5 cities where minimum wage goes furthest—and where it falls short

Canva

5 cities where minimum wage goes furthest—and where it falls short

A supermarket cashier interacts with a customer.

Despite persistent inflation, the federal minimum wage remains $7.25 per hour. More than 13 years have passed since Congress last raised the federal minimum wage in 2009, the longest such stretch in American history. While many cities, counties and states across the nation enforce their own minimum wage well above the federal minimum, the cost of living in each can greatly impact just how far those wages can go.

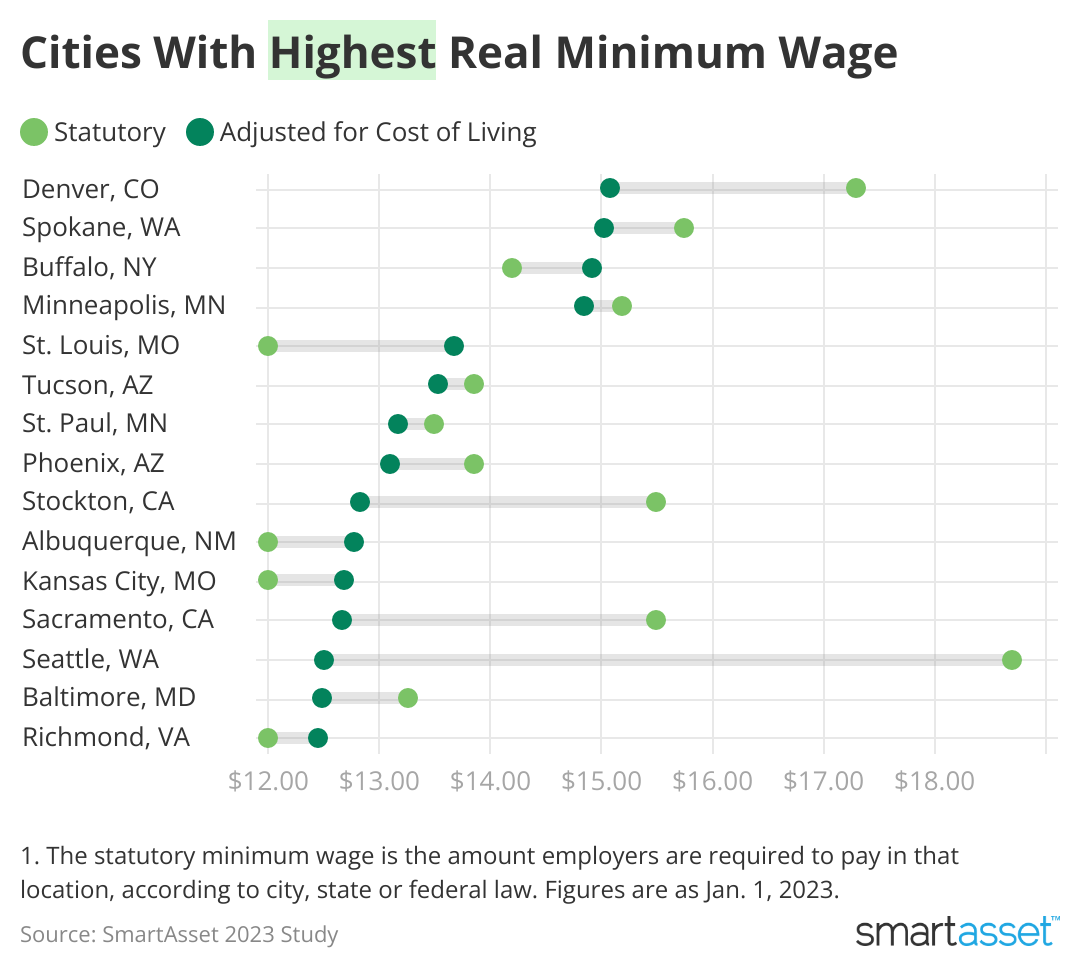

To get a clearer picture of where minimum wage goes the furthest, SmartAsset ranked 79 of the largest U.S. cities based on how much the minimum wage (as of Jan. 1, 2023) is worth after adjusting for the cost of living in each city.

This is SmartAsset’s second study on which cities have the highest and lowest real minimum wage. You can read the 2022 edition here.

![]()

Canva

Key Findings

Kitchen staff work together in a clean, modern restaurant.

- Minimum wage goes furthest in Denver. After a January 2023 increase, the Colorado capital now has a minimum wage of $17.29 per hour, which ranks second-highest study-wide. However, residents in this city are getting the biggest bang for their buck. The city takes the No. 1 spot for the highest minimum real minimum wage, despite experiencing the 22nd-highest cost of living.

