What is a Power of Attorney? A comprehensive guide

WitthayaP // Shutterstock

What is a Power of Attorney? A comprehensive guide

A senior father and his young son looking at information using a laptop at home.

Power of attorney documents give one or more people the right to act as your agent when you’re unavailable, incapacitated, or otherwise indisposed. Beyond more general types of POAs, specialized versions exist to address specific situations, such as real estate transactions or end-of-life care decisions.

Depending on the power of attorney you choose to use, you can protect yourself financially, make business dealings more convenient, or ensure that your wishes are taken care of if you’re incapacitated. In this guide, LegalZoom will explain every type of POA, discuss how to choose the right agents, and go over the potential risks involved with the process. That way, you can choose the best type of POA for your needs.

What Is a Power of Attorney?

A power of attorney is a legal document giving one person (the agent or attorney-in-fact) the right to make certain decisions for another (the principal). The broadest of these documents is known as a general power of attorney, though other, more specific POAs can limit the power of an agent to certain topics.

The scope of an agent’s powers depends on both the type of POA you use and the terms outlined within it, so it’s important to take special care when drafting any power of attorney document.

You may, for instance, want to give your real estate agent a limited financial power of attorney in order to handle the sale of your home. In another situation, you may give your spouse or adult child health care power of attorney, so they can make medical decisions on your behalf if you become incapacitated.

Quick power of attorney facts:

- Power of attorney is a legal document that grants an agent authority to make decisions on behalf of the principal.

- Different types and scopes exist, including durable, springing, health care, and financial powers.

- Creating a POA requires selecting an agent, drafting the document according to state laws, and understanding the risks and safeguards associated with it.

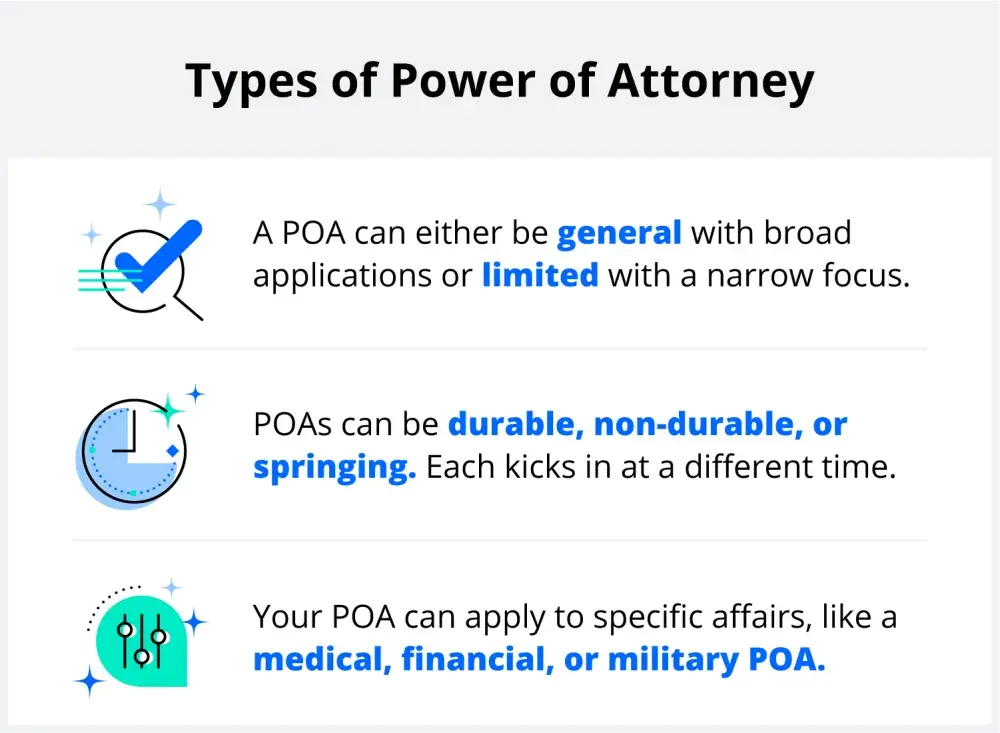

The 9 Types of Power of Attorney

There are several different types of power of attorney, each with its own uses and advantages. Before you choose which type is right for your needs, it’s best to understand all of your options, what they can and can’t do, and any potential risks associated with that type. Overall, there are nine main types of power of attorney:

