First-time homebuyers in today's market are older and wealthier, but often need help from family and luck in location

Pravinrus // Shutterstock

First-time homebuyers in today’s market are older and wealthier, but often need help from family and luck in location

low angle shot of keychain with miniature house figurine hanging from door and the sky visible in the background

First-time buyers knocking on the door of homeownership in 2024 are still shopping in one of the most difficult real estate markets in decades.

Home prices aren’t far off record highs, with the median sales price at $431,000 in the U.S. Mortgage rates are only a few months removed from 8% for a 30-year loan, the highest in over 20 years. And inventory is still well below pre-pandemic levels.

Still, first-time purchasers made up 32% of all homebuyers in the past 12 months — a share that’s remained mostly consistent over the past 10 years, according to a recently released report from the National Association of Realtors (NAR), reviewed by ConsumerAffairs, which raises the question:

Just what does it take to become a first-time homebuyer today?

Shopping in one of the nation’s financially friendly places is key. But so is getting help from others.

![]()

ConsumerAffairs

First-time buyers can afford the down payment — often thanks to help from family

bar graph showing How much financial help are first-time homebuyers getting from family

Say you’re a first-time buyer in the current housing market. Like most in this group, you’re searching for a modest house, and you plan to take out a loan. (Over 9 in 10 new homeowners finance, according to NAR data.)

On a home priced at the median, you’d need an absolute minimum down payment of $12,930, or 3%, to take out a conventional loan. To avoid mortgage insurance, which typically requires putting 20% down, you’d have to come up with $86,200.

Most Americans who rent or otherwise don’t own a home don’t have the net wealth to afford a down payment of that size, according to the Federal Reserve’s most recent consumer finances survey, released in October 2023.

“The lack of sufficient savings for a down payment makes it difficult to qualify for a mortgage in today’s market,” said Susan M. Wachter, a real estate professor at the Wharton School at the University of Pennsylvania.

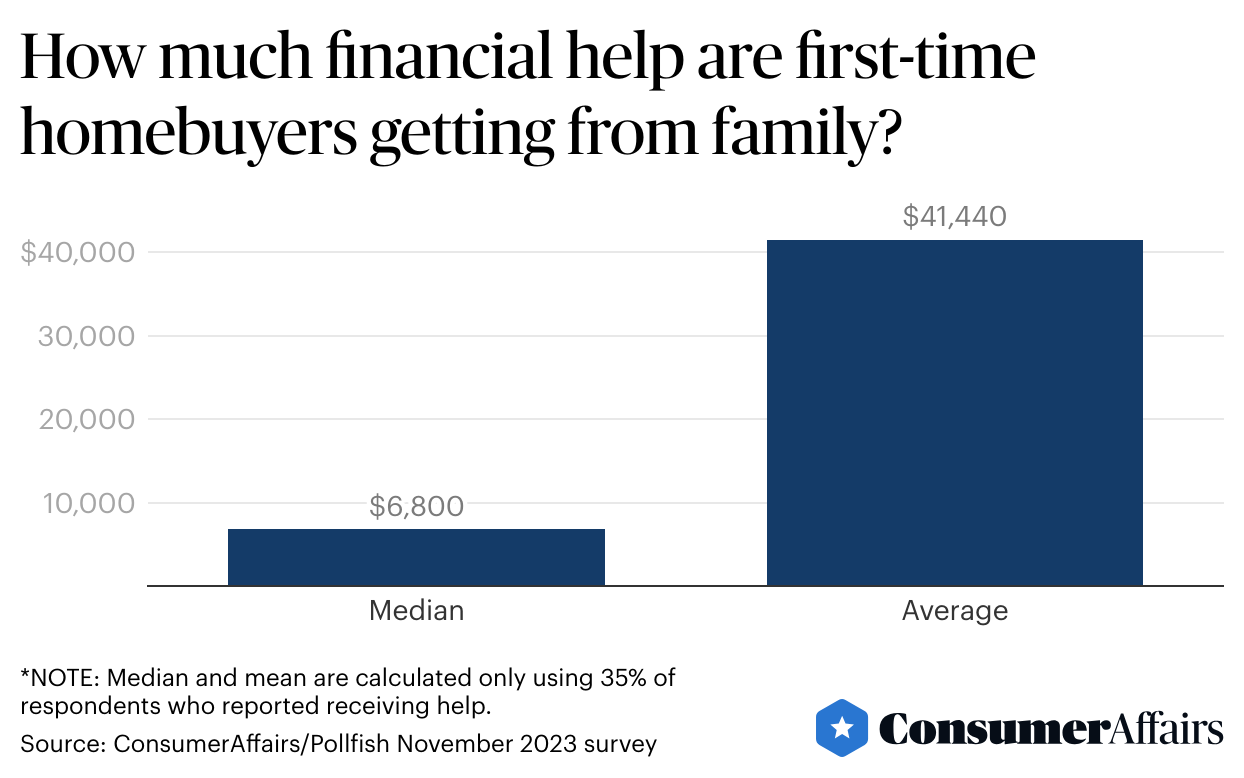

To make up the difference, about 35% of first-time homebuyers are getting financial help from family members, according to a new survey from ConsumerAffairs. Contributions range from as little as $100 to as much as $990,000. The median gift was $6,800, while the average was $41,440.

