Boomers could work minimum wage and pay off college debt—a feat that would take Millennials at least twice as long

Photo Illustration by Stacker // Canva

Boomers could work minimum wage and pay off college debt—a feat that would take Millennials at least twice as long

photo illustration showing two people of different generation with background symbolizing student debt

Most Americans intuitively know that higher education has become disproportionately expensive for younger generations—thanks to millions of graduates trapped in student debt.

But are education costs really so out of reach for younger generations, considering new career opportunities and wage inflation? Creditnews put that theory to the test by comparing the college tuition costs of Baby Boomers and Millennials against what both generations earned after graduation.

Our analysis revealed a stark difference in the “purchasing power” of a college degree in the 1980s and today, driven by the growing disparity between tuition costs and wages. Even though Baby Boomers had it much easier back in the day, student debt is catching up with them, too.

In a twist, Boomers’ student debt balances have recently exploded as many Boomers take out loans to put their kids through college.

Key findings

- Between the mid-1980s and 2010, the cost of a Bachelor’s degree in public and private colleges increased by 421% and 303%, respectively;

- Over the same period, the average post-graduation salary saw a 165% increase, while the federal minimum wage jumped by a mere 116%;

- Baby Boomers earning minimum wage could pay back their public college tuition by working just 1,410 hours—a figure that dropped to 481 hours for those earning the average post-graduation salary;

- In comparison, Millennials earning minimum wage need 3,398 working hours to pay back their public college tuition and 1,004 hours if they earn the average post-graduation salary;

- When attending private colleges, Millennials need to work five times as many hours as Baby Boomers to pay down their tuition if they earn minimum wage;

- Despite enjoying more affordable college, Baby Boomers have racked up $78.2 billion in federal student loans to put their kids through school.

How quickly each generation could have paid off their college tuition

According to our analysis, the cost of an undergraduate degree in public and private colleges soared by 421% and 303%, respectively, between the Boomer and Millennial graduation years. What’s more striking is that Millennials didn’t just pay more in absolute dollar terms; their higher education degree came at a multi-fold higher cost relative to what they earned post-graduation.

Here’s a breakdown of public and private college costs.

![]()