- Minimum wage workers in Seattle earn the most. No city in our study has a higher statutory minimum wage than Seattle, where minimum wage workers earn $18.69 an hour. But Seattle is also among the highest cost-of-living cities in our study. After adjusting for those costs, Seattle’s real minimum wage shrinks to $12.51.

- Less than a quarter of cities have a $15 minimum wage. Only 18 out of the 79 cities in our study have a statutory minimum wage of $15 or more. Meanwhile, 30 cities have a minimum wage that defaults to the federal minimum of $7.25, including four of the cities at the bottom of our rankings.

- Cost of living in Orlando closely tracks the national average. While Orlando is best known as the home of Walt Disney World, the cost of living in the city is just 0.2% above the national average. As a result, the city’s $11 minimum wage is worth $10.98 after adjusting for cost of living.

SmartAsset

5 Cities Where Minimum Wage Goes the Furthest

Chart showing a list of cities with the highest real minimum wage.

These five cities have adjusted their minimum wage so that hourly employees can make their money go further.

1. Denver, CO

The Mile High City’s statutory minimum wage, which rose to $17.29 per hour on Jan. 1, 2023, ranks second-highest among the 79 cities in our study. A city ordinance adopted in 2019 requires Denver’s minimum wage to increase each year based on the Consumer Price Index, which tracks the price of goods and services in the economy. After factoring in the cost of living, which is 14.7% higher than the national average, Denver has the highest adjusted minimum wage in our study: $15.07.

2. Spokane, WA

Spokane doesn’t have its own minimum wage law, but Washington’s statewide minimum wage increased by $1.25 to $15.74 per hour on Jan. 1, 2023. After adjusting for the city’s cost of living, which is slightly above the national average, Spokane’s minimum wage is worth $15.02.

3. Buffalo, NY

Buffalo may be one of the snowiest cities in the country, but the minimum wage goes the third-furthest out of all 79 cities that were considered for this study. The New York state minimum wage jumped $1 on Dec. 31, 2022, reaching $14.20. However, Buffalo’s cost of living is below the national average, making the minimum wage worth $14.92 after adjusting for the city’s cost of living.

4. Minneapolis, MN

The minimum wage in Minneapolis increased to $15.19 on Jan. 1, 2023 for large employers, marking it the third increase to the city’s statutory minimum since a wage ordinance was approved in 2017. The minimum wage in Minnesota’s largest city is now 43% higher than the state-mandated minimum. After adjusting for cost of living in Minneapolis, which is 2.3% above the national average, the minimum wage equals $14.85 per hour.

5. St. Louis, MO

Under a state law that took effect in 2017, municipalities in Missouri cannot institute a minimum wage that’s higher than the state minimum. As a result, minimum wage workers in St. Louis earn $12 per hour. However, St. Louis has one of the lowest cost-of-living indexes in our study at 12.3% below the national average. When adjusting for the city’s cost of living, the hourly minimum wage in St. Louis is worth $13.68.