- General power of attorney

- Durable power of attorney

- Limited power of attorney

- Springing power of attorney

- Medical power of attorney

- Financial power of attorney

- Revocable power of attorney

- Irrevocable power of attorney

- Military power of attorney

![]()

LegalZoom

What Is a General Power of Attorney?

Infographic showing different types of power of attorney.

A general power of attorney gives an agent broad authority to act on the principal’s behalf in a wide variety of situations, such as signing documents, buying property, or making other legal decisions. Typically, a general power of attorney has four basic qualities:

- A general power of attorney (GPOA) grants broad powers. A person with general power of attorney has the right to perform most legal acts the principal could perform.

- A general power of attorney is non-durable. Unless the document is written to be durable, a GPOA loses power if the principal becomes incapacitated.

- A general power of attorney is revocable. The principal of a GPOA can revoke the document at any point, so long as they are deemed mentally competent.

- A general power of attorney is often temporary. By design, a GPOA is revoked after a set time period: either when the principal becomes incapacitated, or when the principal dies.

How Much Does a General Power of Attorney Cost?

A general power of attorney typically costs between $200 and $500. That said, this cost can vary depending on state laws and the complexity of the principal’s needs.

What Is a Durable Power of Attorney?

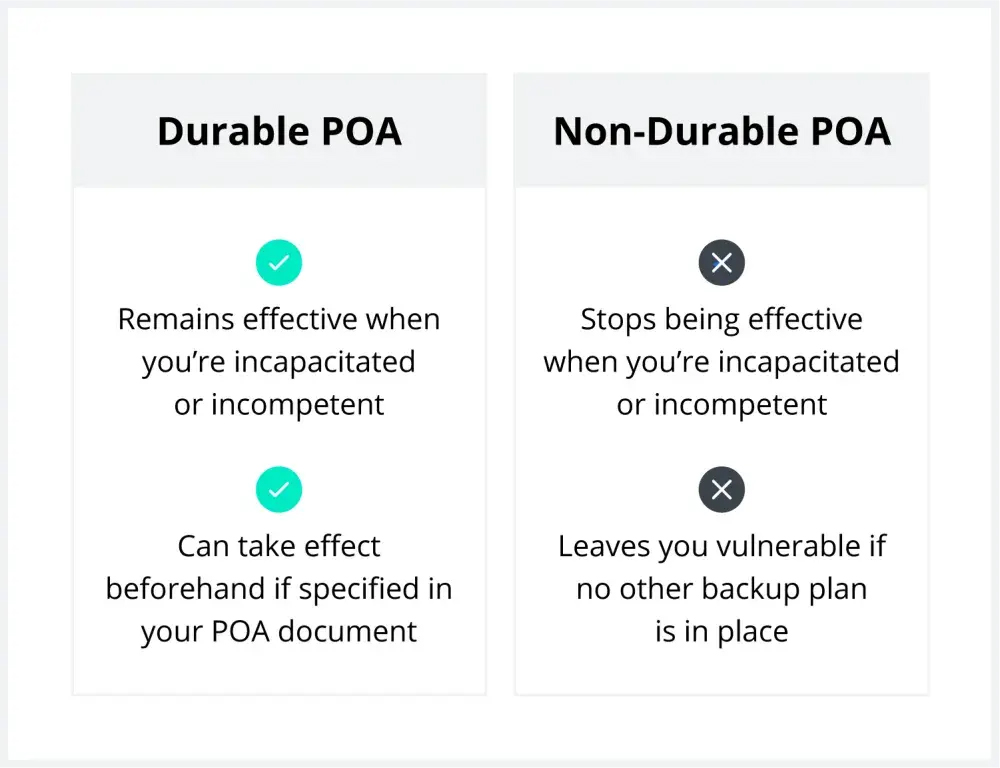

A durable power of attorney, or DPOA, is one that remains in effect even if the principal becomes incapacitated, allowing the agent to continue making decisions until the principal recovers or dies.