Creditnews

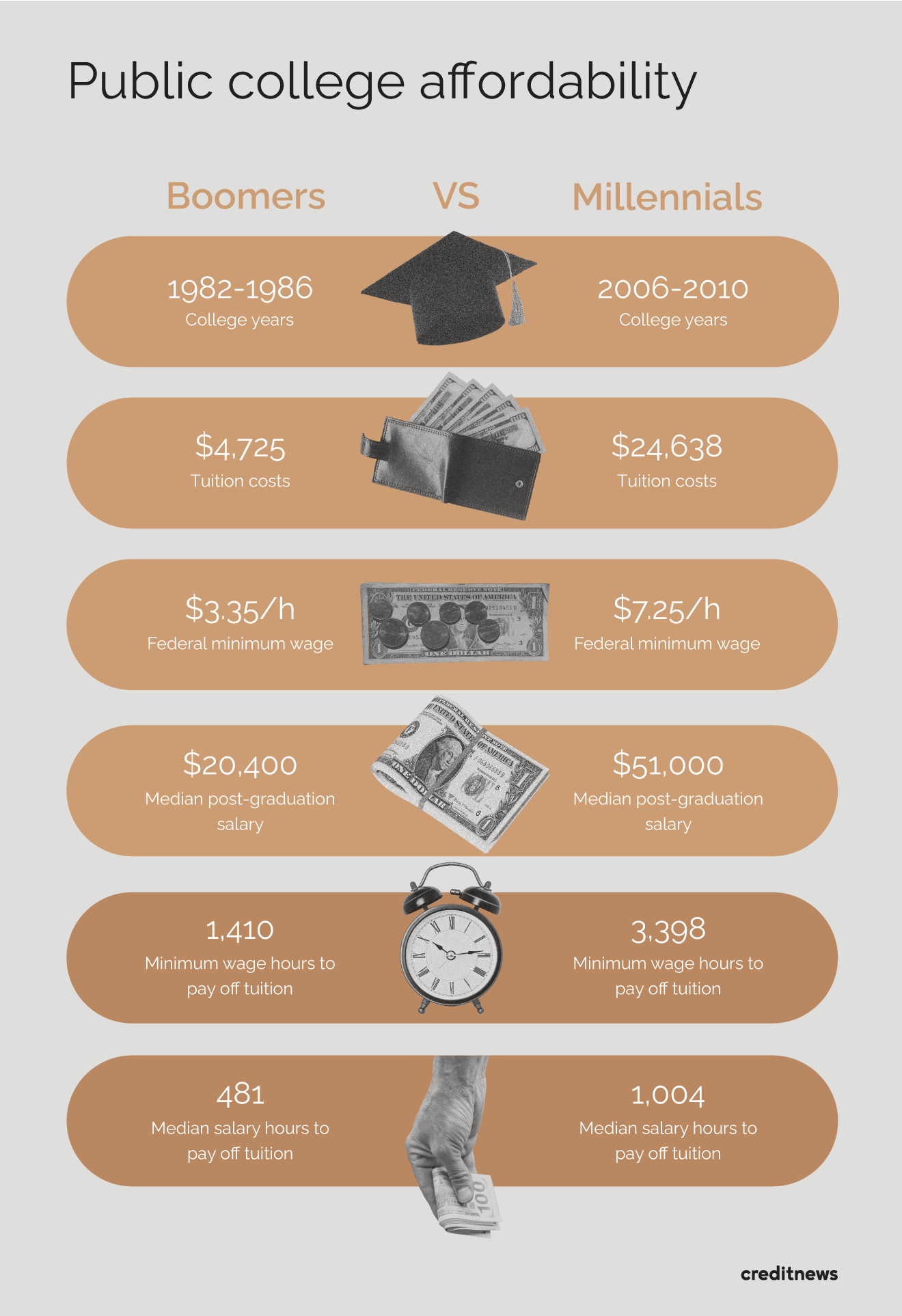

Public college

infographic comparing public college statistics for each generation

Baby Boomers who attended a public college between 1982 and 1986 paid a total of $4,725 for a Bachelor’s degree. Even if they had earned the minimum wage ($3.35 per hour), it would have taken them 1,410 hours to pay back their tuition in full. That’s equivalent to about nine months of work, assuming a typical 40-hour work week.

However, had they earned the average post-graduation salary ($20,400), they could have paid off their full tuition in 481 work hours or three months. On the flip side, Millennials who attended a public college between 2006 and 2010 paid $24,638 in tuition costs and related fees.

Although Millennials faced a 421% increase in tuition costs compared to Baby Boomers, their post-graduation wages hardly caught up—with the federal minimum wage and median post-graduate salaries increasing by only 116% and 165%, respectively. By the time they graduated, Millennials could earn the federal minimum wage of $7.25. At that rate, it would have taken 3,398 working hours for Millennials to pay back their tuition in full.

Even those Millennials who earned the average post-graduation salary in 2011 ($51,000) needed 1,004 hours’ worth of work— or more than six months—to pay off their tuition costs. That’s twice as much as Boomers, even with wage inflation factored in.

