IRS Free File service available to taxpayers with 2020 income $72,000 and below

IDAHO FALLS, Idaho (KIFI) - Tax season is here, and filing this year could be easier than ever.

The IRS has partnered with companies to help you prepare your tax forms online for free.

The free products are available to any taxpayer or family who earned $72,000 or less in 2020.

"All the software is done in a question and answer format. So basically, it leads you through all the sections, in order to complete your return," said Karen Connelly IRS media relations, acting media section manager.

Tuesday launches the start for taxpayers to prepare and file their federal income tax right from home.

Last year, in Idaho there were nearly 24,000 users who filed free online.

That's up from 16,000 the year before.

"We're about a 46% increase. We believe the increase is probably due to the pandemic. People not being able to readily access a tax pro and are just wanting to complete their taxes in the comfort of their own home in the safety of their own home," said Connelly.

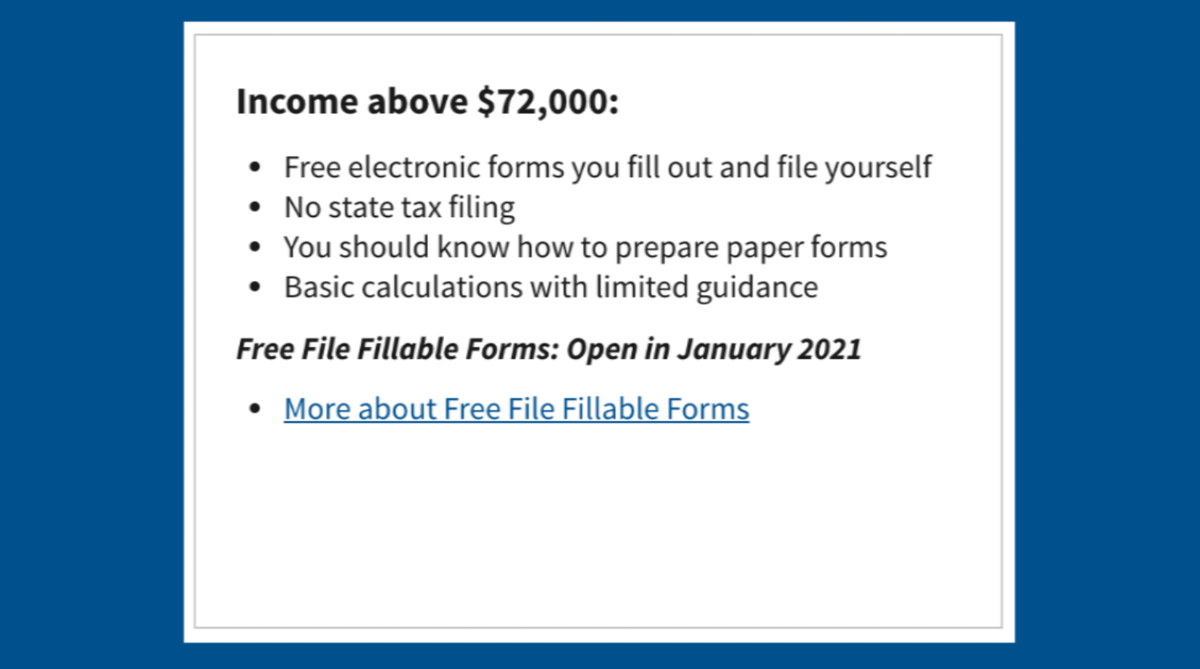

Taxpayers with earnings above $72,000 can use services under IRS Free File Fillable Forms.

"Basically, those are the electronic forms that folks can use and submit their tax forms electronically. That does not depend on income," said Connelly.

The IRS says these resources will give taxpayers an early opportunity to claim credits like the recovery rebate credit and other deductions.

Last year, free filing tax service in the state of Idaho was only offered for people who earned $57,000 a year or less.

For more information on how to file your federal taxes online for free visit here.

IRS Free File participants

For 2021, these providers are participating in IRS Free File:

- 1040Now

- ezTaxReturn.com

- FreeTaxReturn.com

- FileYourTaxes.com

- Intuit (TurboTax)

- On-Line Taxes (OLT.com)

- TaxAct

- TaxHawk (FreeTaxUSA)

- TaxSlayer

For 2021, the following providers have IRS Free File products in Spanish:

- ezTaxReturn.com

- TaxSlayer (Available after January 18)