This type of power of attorney is particularly useful in situations where the principal becomes mentally incompetent or physically unable to manage their personal care, property, or finances, such as with an illness or accident.

Just like with a general power of attorney, an agent’s authority under a durable power of attorney is broad. Depending on the type of durable power of attorney used, this authority may include:

- Paying bills.

- Managing investments and property.

- Filing taxes.

- Signing contracts.

- Collecting debts.

- Applying for benefits.

- Taking legal action.

- Making healthcare decisions.

- Depositing, withdrawing, or transferring funds.

Alongside these powers, however, the agent of a DPOA must also follow certain obligations, including:

- Acting in the principal’s best interests

- Avoiding conflicts of interest

- Maintaining accurate records

- Providing regular reports

- Following the terms of the DPOA

- Transferring responsibilities upon termination of the DPOA

A durable power of attorney becomes effective once signed by the principal and remains valid until the principal’s death. After the principal’s death, responsibility for their estate (if any) will be taken up by their executor, who may work with the previous attorney-in-fact to prepare the estate for probate.

How Much Does a Durable Power of Attorney Cost?

A durable power of attorney can cost between $300 and $600, depending on the principal’s long-term needs and other estate plans. For principals with especially complicated or large estates, this type of POA may be even more expensive than usual.

LegalZoom

What Is a Limited Power of Attorney?

Infographic showing difference between durable and non-durable POA.

A limited power of attorney grants an agent narrow authority to perform specific actions on behalf of the principal. Rather than the broad, catch-all nature of a general power of attorney, this empowers an individual to handle certain tasks outlined within the document—and nothing else.

Often, a limited power of attorney is designed to expire after a task or set of tasks has been accomplished by the agent. This could include having someone sell property, close a business deal, or other clearly defined legal responsibilities.

How Much Does a Limited Power of Attorney Cost?

A limited power of attorney usually costs between $150 and $400, which is less than most other types of POAs. This decreased cost is often because a limited power of attorney outlines only specific tasks or responsibilities for the named agent, rather than a broad range.

LegalZoom

What Is a Springing Power of Attorney?

Infographic explaining limited POA.

A springing power of attorney is a unique type of POA that only takes effect in the event of a predetermined “trigger,” such as the principal becoming incapacitated, after which the POA “springs” into action. When creating the springing power of attorney, the principal chooses what event or events can activate the agent’s powers.

For certain triggers, such as the principal becoming medically incapacitated, a springing power of attorney must include language to determine who has the power to declare the principal incapacitated (more than one doctor, for example).

It is important to note that there can be a delay in the activation of the power of attorney, as the agent must obtain a determination of the principal’s incapacity before exercising their authority.

How Much Does a Springing Power of Attorney Cost?

A springing power of attorney typically costs between $300 and $600. This slight added cost comes from the need for specific, nuanced language detailing the trigger or triggers that cause the springing POA to activate.

LegalZoom

What Is a Medical Power of Attorney?

Infographic explaining springing POA.

A medical power of attorney gives the attorney-in-fact the authority to make health-related decisions in the event of the principal’s incapacitation. For instance, you might give your spouse, an adult child, or a close friend medical power of attorney to talk to your doctors and prevent treatments that you don’t want. This type of agent can also make decisions about your overall medical treatment, pay bills, and otherwise act independently in your best interest when you are incapacitated.

Just like with a springing power of attorney, a medical POA only comes into effect when the principal is no longer able to make health-related decisions for themselves. Even more so than with financial or limited POAs, it’s important to choose an agent that understands your wishes when creating a medical power of attorney. That way, you can be confident that your chosen agent understands you well enough to make potentially life-altering decisions when the need arises.