About 16% of all participants said their families were contributing $10,000 or more, 11% said they were giving at least $20,000, and 7% said they were contributing $50,000 or more.

Mark J. Eppli, the director of the Graaskamp Center for Real Estate at the University of Wisconsin-Madison, said he was “not surprised” by the percentage of first-time buyers getting down payment help from family. He noted the sharp rise in household wealth over the past three years, from about $104 trillion in the first quarter of 2020 to about $144 trillion in the second quarter of 2023, which he attributed to stock market returns and increasing home equity.

They have much higher incomes

The combination of higher mortgage rates and home prices translates to higher mortgage payments. On a $431,000 home, after subtracting a down payment of 8% — the median amount put down by first-time buyers over the past year, according to NAR — the buyer is looking at a loan amount of about $396,500.

On a 30-year fixed mortgage with a rate of 6.67%, the monthly payment (not including taxes and insurance) would be $2,550. Just two years ago, when the median home price was nearly the same, a buyer taking out the same loan at the then-prevailing rate of 3.05% had a monthly payment of $1,633, or nearly $1,000 lower.

The upturn in monthly mortgage payments likely explains NAR’s finding that today’s first-time buyers have a median household income 35% higher than a year ago: $95,500. When home prices or rates rise, increasing borrowing amounts and monthly payments, buyers need higher incomes to satisfy debt and salary requirements, Wachter, the Wharton professor, explained.

“This is a substantial barrier since the total cost of owning, including mortgage rates, property insurance and property taxes, have all increased relative to incomes,” she said.

They are older than ever

The median age of first-time homebuyers in the last year was 35, according to NAR, higher than the 28-to-33 range it has documented in the past 40 years of its survey. In 2022, it was 36, the highest age the trade association has recorded.

The age increase is in part an effect of first-time buyers waiting longer to save enough for a down payment, said Clare Trapasso, the executive news editor at Realtor.com. The median down payment among successful buyers is at its highest level in two decades, reflecting a fiercely competitive market in which sellers are weighing multiple offers — so buyers not only need to have more in hand because of higher home prices but also to sweeten their offers.

About 1 in 3 need FHA, VA, or other USDA loans

Just as about a third of first-time buyers need family help on the down payment, about 3 in 10 need help from the federal government, using loans that have both less strict qualification standards and lower down payment requirements.

Federal Housing Administration loans have low down payment requirements and more flexible credit and debt-to-income ratio standards than many conventional loans, and they allow co-borrowers. According to the FHA’s latest annual report to Congress, 82% of FHA loan borrowers, or 478,000 people, in the 2023 fiscal year were first-timers. About 3 of every 4 home loans made to borrowers with a credit score below 680 and a down payment of less than 5% were FHA-insured.

Department of Veterans Affairs loans allow service members, veterans, and their families to buy a home with no money upfront and no mortgage insurance, while USDA loans help low- and moderate-income households purchase in rural areas without a down payment.

Dan Green, the CEO of Homebuyer.com, a mortgage company that works with those new to the thomebuying process, called USDA loans “overlooked” — possibly because people mistakenly believe the areas with eligible properties are far from metro areas.