SmartAsset

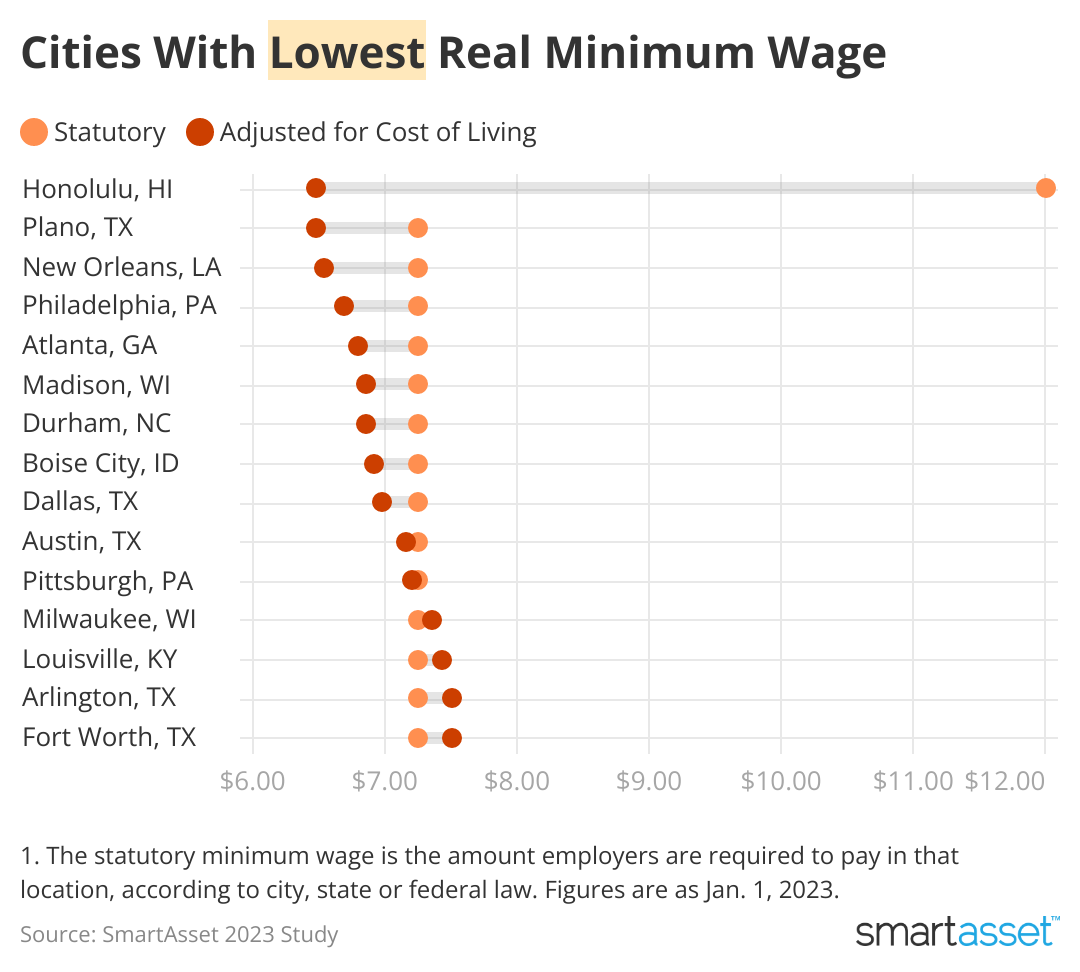

5 Cities Where Minimum Wage Pays for the Least

Chart showing a list of cities with the lowest real minimum wage.

For workers in these cities, minimum hourly wages come up short when compared to the cost of living.

1. Honolulu, HI (Tie)

Out of the 79 cities in our study, the minimum wage in Honolulu pays for the least. Minimum wage workers earn $12 per hour, but the city’s exorbitant cost of living shrinks the purchasing power of those earnings. At 85.6% above the national average, Hawaii’s capital city has the third-highest cost of living across our study. That means the hourly minimum wage in Honolulu is actually worth $6.47 when adjusting for cost of living. However, the state-mandated minimum wage will increase $2 in 2024, 2026 and 2028, when it reaches $18.

1. Plano, TX (Tie)

Not only is Plano’s cost of living 12.1% higher than the national average, but it has the lowest possible minimum wage. The state of Texas adopts the federal minimum wage of $7.25 an hour, rather than instituting its own higher wage. After adjusting for the cost of living in this suburb of Dallas, Plano’s minimum wage is worth just $6.47.

3. New Orleans, LA

While New Orleans raised the minimum wage for city workers to $15 an hour in 2022, other workers are subject to the federal minimum wage of $7.25. With the cost of living 10.8% higher than the national average, the minimum wage is worth only $6.54 in New Orleans.

4. Philadelphia, PA

The minimum wage in Pennsylvania, which mirrors the federal minimum, hasn’t risen since 2009. Gov. Josh Shapiro has called for a $15 minimum wage, which would presumably help minimum wage workers in the state’s largest city contend with a cost of living that’s 8.4% higher than the national average. As a result, the minimum wage in Philadelphia is worth $6.69 after adjusting for the city’s cost of living, making it one of the places where the minimum wage is worth the least.

5. Atlanta, GA

Like Texas, Louisiana and Pennsylvania, minimum wage workers in Georgia only earn the federal minimum. In Atlanta, the cost of living is 6.6% above the national average. The minimum wage is worth only $6.80 after adjusting for cost of living, the fifth-lowest across our study.