How Much Does a Medical Power of Attorney Cost?

A medical power of attorney costs between $200 and $500, though this can vary from state to state. Additionally, principals with complex wishes regarding treatment and end-of-life care may need to pay more for a power of attorney.

What Is a Financial Power of Attorney?

A financial power of attorney is a legal document that grants an individual (the agent) the authority to manage the financial matters of another person (the principal). This type of POA is restricted to financial matters and does not extend to healthcare decision-making or legal matters unrelated to finances.

When establishing a financial POA, it’s important to consider the specific tasks and responsibilities the agent will have with such a power, similar to how you would with a limited power of attorney. These tasks and responsibilities may include:

- Managing bank accounts.

- Managing investments.

- Managing retirement accounts.

- Buying or selling property.

- Managing rental properties.

- Paying bills and debts.

- Filing tax returns.

- Making charitable donations.

When choosing an agent for your financial power of attorney, it’s important to select someone with a clear understanding of your personal finances, your financial values, and the responsibilities of the role. Often, the best agent will be someone with experience handling individual or business finances.

How Much Does a Financial Power of Attorney Cost?

A financial power of attorney generally costs between $200 and $500, depending on the complexity of the principal’s finances.

What Is a Revocable Power of Attorney?

A revocable power of attorney is any other type of POA that can be revoked by the principal at any time. In that sense, a revocable power of attorney is not quite its own type of POA, but instead a condition that can be applied to other types of POAs.

Keep in mind that this type of POA can be revoked by the principal for any reason so long as they are deemed mentally competent to do so.

What Is an Irrevocable Power of Attorney?

An irrevocable power of attorney is special in that it cannot be revoked or terminated by the principal, except in specific situations. Like revocable POAs, an irrevocable power of attorney is less of a distinct type of POA, but instead can be applied to other types of POAs.

Often, an irrevocable power of attorney will be used in complex legal situations where the agent needs guaranteed authority for a set period of time. Some examples of such situations include:

- Estate planning: A principal may use an irrevocable power of attorney to ensure that their agent can effectively and continually manage the assets within an irrevocable trust.

- Loans: A financial institution may require an irrevocable power of attorney to be drafted in order to secure a loan.

- Business deals: In large, complex business deals, such as mergers or acquisitions, the involved parties may use an irrevocable power of attorney to maintain equality and guarantee consistent decision-making.

What Is a Military Power of Attorney?

Military powers of attorney give spouses and loved ones the authority to handle many of the day-to-day tasks faced by service people living outside of the United States. While technically a type of limited POA, a military power of attorney is distinct and common enough to deserve its own conversation. Some examples of how a military POA might be used include:

- A service member is deployed, and a spouse or partner needs to register a newborn in the Defense Enrollment Eligibility Reporting System. This is a database of active-duty and retired service members, family members, and others eligible for TRICARE health services.

- A military spouse needs permission to rent, buy, or refinance a home jointly or just in the service member’s name.

- A military spouse needs permission to buy or sell a vehicle jointly or solely owned by a service member.

- A military spouse needs to receive or store household goods even though they aren’t on the ownership paperwork.

- A dependent needs replacement identification while the service member is abroad.

If you are a service person, get a military attorney to help you prepare and sign the appropriate power of attorney. Military legal assistance offices are located on almost every base, ship, and installation. Visit the U.S. Armed Forces Legal Assistance locator to find the office nearest your location.

How to Set Up Power of Attorney in 7 Steps

In most cases, a power of attorney is created in response to a specific need, such as selling a piece of property. Certain types of POAs, such as medical powers of attorney, can be created as soon as you turn 18 and your parents or guardians no longer have the power to make health care decisions for you.

Regardless of which is true for your situation, the process of setting up a power of attorney takes about seven steps:

Step 1: Choose the right type of POA

Decide what kind of power of attorney you need. This may sound simple, but there are legal subtleties that aren’t obvious to someone unfamiliar with this. If necessary, sit down with a legal professional to talk out your options and choose the best power of attorney for your circumstances.

