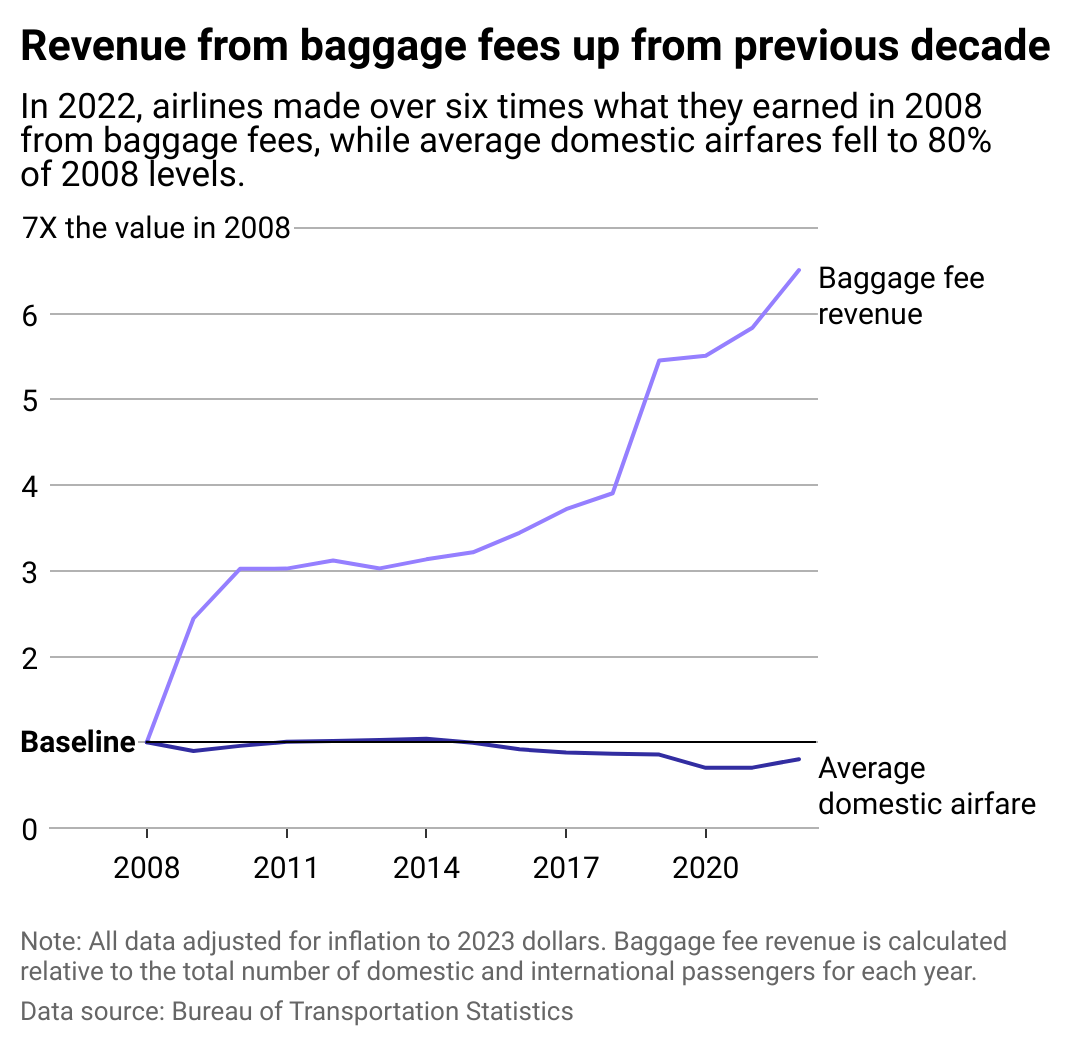

Line chart showing revenue from baggage fees up from previous decade. In 2022, airlines made over six-times what they earned in 2008 from baggage fees while average domestic airfares shrinked slightly to 80% of 2008 levels.