ConsumerAffairs

It helps when they buy in “financially friendly” markets

top financially friendly metro areas for first-time home buyers

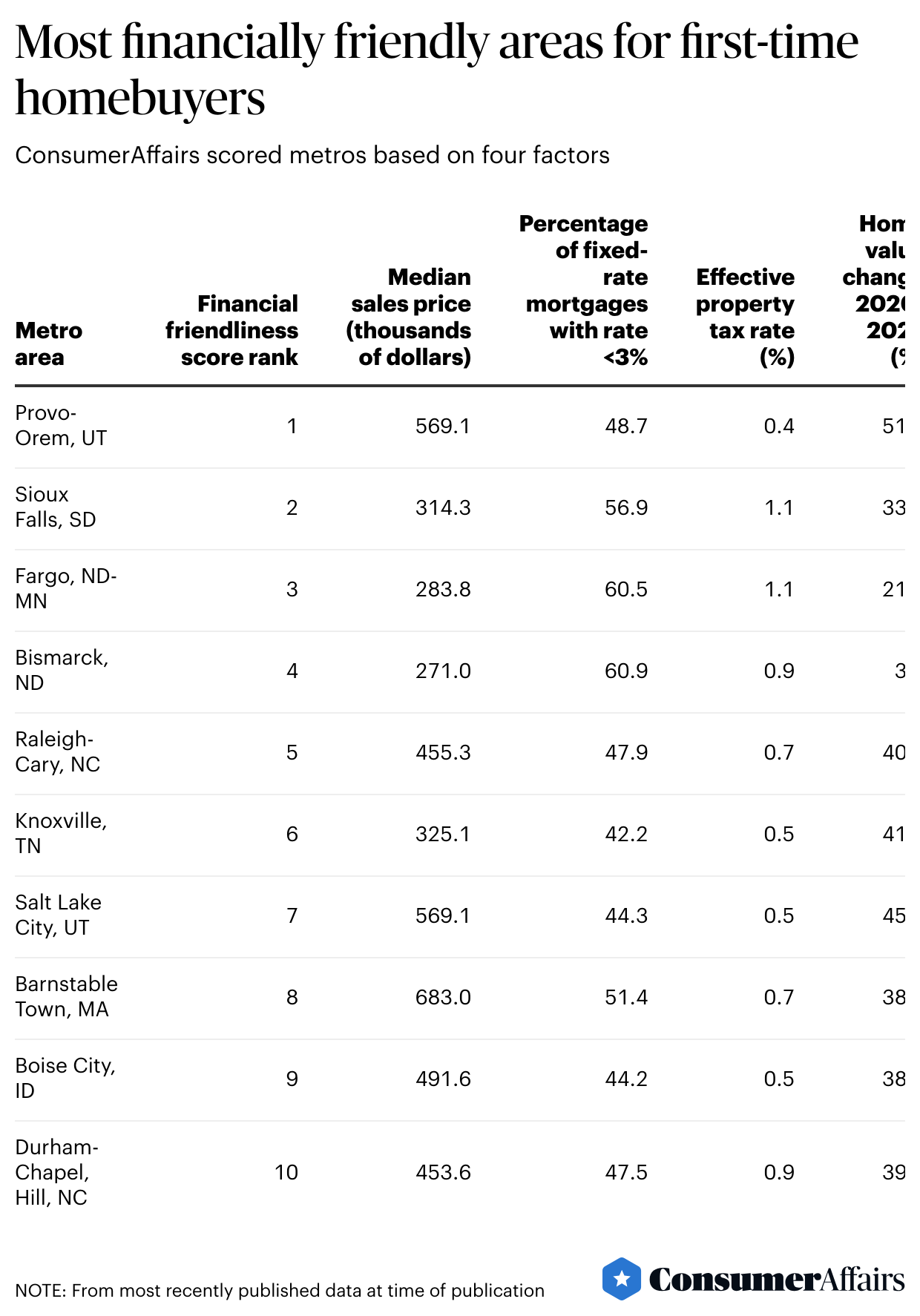

Where buyers are looking for a first home makes a difference. ConsumerAffairs ranked the best metro areas for first-time buyers based on four “financial friendliness” scores, including median sales price, mortgage rates, property taxes and home value changes.

Not all of the winners have dirt-cheap home prices: Our top pick for financial friendliness was the Provo-Orem area south of Salt Lake City, where the median sales price for a single-family home is $569,100, higher than the national median.

But the Provo-Orem market has financial attributes that make it a good place to be a first-time homebuyer, even at above-average prices.

The low effective property tax rate of 0.4% per year is one. The other is rapidly increasing home values. Between 2020 and 2022 the area saw a 51.4% hike, which conveys homebuyers flexibility to refinance or trade up for a bigger home more quickly than in areas with flatter valuation.