SmartAsset

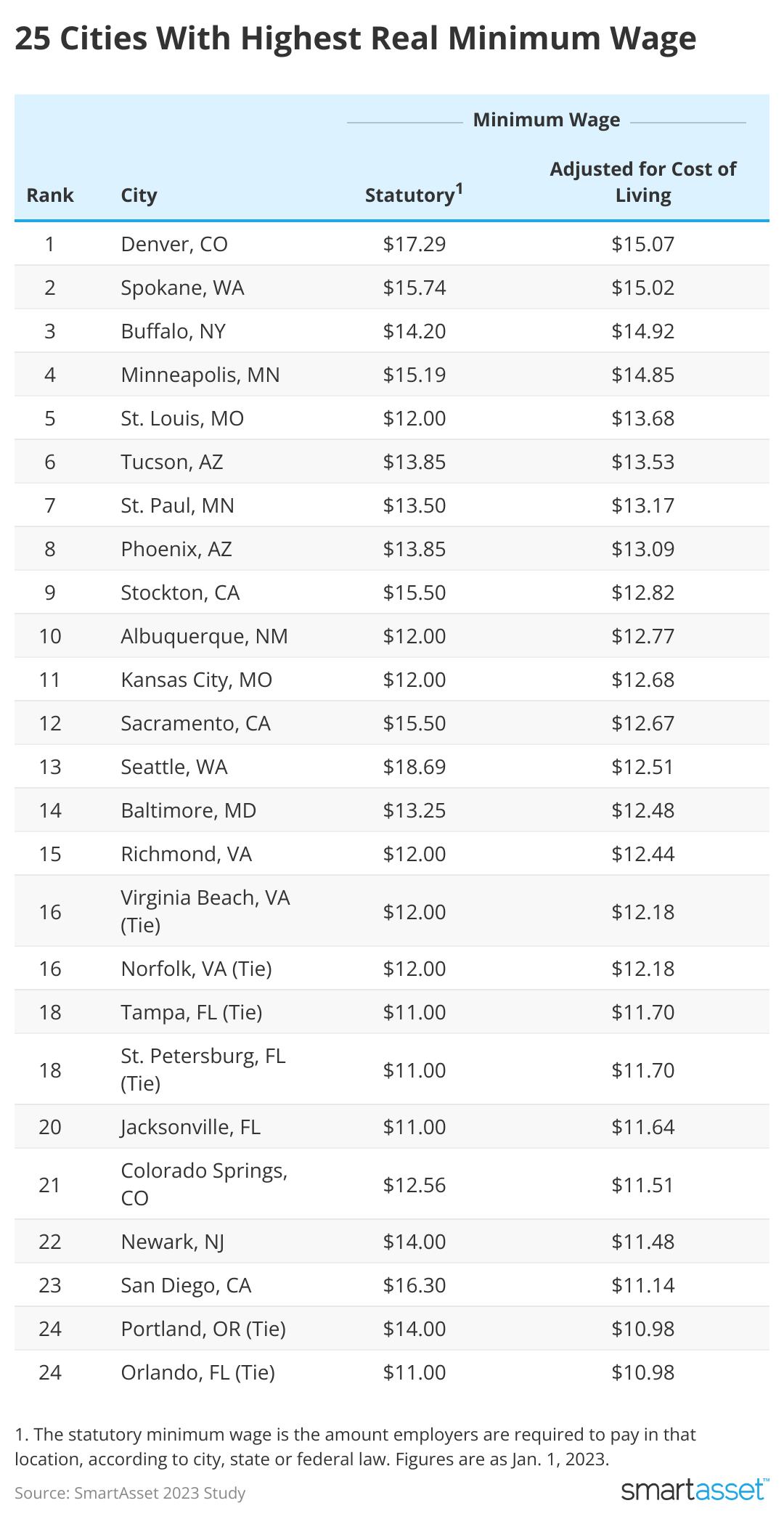

Data and Methodology

A chart listing the 25 cities with the highest real minimum wage.

SmartAsset collected state and city minimum wages across the country, pulling data from minimumwage.com and government websites. We then adjusted the applicable minimum wage for 79 of the largest cities in the U.S., according to the local cost of living, using data from the Council for Community and Economic Research. The cost of living takes into account the price of housing, groceries, utilities, transportation and miscellaneous goods and services.

For example, the statutory minimum wage in Los Angeles is $16.04 per hour, but the cost of living is 48% higher than the national average. To calculate the city’s adjusted minimum wage, we divided the city’s statutory minimum wage by 1.48. As a result, in terms of purchasing power, the minimum wage in the City of Angels is just $10.84.

In our analysis, we used the minimum wage as of Jan. 1, 2023. In cases where cities differentiate between small and large employer minimum wage rates, we considered the minimum wage rate required for large employers. Additionally, for cities and states that distinguish between jobs offering health benefits and those that do not, we used the minimum wage for jobs that do not offer qualifying health benefits.

This story originally appeared on SmartAsset and has been independently reviewed to meet journalistic standards.