Step 2: Select an agent

Select candidates to be your attorney- or attorneys-in-fact. Talk to them at length to make sure they understand their duties and are willing and able to carry them out. Remember that you aren’t limited to active agents: you can also name alternatives.

Step 3: Draft your POA

Write your power of attorney or find a POA document that you can use and amend it to meet your needs. Laws are different in every state, so ensure that the legal documents you are using follow your state’s laws. In many cases, it’s best to consult a qualified lawyer to draft your power of attorney for you.

While yes, you can draft your own power of attorney without the help of a lawyer, it is a complex legal document, so getting legal advice is always a wise choice.

Step 4: Check for state-specific compliance

Some states require very specific and direct language for certain powers (such as estate planning), so it can be very important to understand state laws when attempting to give certain powers to an agent, as broad language may not always be legally acceptable.

Step 5: Sign the POA

Arrange for your chosen agent (or agents) to sign the document. In most states, this will require having witnesses and a notary present to validate the signatures of everyone involved.

Step 6: File and distribute copies of your POA

Just like with any legal form, your power of attorney should be filed appropriately and have copies kept in a safe place. In Texas, for instance, powers of attorney must be filed with the court in the county in which you live or hold property.

In any case, keep copies of your documents in a safe place. If you put a copy in your home safe or a safety deposit box, keep one someplace accessible, like a filing cabinet in your home or office. Also, give a copy to your attorney-in-fact, your doctor (in the case of a health care power of attorney), and any trusted business partners. If you plan to undergo a procedure such as surgery, take a copy of your health care POA with you and share it when you first check in to the medical facility.

Step 7: Review and update periodically

Getting married, divorcing, moving to a different area, or taking a different job that requires travel or could be dangerous are all reasons to review your powers of attorney. In other words, if the people and situations in your life change, so should your powers of attorney.

Also, if you change states, your new state will probably acknowledge your current power of attorney. That said, you should quickly update it to follow the laws of your current state.

How to Choose Your Attorney-In-Fact

Being assigned the responsibilities of being an attorney-in-fact is not a good fit for everyone. Before you make your final decision, talk to the person or people you are considering and see if they really are able and willing to do the job.

Here are some signs you might be considering the wrong person to be your attorney-in-fact.

- Their schedule is too busy: Someone who is already overscheduled may not have time to give the job sufficient attention. The tasks involved can be time-consuming. If the person is too busy, your needs and concerns may not get their fullest attention.

- They’re willing but not able: This job requires paying attention to details. Not everyone is able to do that. Someone who is unhealthy, disorganized, or unable to see a job through may not do a good job of managing your money or paying bills on time.

- They would be grief-stricken if something happened to you: Sometimes, it is a mistake to give this important job to the person who will be most worried about your well-being. Someone who is overcome with emotion in the event of an accident may not be able to make crucial decisions on your behalf.

- They don’t take the position seriously: Serving as an attorney-in-fact is serious business. Don’t choose any candidate who doesn’t care enough to deal with serious issues or is unlikely to notice and take action about poor care or abuse.

Your potential attorneys-in-fact also deserve to know exactly what will be required of them. If the job sounds like something they don’t feel able to do, they should be able to say no without feeling guilty or that they are disappointing you.

Choosing Alternative Agents

In addition to selecting a primary agent, it’s recommended to designate one or more successor agents in case the primary agent becomes unavailable or is unable to fulfill their duties. Having backup agents in place can provide additional peace of mind and ensure that the principal’s interests are protected at all times.

Remember that your agent doesn’t need to be a lawyer. Technically, any competent adult can serve as an attorney-in-fact. That said, there are advantages to involving a lawyer, especially if that lawyer is meant to handle both your powers of attorney and your estate plan. These can be complicated issues, and using an expert to set them up can relieve your and your loved ones’ stress. If you need help, contact the local chapter of the American Bar Association.

Questions to ask a potential attorney-in-fact:

Here are some things to ask your candidates before you make your decision.

- Do you have any questions about what your responsibilities would be?

