Where baby boomers are buying the most homes

Wileydoc // Shutterstock

Where baby boomers are buying the most homes

A row of newly built homes in Raleigh, NC.

Baby boomers are retiring in record numbers. Retirement often signals a major shift in a person’s life. Many retirees choose to downsize to a more manageable home or move to an affordable area to better stretch their fixed dollars. Others simply want to enjoy a different lifestyle with their newfound free time. These shifts in dollars and demand can affect local economies—especially if they’re done en masse.

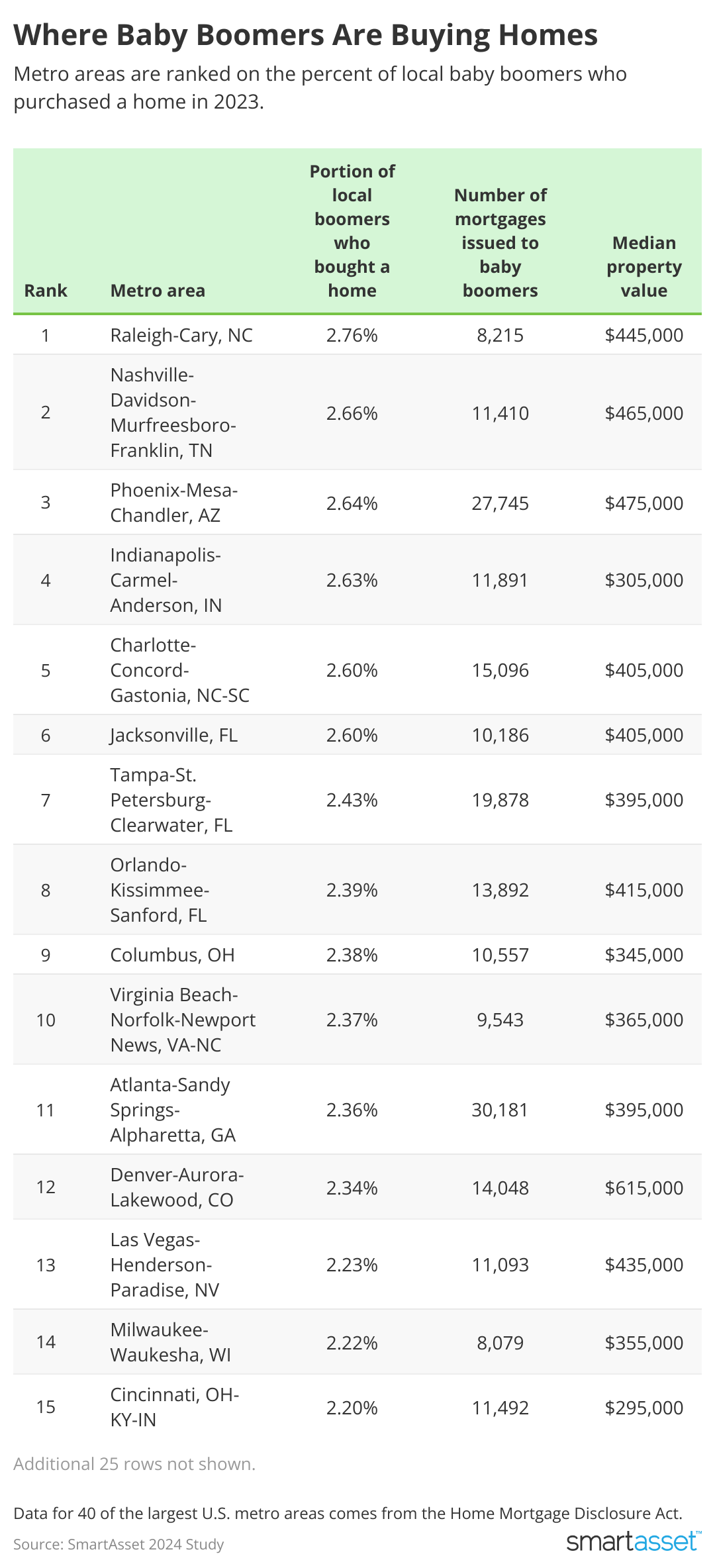

With this in mind, SmartAsset examined 2023 mortgage data for 40 of the largest U.S. metro areas to determine where baby boomers are buying homes at the fastest rate relative to the local population. The associated median interest rates, property values, and boomer incomes were also evaluated.

Key Findings

- Baby boomers are buying homes at the fastest rates in Raleigh-Cary, NC. This metro saw 8,215 mortgages issued to homeowners in this age range in 2023, relative to a total population of just about 300,000 boomers. The Nashville metro area had the second-highest rate of boomers buying homes (11,410 mortgages issued) and the Phoenix metro ranked third with 27,745 new boomer mortgages.

