Credit scores stayed steady as consumer debt balances rose in 2022

Canva

Credit scores stayed steady as consumer debt balances rose in 2022

A man works on a laptop while looking at bills.

Consumers in 2022 exited nearly two years of economic recovery, and are now finding that economic currents are moving as fast, if not faster, than prior to 2020. Even as average balances rise for most types of consumer debt and credit card delinquency rates climb—FICO Scores remain steady.

As part of our ongoing analysis of credit and debt in the U.S., Experian reviewed anonymized credit report data to see how consumers’ credit scores have changed over the past year and to understand the pandemic’s impact on how they use credit. This analysis compares data from the third quarter (Q3) of 2021 with Q3 2022.

Average credit card and loan balances for consumers increased last year, driven by higher APRs, inflation, increased demand for goods and services and other factors. Unemployment remains historically low and wages are growing, though not quite as much as the prices for goods and services workers consume. Additionally, households still have more cash in savings and checking accounts, on average, than in previous years, thanks in part to stimulus checks issued during the pandemic.

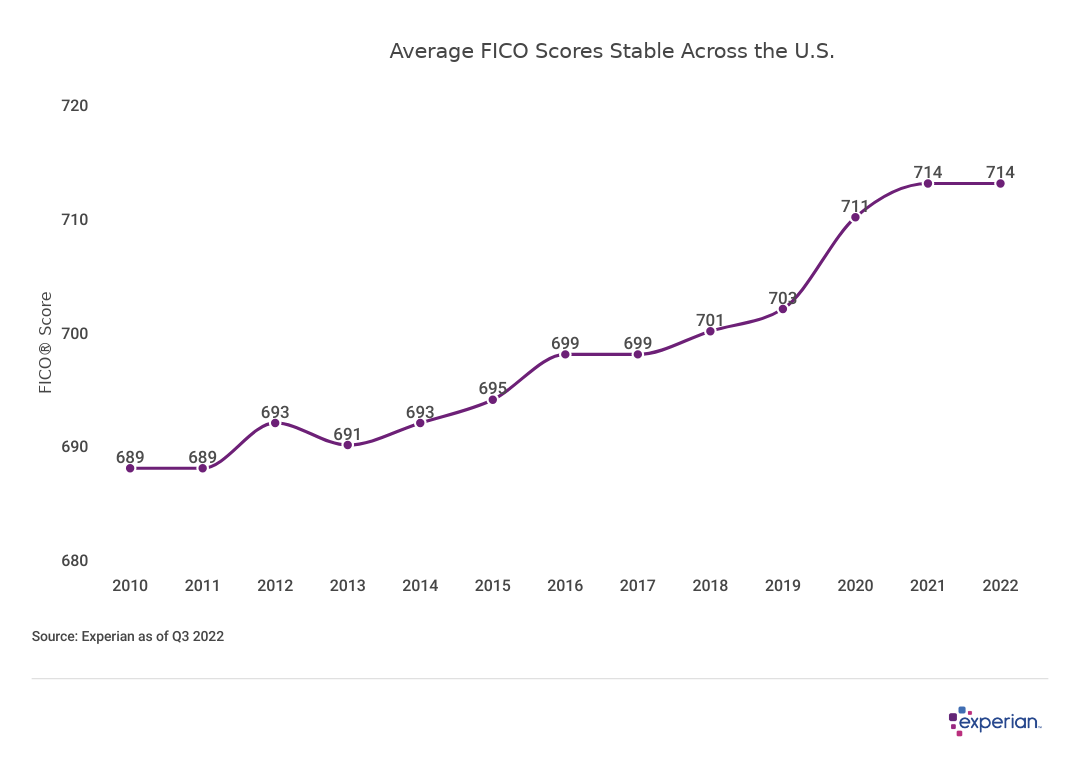

For now, at least, consumers appear to be keeping up with the primary economic headwind facing them: inflation. The average credit score in the U.S. remained steady at 714 in 2022, and is still a full 11 points higher than prior to the pandemic, when the average score was 703.