Southwest Airlines is credited with innovating the low-cost carrier business model. After 1978’s pivotal Airline Deregulation Act, the federal government could no longer regulate routes, fares, or even whether a new airline carrier could exist. The law was intended to increase competition among airlines, which would, in turn, lower ticket prices.

Enter Southwest.

While established airlines had historically focused on business travelers, Southwest marketed “no-frills” flights to leisure travelers on a tight budget. These everyday travelers prioritized cost over luxury, and airlines were able to accommodate demand by offering lower prices with trimmed amenities.

Airlines changed their business models to focus on selling more seats per scheduled flight, which led to adding more seats on aircraft while decreasing average legroom. Low-cost carriers were best positioned to offer no-frills flights and streamlined their offerings to low baseline ticket costs with more complex fee structures. It was a big shift from the “golden age of travel” that lasted from the 1950s through most of the 1970s and emphasized the luxurious style popular at the time: Think ample legroom, multiple-course meals, and free-flowing champagne.

Some passengers complained about the lack of quality, but it wasn’t proportional to the number of new passengers who could now afford to fly. These new budget-conscious flyers had lower service expectations based on the lower price point. Airfares decreased significantly since the Airline Deregulation Act due to the increased competition. In 1975, 209 million passengers flew; in 2019, 930 million took to the skies.

More people flying meant more competition. The low-cost model has taken off with Frontier, Spirit, Allegiant Air, and Sun Country Airlines all in operation (and competition) in the U.S. They typically don’t offer in-flight snacks or entertainment and charge additional fees for carry-on bags and seat selection. Low-cost airlines proved so effective that even full-service carriers like United Airlines, American Airlines, and Delta Air Lines have adopted basic economy fares to stay competitive.

However, the distinguishing factor between budget airlines and full-service carriers is not the frill-free, low-cost airfares but the cost of their operating expenses. Budget airlines keep these low in myriad ways, from maximizing the number of passengers on each flight to only having one airplane model in their fleet, simplifying training and maintenance.

Tile

How to navigate low-cost carrier fees

Bar chart showing low cost airlines earn the most from baggage fees. Breeze tops the list at $49.90 per passenger while Southwest is at the bottom with 43 cents per passenger.

The low-cost fee structure is not without its drawbacks. Limited itineraries can add days to get home or to the destination in the event of a cancellation, and bags beyond a personal item can cost up to $60 more.

While it’s possible to fly on a no-frills flight for less than the cost of a ticket on a legacy airline, travelers need to read the fine print and understand how low-cost airlines work before booking a flight.

Saving money on low-cost carriers is best suited for passengers willing to “play the game,” as those willing to forego a seat assignment and limit baggage will save the most money. Although travelers can’t bring drinks from home due to TSA security regulations, they can pack their own snacks since many low-cost carriers only offer snacks for sale during flights.

Remember that low-cost carriers tend to charge steep change and cancellation fees. On Spirit, for example, cancellation fees rise incrementally toward departure. The fee is $69 if travelers cancel or change their ticket between 31 and 59 days from departure, but it climbs to $119 six days or fewer before the flight. Travelers who need flexibility might want to seek other options.

While many passengers know about baggage fees, some low-cost airlines have a tiered system based on seating or time, pushing up fees even higher. On JetBlue, if travelers add the first two checked bags at least 24 hours before departure, they get $10 off. It’s also important to check the carrier’s website for luggage and personal item dimensions beforehand. Low-cost carriers tend to offer less baggage space than legacy carriers. They often check the weight and dimensions of passenger personal items at the gate, forcing passengers with backpacks a couple of inches too wide to pay at the counter before they’re allowed to board.

If you like being first in line, consider upgrading your boarding order. Southwest now charges up to $30 per flight segment for priority boarding. If a family of four has a layover, that’s $240 in boarding fees just for one way.

Before booking, figure out your priorities. If checking a bag or legroom is important, compare the final price of low-cost carriers to legacy airlines. On some routes, the legacy airline may offer a more competitive price.

Those low-cost fares may not be such a steal after all.

Story editing by Alizah Salario. Copy editing by Paris Close.

This story originally appeared on Tile and was produced and distributed in partnership with Stacker Studio.