- The most mortgages were issued to baby boomers in the Atlanta, GA metro area. 30,181 mortgages were issued to this generation in the Atlanta-Sandy Springs-Alpharetta metro area in 2023. The average income for these households was $99,000, compared to a property value of $395,000. The Phoenix metro had the second-most boomer mortgages issued at 27,745.

- San Francisco is least preferred by baby boomers. Metrics from the San Francisco metro area are unfavorable for affordability, with the average new boomer household earning a median of $216,000, and property values coming in at $1.55 million. The area has the slowest rate of boomers buying homes relative to the population, with only 2,626 mortgages issued last year.

- Boomers got the best interest rates in these metros. Three metro areas tie for the lowest interest rates being issued to baby boomers at a median of 6.625% in 2023. These include Austin, TX (ranking 28th overall for the rate at which boomers are buying homes); Milwaukee, WI (10th); and San Antonio, TX (25th).

![]()

SmartAsset

Top 10 Metro Areas Where Baby Boomers Are Buying the Most Homes

Table showing where baby boomers are buying the most homes.

- Raleigh-Cary, NC

- Percent of local baby boomers who purchased a home in 2023: 2.76%

- Total number of baby boomer mortgages originated in 2023: 8,215

- Median interest rate on baby boomer mortgages: 6.75%

- Median property value of baby boomer purchases: $445,000

- Median income of new baby boomer homebuyers: $112,000

- Nashville-Davidson-Murfreesboro-Franklin, TN

- Percent of local baby boomers who purchased a home in 2023: 2.66%

- Total number of baby boomer mortgages originated in 2023: 11,410

- Median interest rate on baby boomer mortgages: 7.00%

- Median property value of baby boomer purchases: $465,000

- Median income of new baby boomer homebuyers: $105,000

- Phoenix-Mesa-Chandler, AZ

- Percent of local baby boomers who purchased a home in 2023: 2.64%

- Total number of baby boomer mortgages originated in 2023: 27,745

- Median interest rate on baby boomer mortgages: 6.75%

- Median property value of baby boomer purchases: $475,000

- Median income of new baby boomer homebuyers: $107,000

- Indianapolis-Carmel-Anderson, IN

- Percent of local baby boomers who purchased a home in 2023: 2.63%

- Total number of baby boomer mortgages originated in 2023: 11,891

- Median interest rate on baby boomer mortgages: 6.99%

- Median property value of baby boomer purchases: $305,000

- Median income of new baby boomer homebuyers: $87,000

- Charlotte-Concord-Gastonia, NC-SC

- Percent of local baby boomers who purchased a home in 2023: 2.60%

- Total number of baby boomer mortgages originated in 2023: 15,096

- Median interest rate on baby boomer mortgages: 6.95%

- Median property value of baby boomer purchases: $405,000

- Median income of new baby boomer homebuyers: $98,000

- Jacksonville, FL

- Percent of local baby boomers who purchased a home in 2023: 2.60%

- Total number of baby boomer mortgages originated in 2023: 10,186

- Median interest rate on baby boomer mortgages: 6.75%

- Median property value of baby boomer purchases: $405,000

- Median income of new baby boomer homebuyers: $102,000

- Tampa-St. Petersburg-Clearwater, FL

- Percent of local baby boomers who purchased a home in 2023: 2.43%

- Total number of baby boomer mortgages originated in 2023: 19,878

- Median interest rate on baby boomer mortgages: 6.99%

- Median property value of baby boomer purchases: $395,000

- Median income of new baby boomer homebuyers: $99,000

- Orlando-Kissimmee-Sanford, FL

- Percent of local baby boomers who purchased a home in 2023: 2.39%

- Total number of baby boomer mortgages originated in 2023: 13,892

- Median interest rate on baby boomer mortgages: 6.89%

- Median property value of baby boomer purchases: $415,000

- Median income of new baby boomer homebuyers: $103,000

- Columbus, OH

- Percent of local baby boomers who purchased a home in 2023: 2.38%

- Total number of baby boomer mortgages originated in 2023: 10,557

- Median interest rate on baby boomer mortgages: 7.25%

- Median property value of baby boomer purchases: $345,000

- Median income of new baby boomer homebuyers: $95,000

- Virginia Beach-Norfolk-Newport News, VA-NC

- Percent of local baby boomers who purchased a home in 2023: 2.37%

- Total number of baby boomer mortgages originated in 2023: 9,543

- Median interest rate on baby boomer mortgages: 6.99%

- Median property value of baby boomer purchases: $365,000

- Median income of new baby boomer homebuyers: $100,000

Data and Methodology

To find where baby boomers are buying homes at the fastest rates, SmartAsset reviewed Home Mortgage Disclosure Act data for 2023. Specifically, originated mortgages for people aged 55 to 74 were considered, relative to the size of the local population aged 55 to 74 according to 2022 Census Bureau data. The median income of new boomer homeowners, as well as subject property value and interest rate, were also considered.

This story was produced by SmartAsset and reviewed and distributed by Stacker Media.