Meanwhile, delinquency rates were comparable with pre-pandemic years, like 2019. Credit card delinquency rates have returned to pre-pandemic levels, and average credit utilization increased from 26% during the pandemic to 28% in 2022, again similar to pre-pandemic levels.

![]()

Experian

Average credit score in the U.S. unchanged at 714

Table showing average credit score in the US remaining steady over time.

As of Q3 2022, the average FICO Score in the U.S. was 714, unchanged after four years of point increases beginning in 2018. In 2022, 72% of Americans had a “good” credit score of 670 or greater, based on the FICO Score 8 credit score model.

Meanwhile, average total debt balances increased by $5,544 to $101,915 in 2022. The 5.8% increase coincides with overall inflation, which increased by 8.2% over the same period, as measured by the consumer price index.

Experian

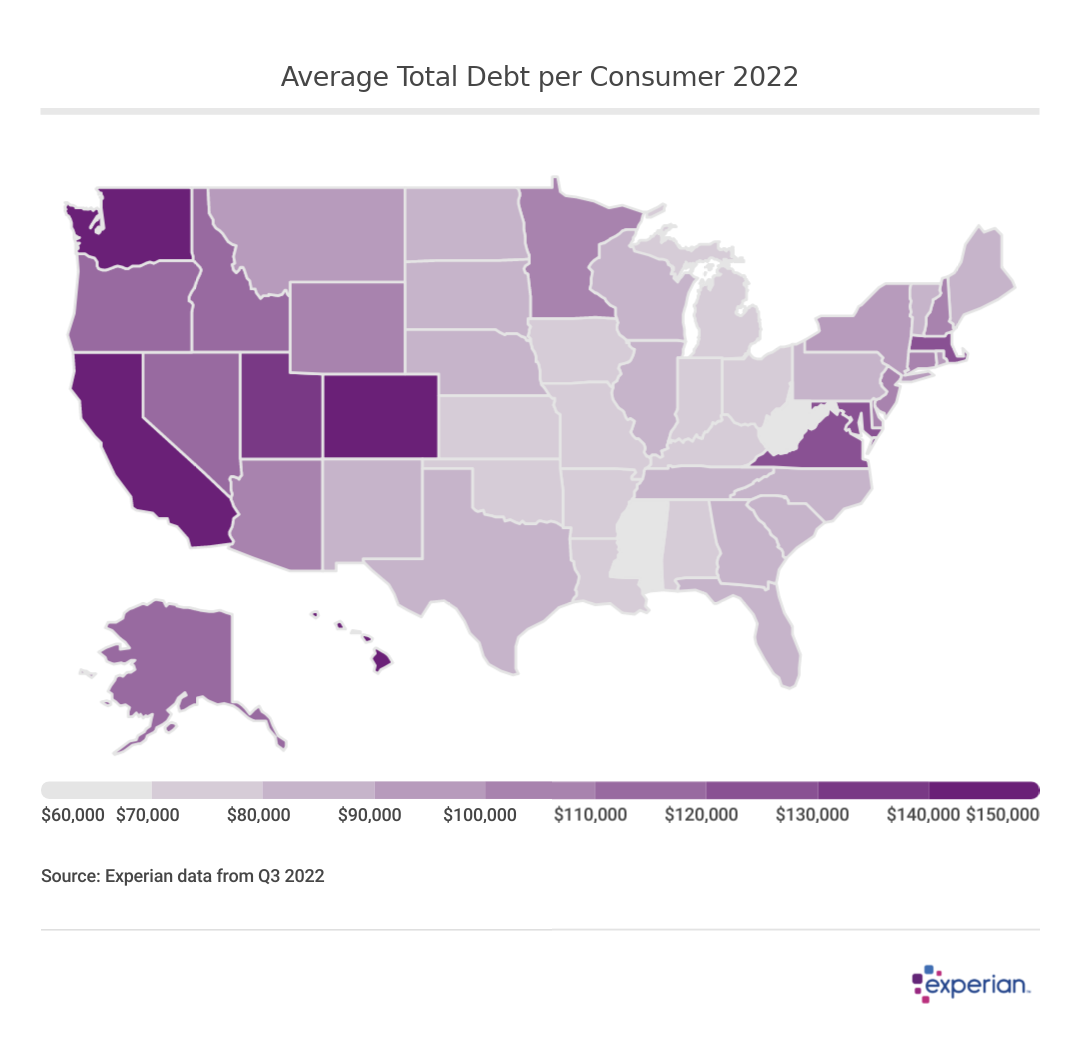

Average total debt levels up in most states

Heat map showing average credit debt across the US.

The 5.8% increase in average total debt in 2022 was largely driven by increases in the more widely held loan products: credit cards, auto loans and mortgages, each of which grew by more than the overall debt level last year as consumer demand—as well as inflation—spurred increases in both spending and retail prices.