- Do you think you currently have time in your schedule to fulfill these responsibilities?

- Do you have concerns about taking on any of these duties?

- Do you have any concerns about potentially managing my money and bills and your own simultaneously?

- If something does happen to me, do you think you will be able to focus on the tasks that you need to complete, or will you be overwhelmed by emotion?

- Do you understand the concept of being a fiduciary? A fiduciary must act responsibly, practically, and in a way that is fair to the person whose healthcare and financial affairs they are managing. Anyone who violates these guidelines and doesn’t act in your best interests can face criminal charges or be held liable in a civil lawsuit.

- How would you deal with it if someone close to me questioned your decision?

- Are you comfortable advocating for my wishes, especially with healthcare providers?

If, after having this discussion, your candidate seems unwilling or declines, don’t hesitate to move on to your next choice and have the same talk with them.

What Are the Limits of a Power of Attorney?

No matter which type of power of attorney you choose, it will no longer remain valid or legally binding when you—the person who created the power of attorney—dies. After that, the trustee of the trust, executor of the estate, or, as they are known in some states, personal representative, is responsible for carrying out all aspects of the estate plans created by your estate planners.

For some people, such as widows and widowers who previously held power of attorney, this can cause issues with accessing bank accounts, making financial transactions, or signing legal documents.

What Are the Risks Associated With Powers of Attorney?

Like everything else, giving or having power of attorney has occasional drawbacks.

Here are three reasons you want to think hard about giving someone you don’t know well and trust your power of attorney.

- Your lawyer-in-fact can handle things in ways you might not approve of. And they potentially can do something that is hurtful to you. For people who accept the job, there are few legal liabilities. A lawyer-in-fact will only be held responsible if you can prove intentional misconduct. If they make an honest mistake, they can’t be held legally responsible.

- You are the only person who provides oversight of your agent’s actions. This limited power has led, in some cases, to elder abuse.

- Because of the potential for abuse, some banks, government offices, and other institutions that deal with financial matters don’t accept powers of attorney.

Why Should You Set Up a Power of Attorney?

Putting power of attorney in the hands of someone you trust can give you peace of mind that your wishes will be carried out even if you aren’t in a position to handle your financial and medical matters yourself.

A well-written power of attorney can make your intentions clear, protect your assets, ensure that your loved ones are taken care of, and prevent any allegations of financial mismanagement. If you travel frequently, powers of attorney can provide even more convenience and peace of mind than normal.

Regardless of which power of attorney you ultimately choose to use, take the time to understand the scope and duration of the document, and make sure that the document you create complies with state-specific laws and regulations. By doing so, you can rest assured that your affairs will be managed according to your wishes, even when you are unable to act on your own.

Frequently Asked Questions

What are the disadvantages of power of attorney?

A power of attorney could leave you vulnerable to abuse and may not grant the intended legal authority. Additionally, it does not cover what happens to assets after death, and there is no direct oversight of the agent’s activities, which can lead to elder financial abuse or fraud.

What four decisions cannot be made by a legal power of attorney?

A power of attorney cannot change or invalidate a will, act outside of the principal’s best interest, violate the terms of nominating documents, or make decisions on behalf of the principal after their death.

What is the most recommended type of power of attorney?

For most people, the best option is a general durable power of attorney as it gives your agent broad powers that remain effective even if you become unable to handle your finances. An attorney can further customize this type of durable POA for more specific needs.

What are the liabilities of being a power of attorney?

As an attorney-in-fact, you may be contacted by creditors of the principal for debts owed; however, you are not financially liable. Nevertheless, the creditors do have the right to attempt to collect payment from the principal.

Who is the best person to give power of attorney?

The best person to give power of attorney to is someone you trust, such as a spouse, close family member, or friend. Alternatively, you may also designate your lawyer. Make sure the person is not a minor and is mentally competent.

Can you get power of attorney without consent?

No, you cannot get power of attorney without the consent of a mentally competent principal.

This story was produced by LegalZoom and reviewed and distributed by Stacker.