Creditnews

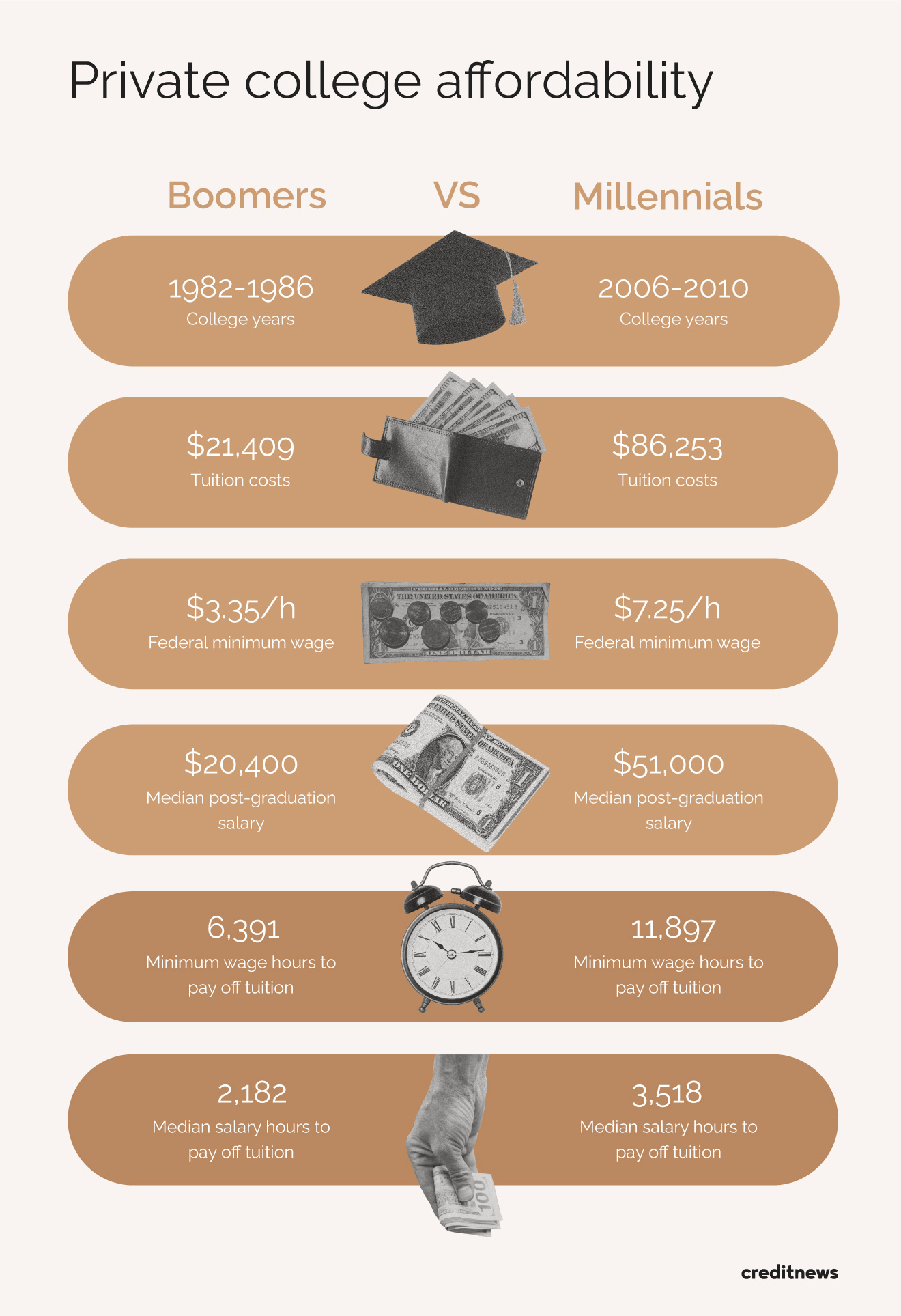

Private college

infographic comparing private college statistics for each generation

Private colleges often provide smaller class sizes, specialized studies, more abundant resources, and higher rankings that may give students better career and networking opportunities after graduation.

However, this comes at a much steeper cost that is carried through both generations. Between 1982 and 1986, Baby Boomers paid $21,409 to earn a Bachelor’s degree at a private college—more than five times higher than the cost of public tuition. But even then, private college was relatively affordable.

Earning the minimum wage, Boomers could have paid back their tuition in 6,391 hours, or roughly three years. For Boomers earning the average post-graduation salary, it would have taken 2,182 hours, or a little more than a year, to pay back the tuition.

For Millennials, the repayment timeline for private colleges is vastly different. Attending a private college between 2006 and 2010 cost $86,253, requiring 11,897 hours, or roughly six years of minimum wage hours to pay off. For those earning median post-graduate salaries, the repayment would take 3,518 hours.

Baby Boomers are racking up student debt on behalf of their kids

It’s only natural to assume that Baby Boomers enjoyed an affordable college education, paid their tuition, and sailed off into the sunset. Unfortunately, things didn’t quite turn out that way.

Decades after graduating college, Boomers now hold some of the highest student loan debt in the country—thanks in large part to Parents PLUS Loans, a federal program that allows parents to take on student loans on behalf of their kids.

According to our analysis, Baby Boomers have amassed $78.1 billion in direct federal student loans—a 155% increase in just six years. The number of Boomers taking on loans, presumably for their kids, doubled from 800,000 to 1.6 million over the same period. That’s more than $48,800 per borrower or an increase of more than $10,000 compared to 2017.

Unlike all other federal student loan programs, Parents PLUS Loans don’t have a stated borrowing limit, which means parents could be racking up even more debt to cover their kids’ education. PLUS Loans also have much higher interest rates compared to other federal loan programs. For the 2023-24 academic year, PLUS Loans carried an interest rate of 8.05%, compared to 5.5% for direct undergraduate loans.

Methodology

Sources

- National Center for Education Statistics

- Federal Student Aid, Department of Education

- Education Data Initiative

- Department of Labor: History of Federal Minimum Wage Rates Under the Fair Labor Standards Act

This story was produced by Creditnews and reviewed and distributed by Stacker Media.