Average student loan balances declined slightly, as borrowers await the resolution of court challenges to the federal Student Debt Relief Plan, and student loan repayments remain paused into 2023. Meanwhile, we’re starting to see a significant number of loans forgiven through other federal student loan programs, such as the Public Service Loan Forgiveness program.

Average home equity line of credit, or HELOC, balances increased in 2022, indicating a renewed interest in a home loan product that lost favor in the lower-interest rate environments of the 2010s. As home equity increases, and mortgage refinances aren’t financially advantageous for most, HELOCs may be the go-to way for homeowners with low fixed-rate mortgages to access their equity in the coming years.

Western states including California, Colorado and Washington saw the greatest increase in home prices in recent years, so consequently experienced larger average increases in overall debt than the rest of the nation, due to larger mortgage balances.

Experian

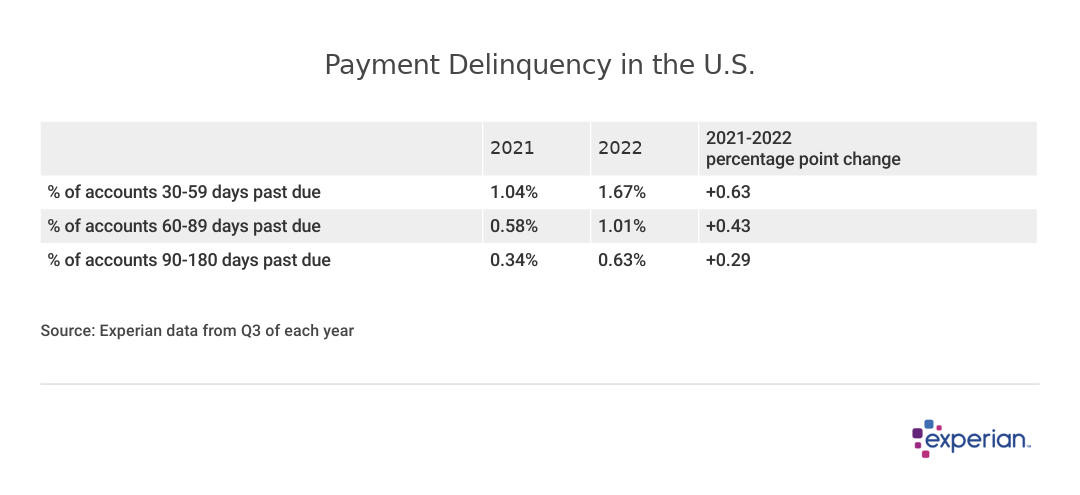

Credit utilization and delinquency rates increase from 2021’s record low levels

Table showing payment delinquency across the US between 2021-22.

Average credit card debt increased significantly in 2022, as consumers increased spending on goods and services such as vacation travel and dining out, two of the larger credit card spending categories that weren’t widely available during the pandemic. The 13% jump brings average credit card debt levels to $5,910, the highest it’s been since 2019.