ConsumerAffairs

Prospective buyers may want to head for the Heartland

map showing minimum down payments by loan type in each state

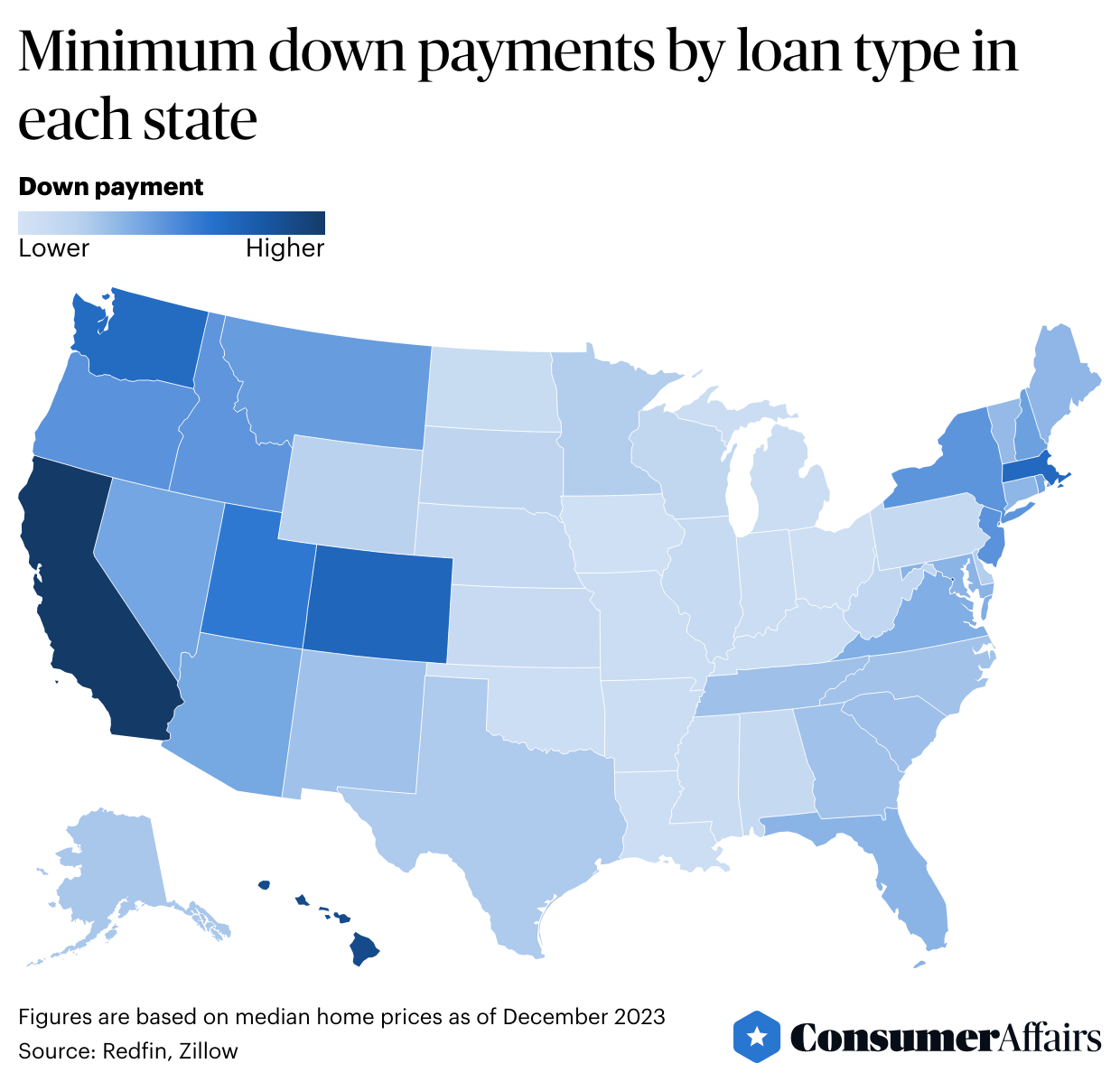

Looking at price data state by state also spotlights where it’s easier to break through. One region that leaps out is the American heartland.

To wit, among the states where a down payment of less than $50,000 will get you into a median-priced home with the standard 20% down payment are the contiguous heartland states of Iowa, Missouri, Arkansas, and Oklahoma.

Another region with a relatively low barrier to entry in terms of price is the Deep South, including Louisiana, Alabama, and Mississippi.

Outlook for first-time buyers

Wherever you live, conditions for first-time buyers appear primed to improve, if perhaps only slightly, in 2024, experts say. Zillow predicts greater supply as more current owners accept that rates aren’t returning to the historic lows of late 2020 and early 2021. Redfin forecasts a 1% year-over-year fall in housing prices in the second and third quarters and gradually falling rates.

“With the slowdown of inflation and the expectation of the Fed’s interest cuts, most experts predict that the mortgage rate will gradually decline this year but still remain above 6%,” said Jung Hyun Choi, a senior research associate at the Housing Policy Finance Center at the Urban Institute, an economic and social policy think tank in Washington, D.C. “This means that while homes would remain unaffordable for many first-time homebuyers in 2024, some improvements are expected as compared to 2023.”

For the time being, though, the market favors first-time buyers with money — and those with access to it through family.

This story was produced by Consumer Affairs and reviewed and distributed by Stacker Media.