Similarly, credit card utilization rates increased from 26% to 28% in 2022, another metric that returned to pre-pandemic levels after two years of depressed credit card spending.

Delinquency rates increased in 2022, but despite the increase, rates are still well below pre-pandemic levels. As of Q3 2022, 1.67% of accounts were 30 to 59 days past due; the number of accounts that were 60 to 89 days past due increased to 1.01%, and 0.63% of accounts were 90 to 180 days past due.

Experian

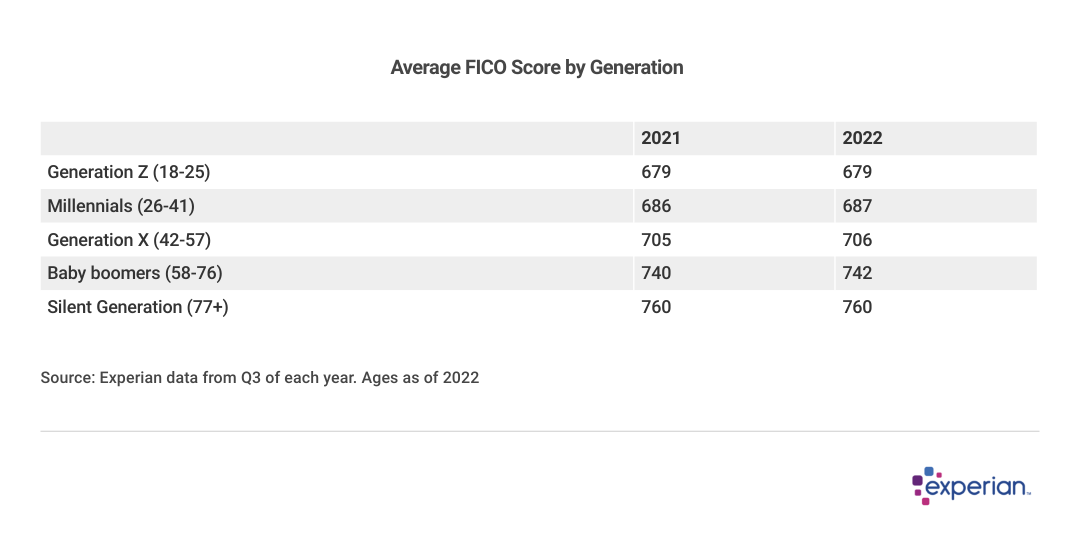

How older and younger credit card users differ by FICO score

Table showing average FICO score by generation.

There wasn’t much movement in credit scores among any generation in 2022. The youngest and oldest generations in our analysis—Generation Z and the Silent Generation—remain unchanged, while Generation X and millennials gained one point on average. Baby boomers saw average scores increase two points.

The average FICO Scores for each generation remain solidly in the “good” credit score range or better, which is a score of 670 or higher. The average scores of baby boomers and the Silent Generation continue to be in the “very good” score range from 740 to 799. Borrowers with very good credit scores or better typically receive lower interest rates on credit card offers and financing than those with lower scores. The length of a consumer’s credit history is an important scoring factor as well, which would help explain why scores increase on average as consumers age.

Experian

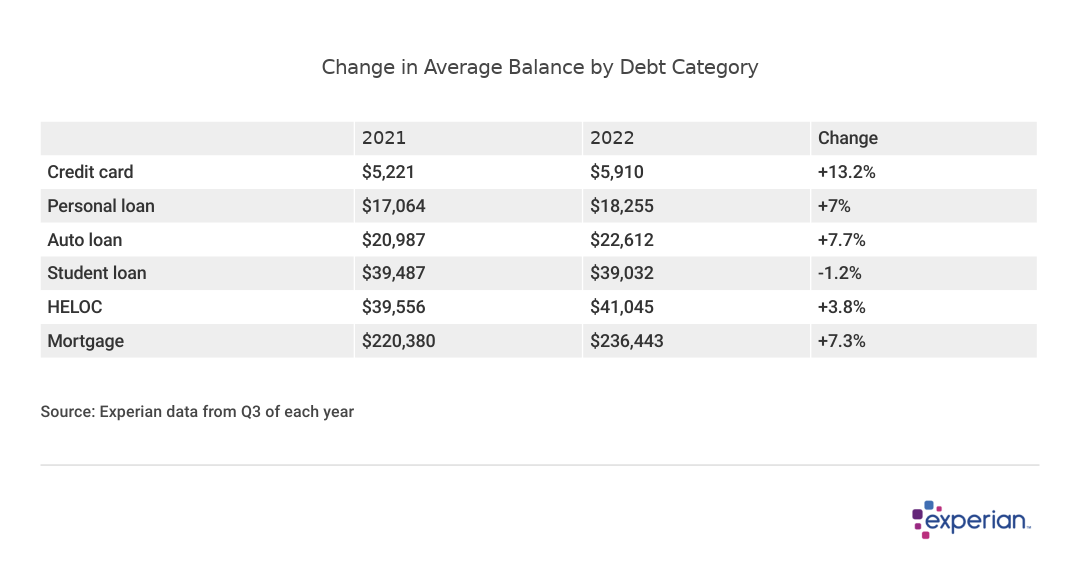

U.S. consumer debt snapshot

Table showing the change in average balance by debt category.

Average balances carried by consumers increased more than in previous years, largely as a function of inflationary pressures and pent-up consumer demand for goods and services that were muted in previous years by the economic slowdown in many sectors of the economy due to the pandemic.

In 2022, inflation came back to life for the first time in decades. Inflation grew at an 8.2% annual rate as of September 2022, according to the consumer price index, the most since 1982. It’s been a shock to many U.S. consumers, especially those younger consumers who have only ever known a low- or no-inflation world. And although inflation has since cooled to 6.4% as of January 2023, it has touched nearly every component of the consumer price index, from the basics like food and rent to discretionary items like meals outside the home.

But despite the higher prices, consumers were more than equipped to manage, based on strong demand for labor (unemployment remains near record lows, and wages are rising) and bank statement balances that remain higher than prior to the pandemic.

Personal loan balances and HELOC balances grew in 2022, as demand for alternatives to the once-popular cash-out refi mortgage may be driving the increases in these types of loans.

Canva

Credit cards see the fastest growth, again

A pile of credit cards resting on a wooden surface.

Most types of consumer loans saw balance increases as well. Average balances for credit cards, the most interest-rate-sensitive consumer loan product, increased by 13.2% over the 12 months ending Q3 2022, to $5,910. Interest rate hikes that increased APRs by more than 3 percentage points account for some of the increase, although increased spending from the previous year was probably more of a factor, as card purchases for most consumer items grew in 2022.

Mortgage and auto balances broadly track inflation

Both auto loans and mortgages, usually the two largest monthly payments for consumers, increased by more than 7% last year. This largely reflects the rapid price increases for both cars (either used or new) and homes in 2022, despite fewer homes and autos sold compared to previous years.

Average mortgage balances increased from $220,380 in Q3 2021 to $236,443 last September, a 7.3% increase over the previous year. As the number of home sales continue to decline, however, fewer new mortgages will be written or refinanced. For this reason, average mortgage balances could slow or even decline in the near future as current mortgage payers pay down existing mortgages, and fewer new mortgages replace them.

Auto loan balances tell a slightly different story despite a similar increase to mortgages. While auto loan rates haven’t climbed as much as other types of loans, it’s still very much an auto dealer’s market, as auto inventory isn’t keeping up with demand. The average balance increase to $22,612 is largely more reflective of more demand than supply, according to industry observers.

Canva

Student loan balances decline prior to court decision

A young woman studies information on a laptop.

Student loan balances declined slightly in 2022, counter to the inflationary trend impacting other types of loans. As payments for most types of student loans continue to be paused by the Department of Education, balances are accruing no interest. Consequently, average balances declined slightly, to $39,032. The Supreme Court’s decision, expected sometime in the spring, will make the difference for more than 16 million borrowers approved for student loan forgiveness by the Department of Education.

Meanwhile, some borrowers are beginning to see entire loan balances being forgiven, due to participation in the Public Service Forgiveness Program, which forgives remaining balances for borrowers working for certain government or nonprofit employers after 10 years of loan payments.

HELOC balances rebound

HELOCs may finally be having a moment after nearly a decade of balance declines and less-than-robust availability of HELOCs from lenders. Average HELOC balances increased for the first time in 10 years in 2022, rising to $41,045 in 2022.

Behind the turn is a lack of other ways to access home equity, which for many homeowners has increased considerably. Industry estimates suggest average “tappable” home equity will have increased to more than $200,000 in 2022. Simultaneously, the other once-popular way homeowners tapped equity (and often lowered their mortgage rate in the process) was through a cash-out refinance mortgage. Cash-out refis have evaporated as mortgage refi rates have risen well above the current rate most homeowners with a mortgage currently pay.

Canva

What borrowers can expect in 2023

An exterior shot of a federal reserve building.

Although the Federal Reserve hasn’t quite finished tinkering with rates, the consensus is that there won’t be the same parade of rate increases as in 2022. This slowdown may finally mean solidification of a “new normal” for consumers and lenders in 2023. Interest rates for credit cards will remain elevated, and, if the economy continues to cool, lenders may become choosier when extending new credit to consumers in 2023.

More interest rate increases expected, but fewer and smaller than in 2022

The Federal Reserve has indicated that it’s not quite done with interest rate increases we’ve been collectively experiencing since March 2022. At the beginning of the new year, the consensus among Fed watchers is that the key Fed funds rate will be raised until it reaches 5%—up another half percentage point from the 4.50% target rate at the beginning of 2023.

As the Fed watches the economy, and Wall Street watches the Fed, the upside for consumers is that inflation has already begun to moderate from its 2022 highs. Prices for cars, gasoline, airline tickets and food were already declining at the end of 2022, according to the consumer price index. The more the Fed observes declining prices, the more likely it is to sooner stop increasing the key fed funds interest rate.

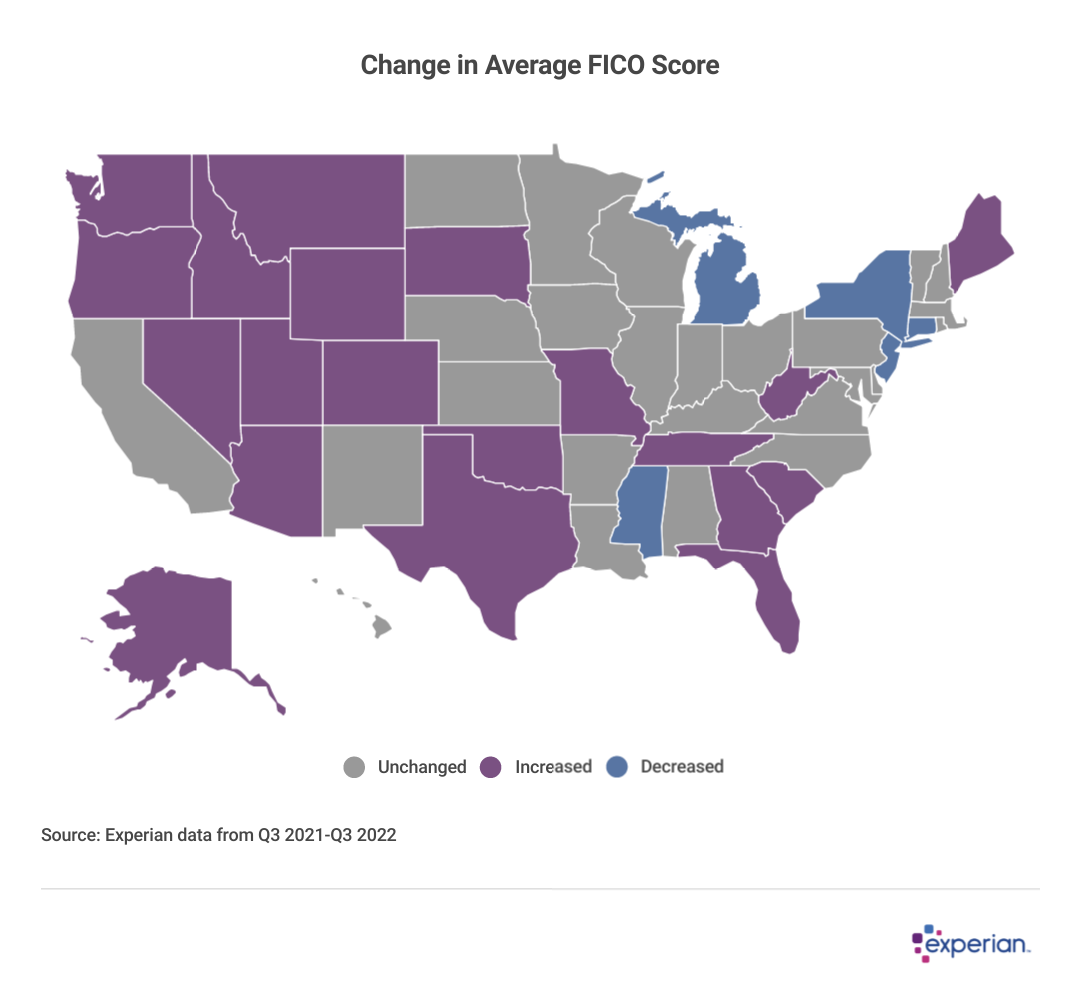

Experian

Credit utilization will continue to pressure consumers’ credit scores

Heat map showing change in FICO score in the US.

When considering what comprises a credit score, credit utilization is one of the most important factors. All other things being equal, lower credit utilization ratios tend to translate to higher credit scores, and vice versa. Even small differences in one’s credit utilization can mean changes in credit score in either direction. For example, here are the average credit utilization ratios for four ranges of good credit scores: Average credit usage percentages are lower as scores increase.

So what goes into a credit usage calculation? It’s the consumer’s balances on their revolving credit accounts versus the total amount of their credit limits as set by lenders.

In 2023, neither input is working in the favor of the consumer: Inflation increases the average balance consumers carry from month to month, while lenders aren’t as quick to extend credit to borrowers as they were when economic conditions were more clear. And the cherry on top: These higher balances are accruing even more in interest than this time in 2021.

But so far, consumers are managing. Near-full employment in the U.S. means that consumers are generally better equipped to manage the higher balances. And delinquencies, while increasing, haven’t climbed to levels observed during the most recent economic recession. So although balances are increasing, average credit scores in most states were nearly unchanged from 2021.

Canva

More shifts in financing and refinancing

A mother and daughter consult with a loan officer.

Lenders are still willing to lend to consumers at the start of 2023, according to the quarterly Senior Loan Officer Opinion Survey. But improving credit scores could save consumers even more in interest than in previous years.

Collectively, most lenders aren’t changing qualifications for some types of borrowing, such as auto loans. However, they do indicate that they’ll be tightening lending standards for accepting credit card applications, according to recent Federal Reserve surveys of bank lenders. A credit score improvement of only a few points could make a difference. For example, some lenders may approve borrowers with a marginally good credit score of 680, but only if they pay a higher APR than they would have with a higher score. On the other hand, lenders have suggested they’re slightly more willing to lend to borrowers with a 720 FICO Score than before.

For homeowners, while the cash-out refi door may be closed for some time, there are still other ways for house-rich owners to access home equity. While home equity loans and HELOC rates are generally higher than conventional, first-lien mortgages, they’re generally less than most personal loans and significantly less than variable-rate credit cards.

Methodology

The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story originally appeared on Experian and has been independently reviewed to meet journalistic standards.